Approximately 85% to 90% of manganese ore is used in the production of additives for mostly the iron and steel industry. Manganese adds strength and toughness to iron and ferro-manganese and silico-manganese additives are used for their sulfur fixing and deoxidizing properties. Whilst the iron and steel industry certainly have a grip on manganese demand, there is an opportunity for manganese to expand in the electric vehicle (EV) battery market. Currently, there is discussion about designing and adopting cobalt-free batteries for widespread application in the EV industry, which shines a spotlight on alternative materials like manganese. Two prominent batteries in production that contain manganese are Lithium Manganese Oxide (LMO) and Lithium Nickel Manganese Cobalt Oxide (NMC) batteries. In LMO batteries, manganese accounts for 61% of the material used in the cathode, whereas manganese only accounts for 20% to 30% of the total cathode material in NMC batteries.

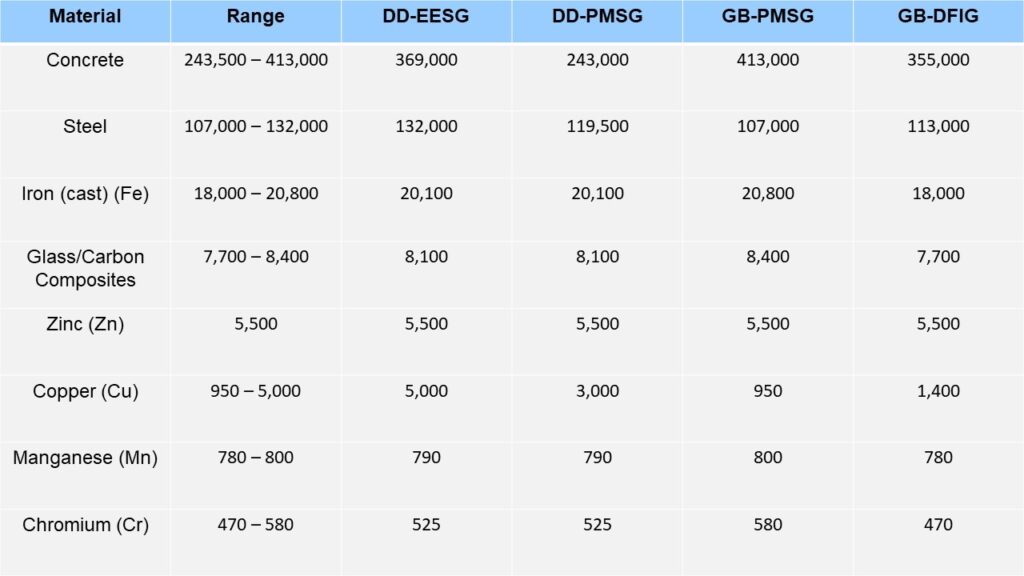

Apart from EV batteries, manganese is also an essential material for onshore and offshore wind power generation. Generally, manganese is used in the tower, nacelle, and gearbox of the wind turbine. There are four main types of wind turbines: direct-drive electrically excited synchronous generator (DD-EESG), direct-drive permanent-magnet synchronous generator (DD-PMSG), gearbox permanent-magnet synchronous generator (GB-PMSG), and gearbox double-fed induction generator (GB-DFIG). The manganese usage estimates for these four types of wind turbines range from 780-800 t/GW (Exhibit 1). The material intensity of manganese is relatively lower than other key metals and minerals used in wind turbines such as iron, copper, and zinc.

