Sasol recently announced that its $11 billion gas to liquids (GTL) and ethane cracker project in Lake Charles, Louisiana has been suspended. Gas to liquids technology takes natural gas and converts it into high-value fuels such as diesel and jet fuel. In addition to fuels, the Sasol plant was also planning to produce petrochemicals. In communicating its decision, Sasol announced that it was delaying final investment decision due to “ongoing capital investment reprioritization.”

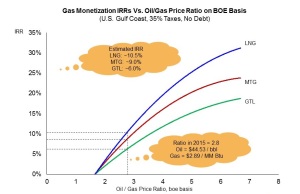

Although current commodity prices may have forced Sasol to delay their final investment decision, GTL projects have long been challenged by high capital costs. In comparison to other gas monetization options, such as LNG, GTL projects are very expensive, costing as much as $100,000 in capital costs per barrel per day of capacity. As a result, GTL project returns have lagged those of other gas monetization options as ADI Analytics has shown previously. Figure 1 shows that at current oil and gas prices, i.e. when the oil to natural gas price ratio on a barrel-of-oil-equivalent (BOE) basis is~2.8, a hypothetical GTL project on the U.S. Gulf Coast offer unlevered rates of only 5% or so.

Given the high capital costs and long timelines of large-scale GTL projects, technology developers such as Velocys, Compact GTL, and several others have been focusing on small-scale GTL. Although the technology is still under development with a long road to commercial deployment, small scale GTL projects could, in principle, offer the potential of lower capital costs.

In research reported by ADI Analytics elsewhere, small-scale, potentially modular GTL projects could be fixed near small and/or remote natural gas fields, which open up the number of natural gas plays that can be easily tapped for feedstock. Further, small-scale GTL technology could offer advantages over large-scale projects including greater efficiency of capital and operating costs, benefits from poly-production, and better feed sourcing. These factors collectively could improve returns and make small-scale GTL look more economically appealing.

-Tyler Wilson and Uday Turaga