The oilfield service (OFS) industry took a major financial hit with the crash of crude oil prices earlier this year. Unlike the exploration and production (E&P) sector, which had bounced back from the oil price downturn of 2014, the OFS sector as a whole never recovered. Demand impact due to COVID-19 and the OPEC+ breakdown further pushed the sector underwater with risks that many companies will never resurface. In 2020 year-to-date returns, oilfield service companies have lost more than 50% of their market capitalization. Some sub-sector such as offshore oil and gas drillers have lost far more and as much as 80% during the course of the year. In comparison, their primary customers, oil and gas operators lost only a little more than 40% in market capitalization so far in 2020.

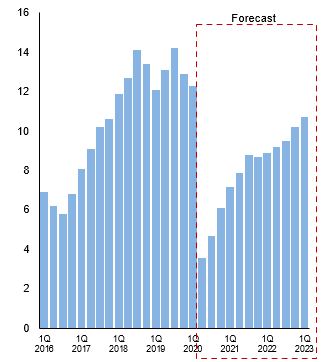

Even so, we see some recovery in the space. For example, U.S. completion activity has improved more than expected from the trough in May 2020. After the number of active U.S. frac crews bottomed out at 100 in mid-May, 40 crews have been put back to work mostly in the Permian Basin of West Texas and New Mexico. Operators are focused on working down the drilled but uncompleted (DUC) inventory levels which is driving completions activity higher. This is evident from the August EIA drilling productivity report which shows that the U.S. land DUC count fell by 77 compared to last month. As oil demand picks up in the coming quarters, we see recovery potential in the pressure pumping segment as we forecast a 3X recovery by 1Q2023 relative to 1Q2020 as shown in Exhibit 1.

Exhibit 1: U.S. pressure pumping demand in million horsepower

What will drive the market ahead

OFS Consolidation

Given the oilfield services sector’s distress, it is undergoing a lot of consolidation. For example, Liberty Oilfield Services acquired Schlumberger’s pressure pumping business in the U.S. and Canada via an all-stock transaction. We believe that this consolidation will take out marginal or underperforming pressure pumping capacity, and newer players that will emerge will have greater scale, technical expertise, and pricing power.

Lowering capital expenditure

There is a continuous demand to increase shareholder value in the oil and gas sector. Earlier, we could see a lot of drilling activity in U.S. shale and OFS companies were investing heavily to provide up to date technologies to the operators at reduced costs. Now, the investors have shifted their focus on OFS companies to limit their capital expenditures to meet short and mid-cycle demand levels instead of peak levels to provide stability to the industry in any cycle going forward. OFS companies must continue to focus on harnessing their existing investments and work toward improving asset utilization

Customer landscape changes

A recovery in oilfield services is also likely because shale operators are all consolidating in terms of both companies and target plays and this will further improve breakeven costs and allow more competitive oil production even if we assume a $40 oil price. In this environment, well completions and other oilfield service needs will get more complex and operators will value oilfield service players focused on value creation, technology expertise, and scale.

Opportunities for reinvention

Mitigating the risk of supply disruption with technology, innovative business models, and collaboration will be the key for the revival of OFS companies. The adoption of new technologies and best practices is already underway with solutions such as automation of pressure testing, pump control, sand handling and pump down operations, optimization of frac-fleets, and cutting maintenance costs through optimized equipment operations. The success of these business models will enable OFS companies to maintain higher utilization rates and asset productivity.

Please contact us to learn more about ADI’s work in oilfield services and preparing them for this perfect storm.

-Utkarsh Gupta and Uday Turaga