On November 5Th Americans will vote for their next president. This election can feel like déjà vu, as the two main candidates are the same as in 2020. According to current polls and reports, the race is expected to be tight. The first debate is scheduled on June 27th and might help inform voters – or not.

We at ADI, are however, kicking off our analyses of the Presidential Election and its implications on oil and gas, energy, and chemicals. It is a bit early for ADI’s usual blog summarizing the proposed energy policies of President Joe Biden and, the Republican nominee, Donald Trump, but we aim to address some questions we’ve been hearing from our clients. In this blog, we address a recurring question: How will the Presidential Election affect the Inflation Reduction Act (IRA)?

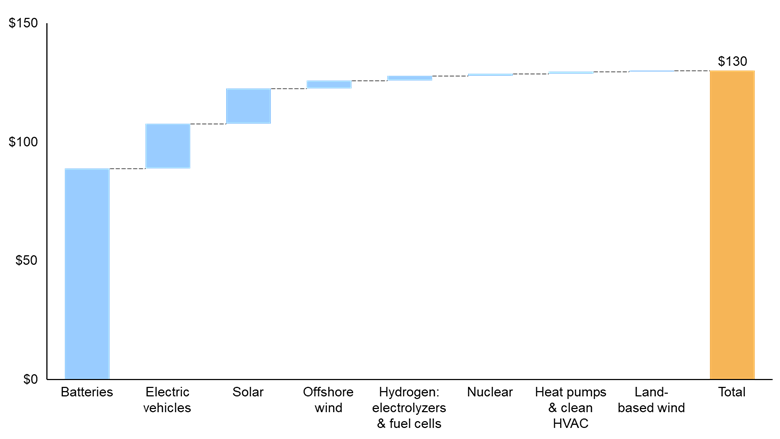

The IRA represents the largest investment in clean technology and climate change mitigation in U.S. history. Despite facing unanimous opposition from the Republican members of U.S. Congress during the voting process, the IRA has since proven to be a significant economic stimulus. Since its passage the total capital investments sum up to ~$130 billion, with 83% being in batteries and electric vehicles manufacturing and 14% directed towards clean electricity production like solar and wind, as shown in Exhibit 1.

Exhibit 1: Breakdown of post-IRA investments by type of technology. Source: U.S. Department of Energy (DOE).

Despite the compelling commercial and economic advantages, the IRA has brought to the energy industry, there are serious concerns about its future if the U.S. presidency changes after the upcoming election. Trump has openly criticized the IRA and other clean energy policies, stating that electric vehicles mandates would “spell the death of the U.S. auto industry”, and his campaign officials have said the administration would seek to cut spending allocated for the IRA’s tax credits.

Here are three factors to consider when evaluating the risks to the IRA in light of the change in presidency:

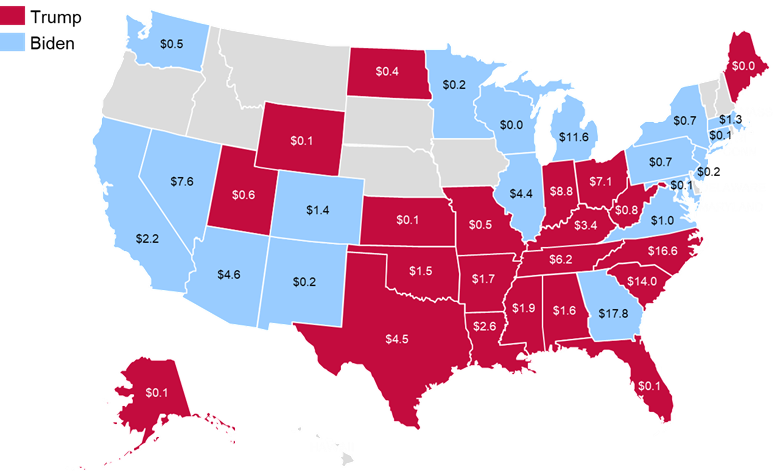

- IRA’s curious romance with red states: Several red states have been the primary beneficiaries of IRA-related spending. Out of the ~$130 billion invested post-IRA, $54 billion is in states that voted for Biden in 2020, and $73 billion to states that voted for Trump, with $3 billion being unreported, as shown in Exhibit 2. For instance, North Carolina, a state where the majority voted for Trump, has been chosen by Toyota for its battery plant, marking a substantial investment of $12.6 billion. Similarly, Texas has raised $4.6 billion for cleantech projects and stands as one of the leaders in renewable electricity production through solar and wind. Several factors have contributed to attracting these projects to red states, such as favorable climate conditions, expansive and affordable land availability, simplified permitting processes, and relaxed union labor laws. Collectively, the significant economic benefits from this spending will weight on any decision by a potential Trump Presidency to cut or replace the IRA.

Exhibit 2: Post-IRA investments by state by party affiliation based on the 2020 elections. Source: U.S. Department of Energy (DOE).

- The show must go on: Over the next few months, we anticipate a rise in funding from the U.S. Department of Energy, especially for companies seeking Loan Program Office (LPO) support. The Treasury has issued further guidance on IRA credits, including clarifications on domestic manufacturing requirements, with more definitive guidance anticipated shortly. Major companies are already adjusting their strategies and implementing numerous projects, based on IRA incentives, making the momentum generated by these initiatives difficult to unwind, even with potential political changes.

- Do as I say, not as I do: In 2020, Biden pledged to transition the U.S. away from fossil fuels, although the U.S. has been breaking records of oil and gas production since them. Similarly, in 2017, Trump labeled Obamacare a “disaster” but encountered difficulties in repealing it during his presidency. These examples highlight the uncertainty of political promises and the enormous political challenges with repealing passed laws. The IRA is established by congressional law, necessitating new legislation for its repeal, a complex and time-consuming process, particularly given the IRA’s comprehensive scope. Thus, despite potential rumors of IRA disruptions, progress in this direction is unlikely, in ADI’s opinion.

Therefore, the IRA is likely to persist despite potential changes in the U.S. administration due to its fundamental economic importance and broad-based political support. While minor modifications or updates may occur, the core structure and benefits of the IRA are expected to remain intact. The economic momentum and realities created by the IRA make substantial alterations unlikely, even in the face of political rhetoric or promises to specific industries.

– Maria Lopes

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets and policies, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains. Subscribe to our newsletter or contact us to learn more