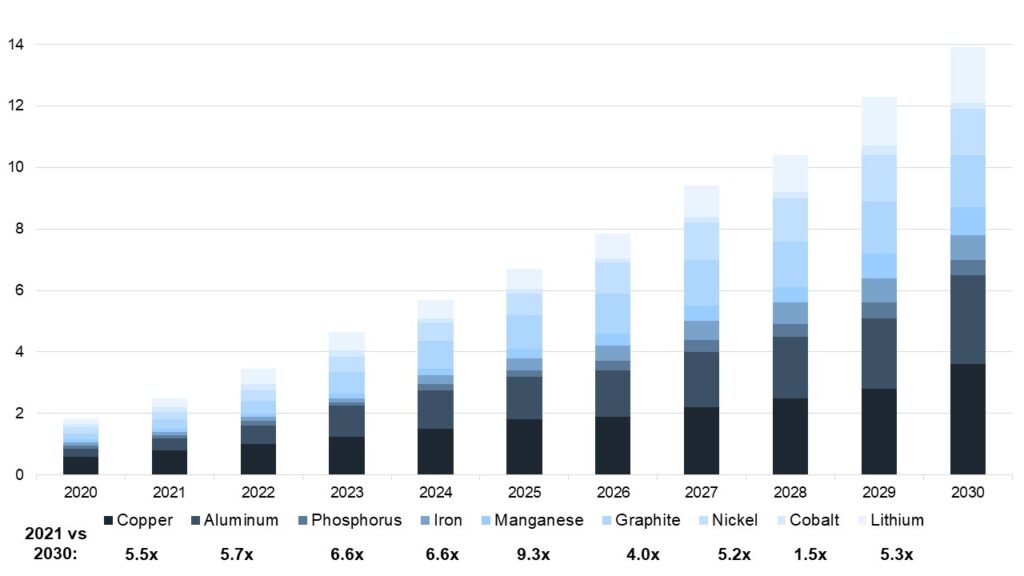

Therefore, the demand for manganese will not be as heavily impacted by the growth of wind power generation capacity due to its relatively low material intensity but is projected to grow by 2030 and 2040 due to other prominent market drivers. One of them is the lithium-ion battery industry. The metals and minerals demand from lithium-ion batteries is estimated to grow by factors ranging from 1.5 to 9.3 between 2021 and 2030 (Exhibit 2).

According to BNEF, the demand for manganese from lithium-ion batteries will be 9.3 times higher in 2030 than in 2021. The manganese battery supply chain is expected to experience the strongest growth through 2030, which aligns with the current growth in manganese use in the electric vehicle industry. In recent months, high-purity forms of manganese have become crucial for electric vehicle manufactures. The NMC battery is a clear leader in the electric vehicle industry, and there is potential for other forms of lithium-ion batteries to rise, especially cobalt-free batteries.

Despite the great prospects for global manganese demand, battery manufactures and end-users are concerned about the future supply of manganese. Since October 2020, dozens of Chinese manganese processors formed a state-backed campaign to establish a “manganese innovation alliance”. Together they plan to centralize the control of key supply and coordinate prices. Their tight hold on supply caused prices to skyrocket around the globe, which alarmed steelmakers and car manufacturers. Manganese ore can be found in many parts of the world, but it is almost solely refined in China. This leaves global supply chains vulnerable to cartel-like activities, and many non-Chinese mining operators are attempting to expand global supply options.

Nine non-Chinese projects to produce battery-grade sulfate are being planned around the world. One of these nine projects has been initiated by Element 25 Ltd., an Australian mining company. The project is located at the Butcherbird Manganese Deposit which is Australia’s largest onshore manganese resource. Supposedly, the site contains more than 260 million tons of manganese ore. However, projects outside of China may require large investments as viable manganese ore reserves are often located in remote regions.

Historically, manganese mine production has been led by South Africa until 2020 when its mine production fell by 10% due to disruptions such as temporary mine closures caused by the COVID-19 pandemic. During 2020, manganese mine production came from South Africa (28%), Gabon (15%), China (7%), Australia (6%), Brazil (6%), and the rest of the world (37%). From 2012 to 2020, world mine production grew at a 1.8% CAGR, with Australia and China being the only top mine production countries with steep, negative CAGRs of -12.2% and -9.9% respectively.

This year, manganese sulphate prices rose by 30% from $867 per metric ton in January to $1,128 per metric ton in June. The market is beginning to recover strongly from the impact of the pandemic, and prices are expected to keep rising in the second half of the year as demand for lithium-ion batteries continue to grow. The manganese sulphate market is forecasted to be in a deficit due to strong demand and limited supply. With current projections, prices are likely to rise to support new refinery projects to meet demand by 2024. Key factors that will contribute to the direction of the manganese market are whether manganese batteries become widely adopted and the speed at which manganese producers can meet demand increases.

ADI is launching a multi-client study – “The New Frontier: Critical Minerals & the Energy Transition” – which is focused on a comprehensive assessment and outlook for critical minerals supply and demand through 2030. This 12-week long multi-client study process builds on ADI’s extensive research and deep expertise in metals, minerals, mining, mineral processing, and energy transition. The study will be based on in-depth primary and secondary research and supply and demand modeling and analytics. Please download the multi-client study prospectus – “The New Frontier: Critical Minerals & the Energy Transition”– and contact us to learn more.

Visit the rest of our blog series, Mining and Metals, to learn more about other critical minerals for the energy transition and stay tuned for upcoming blog posts.

– Jacqueline Unzueta & Swati Singh