One of the biggest challenges to renewable energy projects is the intermittency of these resources; the sun doesn’t always shine, and the wind doesn’t always blow. These challenges have been made apparent around the world from wind droughts in Europe to winter storms in Texas. One solution to this challenge is expanding grid-scale energy storage systems (ESS) and improving long-duration energy storage (LDES).

ESS technology and capacity

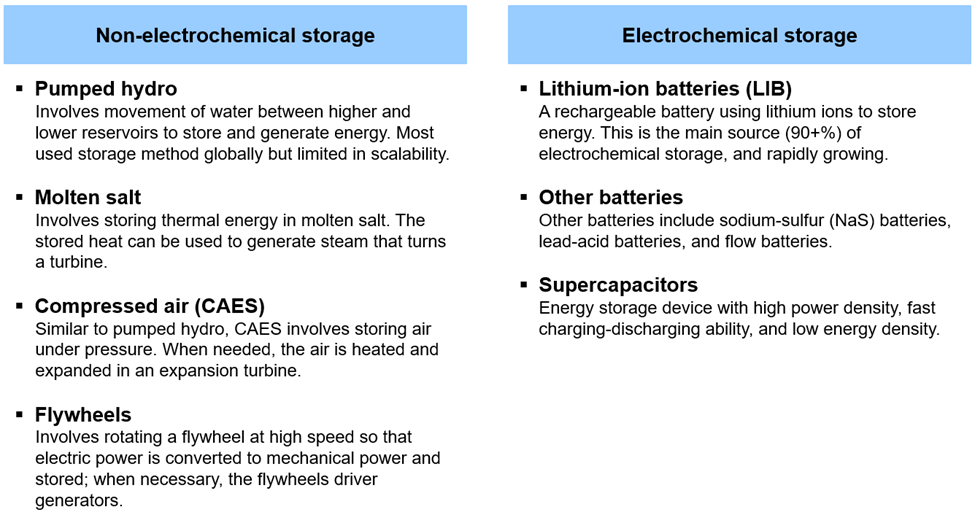

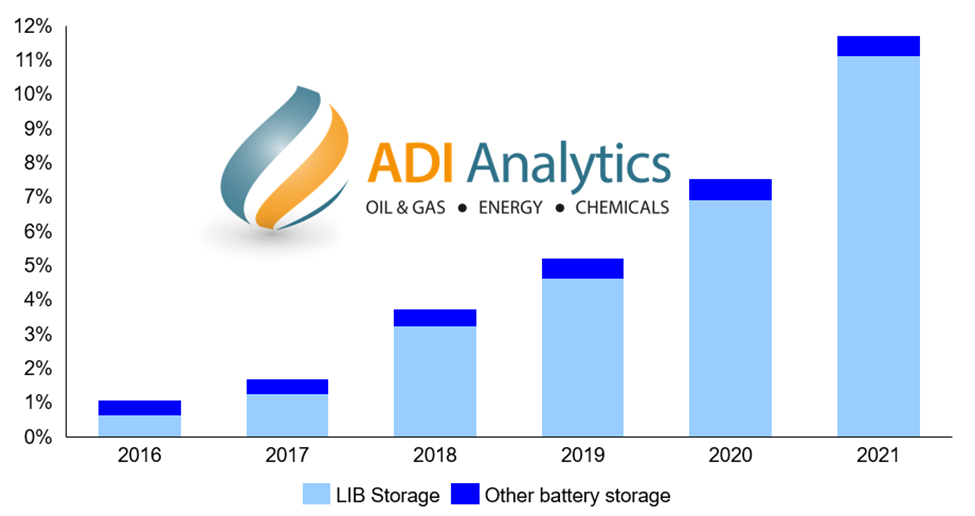

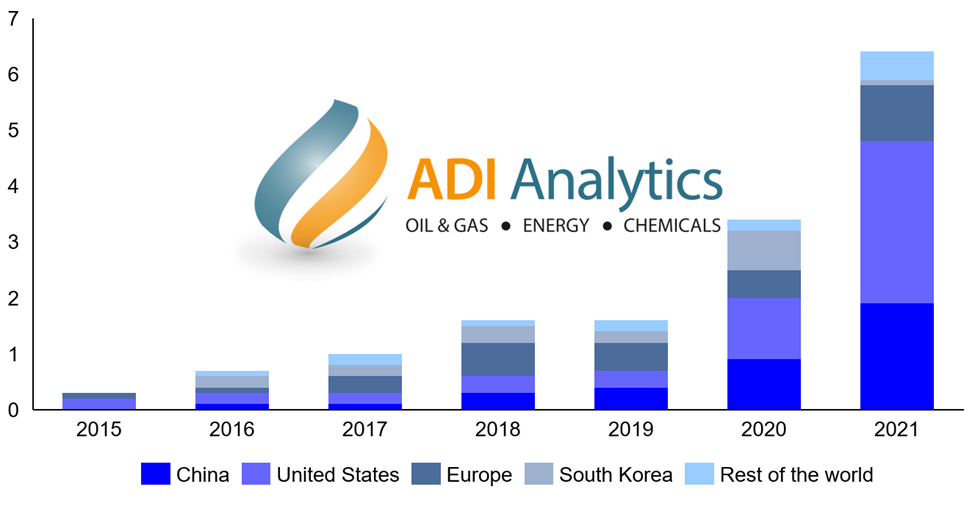

There is a broad range of ESS technology available, and in simplest terms, it can be divided into two main categories: electrochemical storage and non-electrochemical storage. Exhibit 1 provides a brief discussion on the various ESS technologies in these categories. Non-electrochemical storage makes up the vast majority ESS capacity, with pumped hydro comprising 181 GW of the 209 GW of total capacity at the end of 2021. The total share of electrochemical storage has been rapidly growing in recent years with advancements in lithium-ion batteries (LIB), making them the second largest contributor to global ESS capacity (Exhibit 2) with the U.S. and China being the largest contributors to battery storage growth (Exhibit 3).

