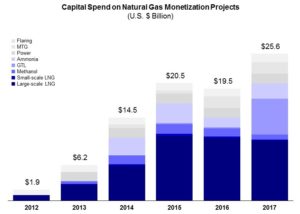

HOUSTON, Texas–Unconventional oil and gas in North America has ushered in a flurry of capital projects aimed at taking advantage of cheap and abundant natural gas. New research from the oil and gas market research and consulting firm, ADI Analytics, forecasts that capital spend on natural gas monetization projects is anticipated to grow at a robust pace of more than 20% annually until 2017. Based on a careful inventory and analysis of project announcements conducted as part of the consulting firm’s Natural Gas Monetization Research Service, ADI projects that there will be up to $80 billion in capital spend through 2017 on natural gas monetization projects. Exhibit 1 shows capital spend by project type until 2017.

Natural gas monetization projects include large-scale LNG, small- and mid-scale LNG, methanol, ammonia, methanol-to-gasoline (MTG), gas-to-liquids (GTL), power generation, and flare gas recovery projects. In the past several years, demand growth for natural gas has been anemic while supply has grown rapidly. New projects offer a way to take advantage of expanded and cheap domestic natural gas supply. “Although capital spend is dominated by large-scale LNG export projects such as those under construction by Cheniere Energy,” says Uday Turaga, CEO of ADI Analytics, “a number of other gas monetization projects have been announced and are moving forward.”

As part of its Natural Gas Monetization Research service, ADI Analytics is researching and benchmarking a wide range of options including large- and small- mid-scale LNG projects, gas-to-liquids, power generation and gas-to-wire, gas conversion to methanol and ammonia, and new technologies to reduce gas flaring. ADI is also exploring how gas monetization projects will be impacted by various factors. Changes in capital costs, commodity prices, regulations, technological innovation, and market supply and demand are just a few of the several factors that impact these projects.

About ADI’s Natural Gas Monetization Research Service

ADI Analytics offers a Natural Gas Monetization Research Service that provides a holistic view of gas monetization including large- and small- mid-scale LNG projects, gas-to-liquids, power generation and gas-to-wire, gas conversion to methanol and ammonia, and new technologies to reduce gas flaring. The Research Service produce various deliverables including monthly briefs for rapid analysis of current market developments, quarterly reports that analyze and cover all natural gas monetization options, and annual reviews. All deliverables are supported by datasets, expert access, and conference calls.

Highlights of the 2Q 2015 report from ADI Analytics’ Natural Gas Monetization Research Service were presented during a free webcast. Click here to view