Electric vehicles (EVs) demand continues to grow, albeit at a slightly slower pace, as ADI has reported previously. Policy support, falling battery pack and cell prices, rising consumer interest, and innovation by automotive OEMs are all driving this growth resulting in concerns on whether there is enough supply of various critical minerals including lithium, nickel, and other critical minerals. ADI is actively investigating critical mineral markets including new materials and chemistries for lithium-ion batteries.

Generating new supply for some of these critical minerals is a time- and capital-intensive feat. Additionally, the mining industry faces challenges such as geopolitical risks and instability, detrimental environmental and social impacts, declining ore quality, capital intensity and long lead times, and lack of infrastructure that are slowing down supply growth. Battery recycling can help overcome some of these challenges by reusing critical minerals recovered from manufacturing scrap or used lithium-ion batteries.

In addition to the critical minerals scarcity, regulations, battery waste growth, and sustainability and circularity goals will drive battery recycling. Today, most of battery recycling is driven by battery manufacturing scrap where scrap production rate can be as high as 10% of a gigafactory’s capacity can be as high as 10% followed by damaged or recalled batteries. Used batteries often find applications in secondary uses such as for stationary use and energy storage but the share of used batteries in battery recycling is expected to grow as the EV fleet matures.

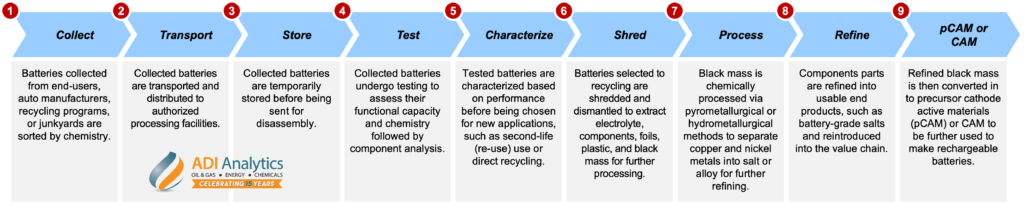

The battery recycling value chain consists of nine steps starting with used battery collection all the way to manufacturing precursor cathode active materials (pCAM) or CAM that are used to make batteries. Exhibit 1 below shows the typical battery recycling value chain. Scrap or used batteries are collected and transported to a storage facility before they are sent to a facility for disassembly. Batteries are then tested to assess their functional capacity and chemistry followed by component analysis to decide whether they are eligible for a second life in uses such as stationary back-up power or energy storage or should be recycled. To recycle, batteries are first shredded and dismantled to separate electrolyte, components, foils, plastic, and black mass. Black mass is the meat here that is processed via pyrometallurgical or hydrometallurgical methods to separate copper and nickel metals into salts or alloys that are further refined into battery-grade salts to ultimately make pCAM or CAM.

Exhibit 1. Typical battery recycling value chain.

Technology developers and investors in this value chain involve themselves across one or multiple steps across this value chain. Shredding, black mass recovery, and refining are some of the areas where they are trying to differentiate themselves in terms of technology and cost competitiveness and quality of the output.

As the EV market grows and matures, ADI expects battery recycling market to rise exponentially where technologies and players will emerge either across the value chain or specializing in a narrow range of segments. ADI has helped several companies including technology developers and investors navigate the battery recycling market with regulations and policy analysis, market research, technology benchmarking, and competitive landscaping and continues to track the market closely.

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including EV market and supporting infrastructure, renewable power demand, and biofuels, hydrogen, and CCUS markets where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives together for meaningful dialogue and strategic insights across the oil & gas, energy transition, and chemicals value chains. Learn more about the ADI Forum, which is chaired by Uday Turaga, Founder & CEO, ADI Analytics, at www.adi-forum.com.

Subscribe to our newsletter or contact us to learn more.

By Panuswee Dwivedi