Growing ESS capacity

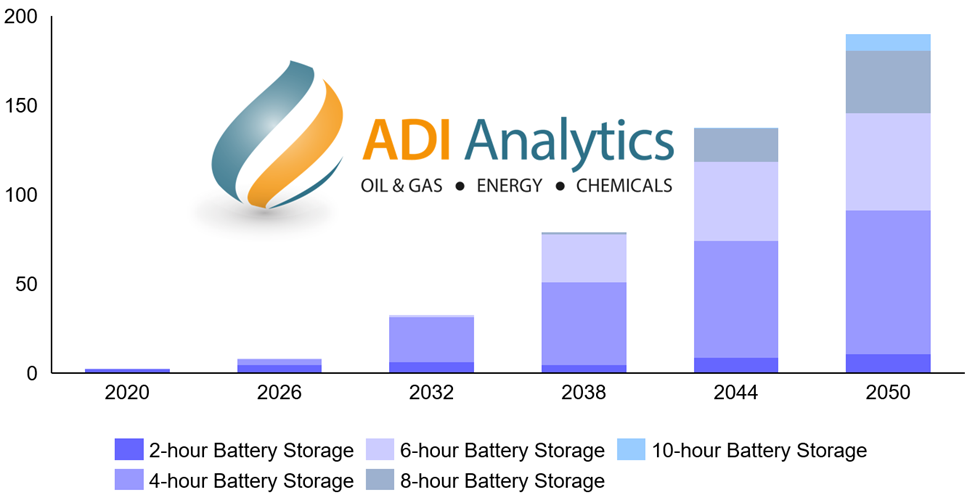

Current battery technology only has a capacity of up to four hours. Advancing LDES – which refers to any technology that can store energy for multiple hours, days, or longer – is essential to propagating renewable energy and overcoming the intermittency issues that are inherent with it. The LDES Council, launched at COP26 in 2021, suggests that LDES capacity needs to increase by 8x to 15x its current capacity for optimal net-zero targets. Pumped hydro is the benchmark standard for grid-scale ESS, partly due to its high round-trip efficiency of ~80%, but it is limited in its scalability. As such, advancements in other technologies, namely electrochemical storage will have to advance to meet these needs. The National Renewable Energy Laboratory (NREL) projections for U.S. battery LDES show batteries with over 4 hours of capacity only becoming significant additions in the mid-2030s (Exhibit 4)

When it comes to batteries, lithium iron phosphate chemistries, a subset of LIBs, are preferred for grid-scale storage. However critical mineral supplies and pricing will undoubtedly influence their use for LDES. Flow batteries, however, are a promising emerging technology for ESS. Performance degradation is slower than in LIBs, and they can be sized according to storage needs. The largest flow battery project is currently underway in China, with a capacity of 100 MW and storage volume of 400 MWh.

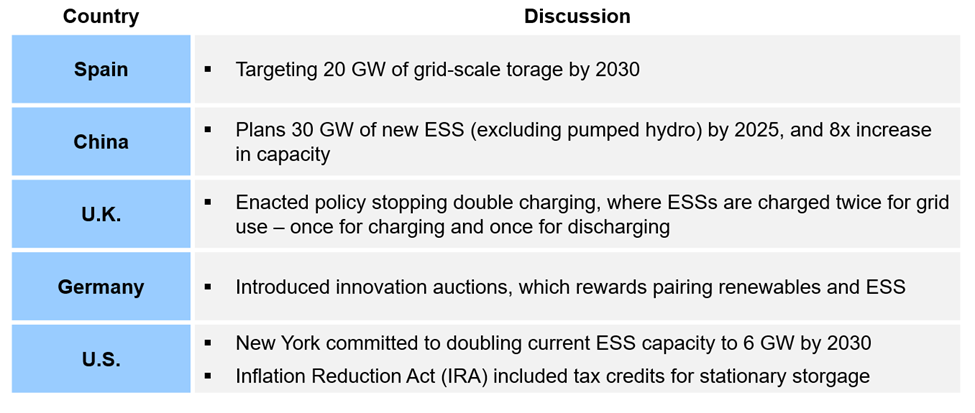

Global investment in ESS remains strong, with almost $10 billion spent in 2021 on battery ESS, with more than 70% of spending on grid-scale systems. Projections for 2022 are estimated at nearly $20 billion. Several countries and states are promoting further ESS development through subsidies, regulatory reforms, and R&D support (Exhibit 5).

Summary

Propagation of grid-scale ESS and LDES is necessary if the world continues to invest in renewable sources of energy, and even more necessary if net-zero targets are to be reached. Advancements to this technology are continually evolving, but the industry remains relatively immature and is likely to remain so for much of this decade. Nevertheless, in the long-term grid-scale energy storage represents a significant and important advancement to meet the world’s energy needs.

ADI Analytics specializes in the energy and energy transition markets. Contact us to learn more.

– Dustin Stolz