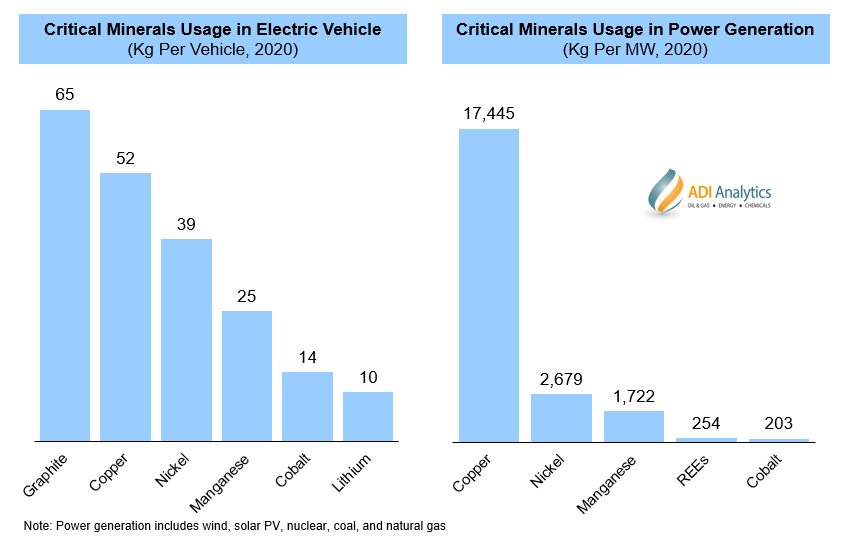

Clean energy technologies such as electric vehicles (EVs), batteries, and energy storage as well as clean power generation will grow dramatically over the next decade driving demand for critical minerals such as copper, nickel, cobalt, lithium, manganese, graphite, and rare earths elements (REEs). Hence, adequate supply of critical minerals is crucial for the growth and application of clean energy technologies. Application of some critical minerals such as copper, nickel, and manganese are vital in both EVs and power generation, while growth in the demand for many other critical minerals will likely vary widely (Exhibit 1).

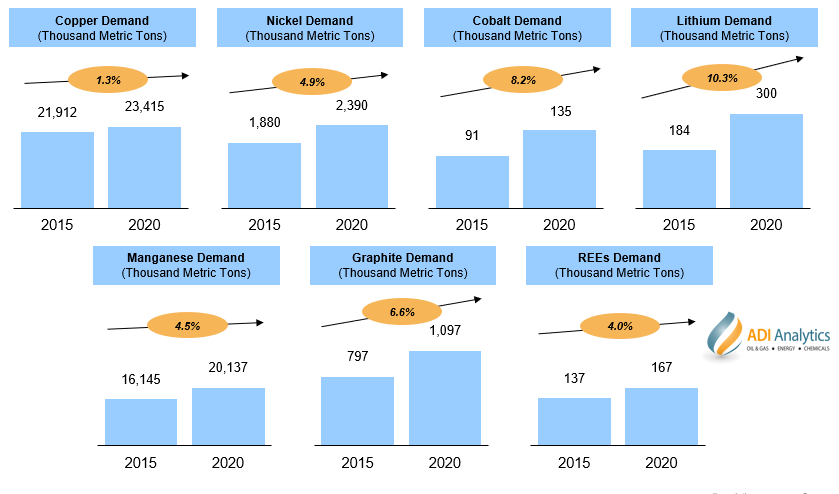

Demand for critical minerals has grown rapidly since 2015 with growing emphasis on the energy transition (Exhibit 2) but supply growth has been slow except for lithium and REEs and will likely result in deficits if not addressed in a timely manner. Today, only 20 countries supply most of the critical minerals used in clean energy technologies and countries such as China, Russia, and Australia are amongst the top five producers of multiple critical minerals. Such concentration of resources and supply can amplify geopolitical risks. Other factors such as government regulations, ESG initiatives, mine reserves exhaustion, rising complexity of mineral ore processing, rising capital and operating costs, and other operational issues will impact security of supply going forward. Further, insufficient investments could also lead to tighter markets in the years ahead.

In light of these dynamics, ADI is launching a multi-client study – “The New Frontier: Critical Minerals & the Energy Transition” – which is focused on a comprehensive assessment and outlook for critical minerals supply and demand through 2030. This 12-week long multi-client study process builds on ADI’s extensive research and deep expertise in metals, minerals, mining, mineral processing, and energy transition. The study will be based on in-depth primary and secondary research and supply and demand modeling and analytics reflected in its comprehensive table of contents (Exhibit 3).

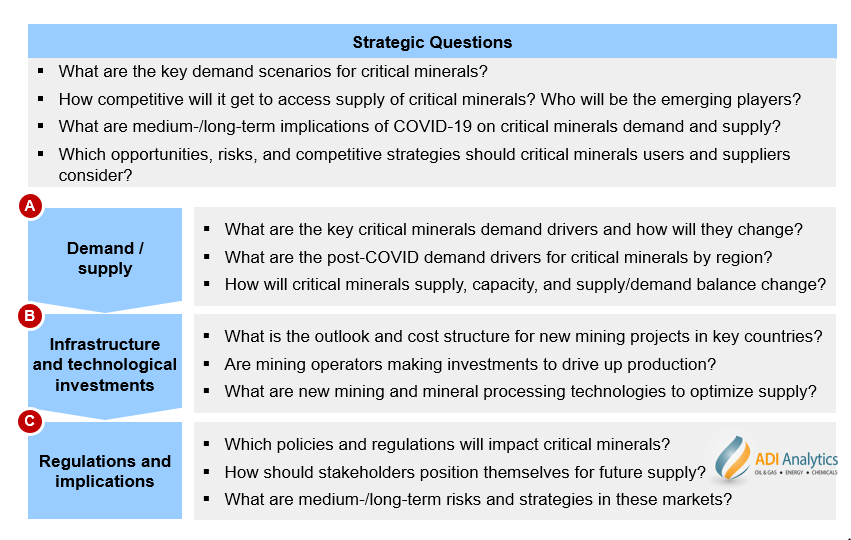

The study will address several strategic questions that need to be answered in critical mineral markets and their outlook over the next decade. Some of the major themes that will be addressed in this study include forecasts for critical minerals demand and supply through 2030, cost-economic analyses, technology innovations, opportunities, risk, and competitive strategy that stakeholders will need to consider post-COVID, and more as shown in Exhibit 4.

Buyers of this multi-client study will receive a ~150-page report, a ~25-page summary deck, a data package, and a workshop with the ADI research team to address questions. Subscribers can join the kick-off call on August 15 and shape the study agenda. The final report will be available November 15. Please download the multi-client study prospectus > > “The New Frontier: Critical Minerals & the Energy Transition”– and contact us to learn more.

Visit the rest of our blog series, Mining and Metals, to learn more about other critical minerals for the energy transition and stay tuned for upcoming blog posts.

– Swati Singh and Jacqueline Unzueta