Nearly two-thirds of global greenhouse gas emissions can be attributed to CO2 from fossil fuel combustion and industrial processes. A report from the Intergovernmental Panel on Climate Change (IPCC) outlines the potential for emissions to fall to 70% of the current levels over the next three decades but more needs to be done to limit global warming level to 2℃ by 2050. Pressure from government agencies, investors, and consumers are driving decarbonization commitments in the industrial sector but several new initiatives are needed to accelerate the energy transition. Identifying and evaluating these new initiatives will be challenging, and Bill Gates has introduced a simple idea of “green premiums” in his latest book, “How to avoid a climate disaster”.

A “Green Premium” is simply the difference in the cost of doing something in a way that produces greenhouse gases and doing the same thing without those emissions. Right now, the primary reason the world emits so much greenhouse gas is that fossil fuel technologies are by and large the cheapest energy sources available. In part, that is because their prices do not reflect the environmental damage they inflict. In other words, moving our immense energy economy from carbon-emitting technologies to ones with zero emissions will cost something.

In his book, Gates talks about technologies which needs investments to commercialize. “Calculating green premiums for all the different activities that cause greenhouse gas emissions such as manufacturing, making electricity, transportation, and heating and cooling buildings can show where we have workable solutions now, where invention is needed, and which breakthroughs deserve the most focus”. Innovation in better technologies, and then being able to scale those technologies to drive prices down is the best approach to lower green premiums. One of the best examples of this happening recently is in energy generation, where solar power has fallen more than 89% in cost, and it is now actually cheaper to get power through solar power than coal.

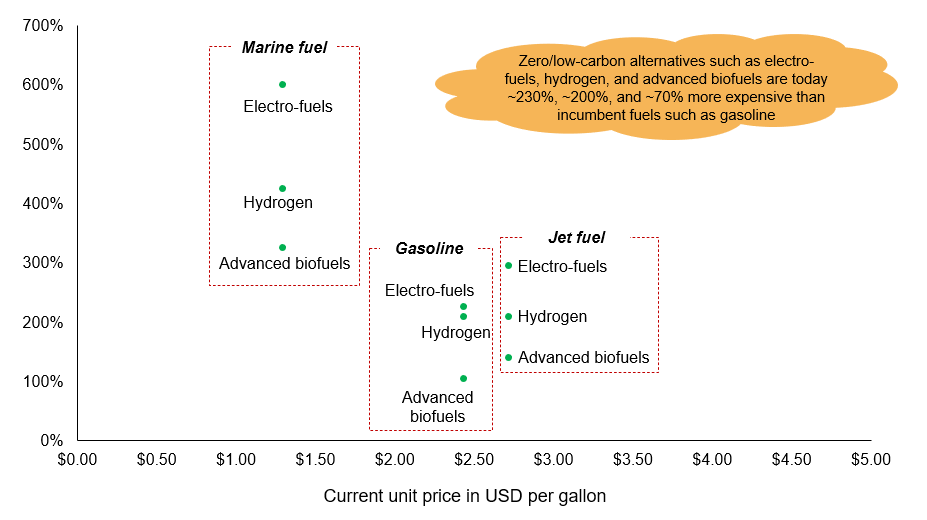

Exhibit 1 shows the green premiums for alternative fuels in transportation as compared to existing fuels. Low-carbon alternatives such as electro fuels, hydrogen, and advanced biofuels are today ~300%, ~200%, and ~150% more expensive than jet fuel which is used in the aviation industry. This means that if the current price of jet fuel is ~$2.70 per gallon, it would cost ~$8.10, ~$5.40, and ~$4.05 per gallon to use alternative fuels such as electro fuels, hydrogen, and advanced biofuels, respectively.

Exhibit 1: Green Premiums for Zero-Carbon Fuel Alternatives in 2020

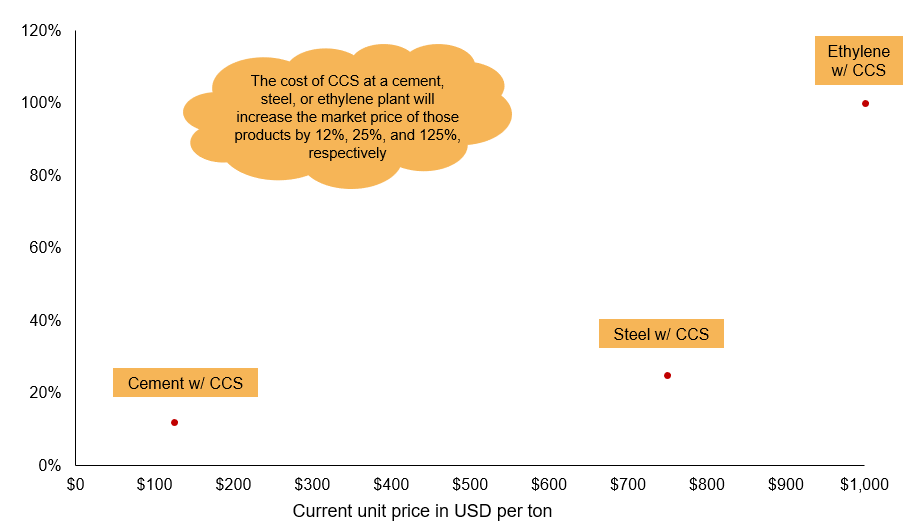

For hard-to-abate sectors such as cement, steel, and ethylene production in petrochemicals industry, there are no current alternatives other than carbon capture technology which will add to the existing production costs raising the green premiums. As shown in Exhibit 2, the cost of CCS at a cement, steel, and ethylene plant will increase the market price of those products by 12%, 25%, and 125%, respectively. In this case, green premiums show us we need more innovation in carbon capture and need to find alternative ways to produce cement, steel, and ethylene production.

Exhibit 2: Current Green Premium for Sectors Using CCS in Hard-to-Abate Sectors

In addition to technological innovation, there needs to be a demand for these new products so that they can get a foothold in the competitive marketplace. Companies can work with governments to fund the first few projects demonstrating a new technology or system works safely, which can prove to investors that the next projects are ready for them to fund. The biggest impact will come from putting a price on carbon where companies can buy and sell the right to emit carbon, and thereby incentivize the most cost- and carbon- efficient technologies.

Our team at ADI Analytics has supported a wide range of clients focused on energy including oil and gas, power and utilities, renewables, and energy transition. Please reach out to learn more about how we can help.

-Utkarsh Gupta