While the energy crisis in Europe is well known, with much of the continent facing gas shortages due to the war in Ukraine and subsequent Russian sanctions and policies, less talked about is an energy crisis brewing in the U.S. Problems with natural gas infrastructure in New England have been mounting for years, and the region faces a potential energy crisis of its own.

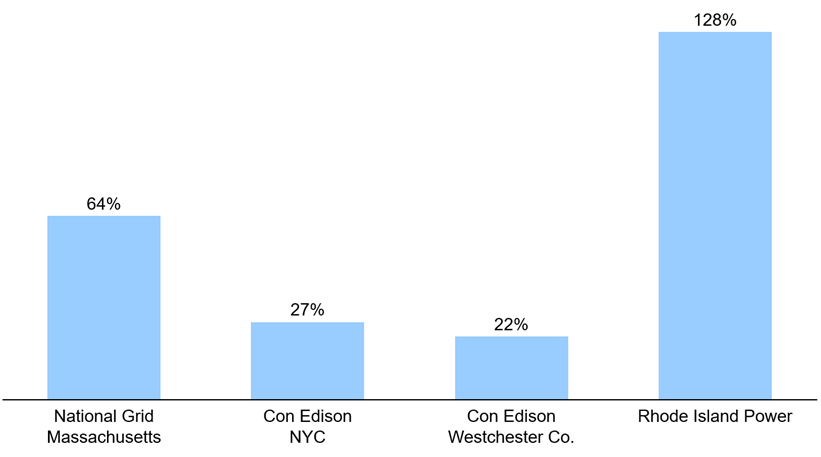

Every winter there are concerns about natural gas supply in New England and how the region’s infrastructure cannot handle a prolonged cold snap. On the region’s coldest days, there is not sufficient pipeline capacity to provide natural gas for home heating and power generation despite the prolific Marcellus and Utica Shales being close by. In fact, New England is the only region in the continental U.S. that imports natural gas, with imports contributing up to 35% of the region’s supplies on peak days. Now, with LNG prices at record levels due to demand in Europe, New England consumers will be paying higher prices for their energy. Exhibit 1 shows some of the announced rate increases announced by utility providers in New England so far.

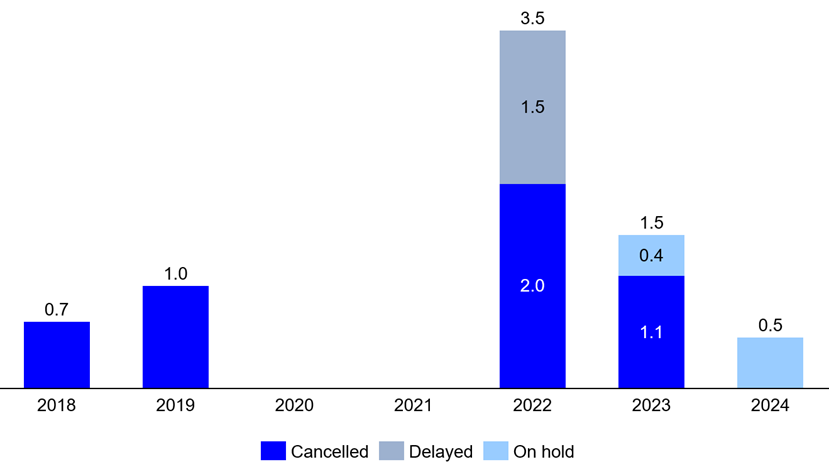

In August, the CEO of Independent System Operator New England (ISO-NE) wrote a letter to the Secretary of Energy about these infrastructure issues. This statement has spurred concerns from customers and consumers seeking to improve energy reliability in the region. Several reasons have been cited for the causes of this brewing crisis, including regional and state policies that do not support the further development of natural gas infrastructure. In fact, regulatory hurdles and lawsuits have stymied pipeline development and access to natural gas in the region, with 7.1 BCFPD of capacity cancelled or delayed since 2018 and only 2.3 BCFPD added. Some of these projects include the Penn East Pipeline (1.1 BCFPD), Diamond East Pipeline (1.0 BCFPD), and Atlantic Coast Pipeline (2.0 BCFPD). Not only do these hurdles affect New England consumers and limit their access to the U.S.’s abundant natural gas resources, but they have also left the Marcellus and Utica shales largely isolated and challenged to supply LNG exports to a world hungry for LNG.

Summary

The simplest fix to these issues is expanded capacity in the region. With abundant, domestic supply, the only real challenge is transportation and access to that supply. Unfortunately, this simple fix is not so simple in today’s polarized world. Additional renewable and green energy projects could provide some relief, but it is apparent that the region needs natural gas, and peak days will require consistent baseload power supply that renewable energy does not provide. Any infrastructure project will likely take years to complete leaving no short-term relief in sight for consumers. Permitting reform for energy projects, such as those proposed by U.S. Senator Joseph Manchin (D-WV) could help speed this process and help New England secure its energy needs.

ADI Analytics is monitoring the global markets and is experienced in providing studies across the energy market. Reach out to learn how we can help.

– Dustin Stolz