Beginning with the 2016 Presidential election in the U.S., ADI has been publishing a summary of energy policy proposals by the leading candidates. Our summary has typically collected the positions of the two candidates on key energy issues, and we have tried to be objective by using their own words — made through statements reported in the media or through policy positions articulated on their websites.

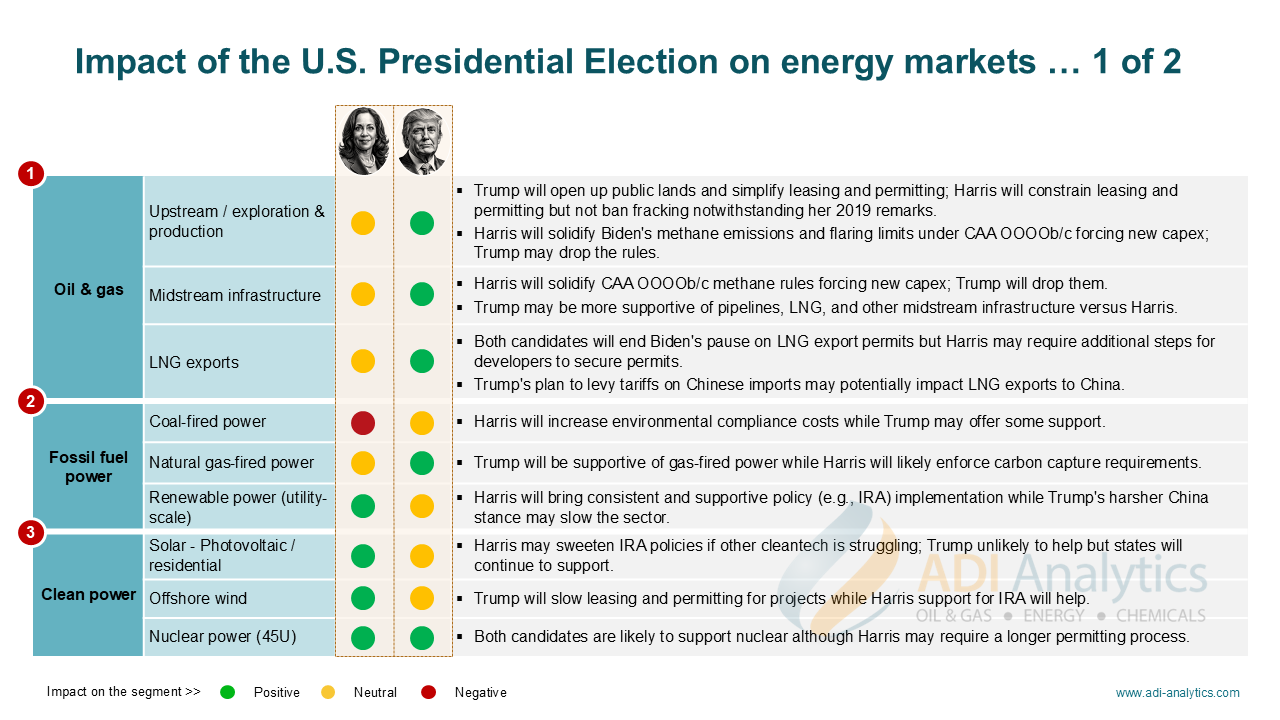

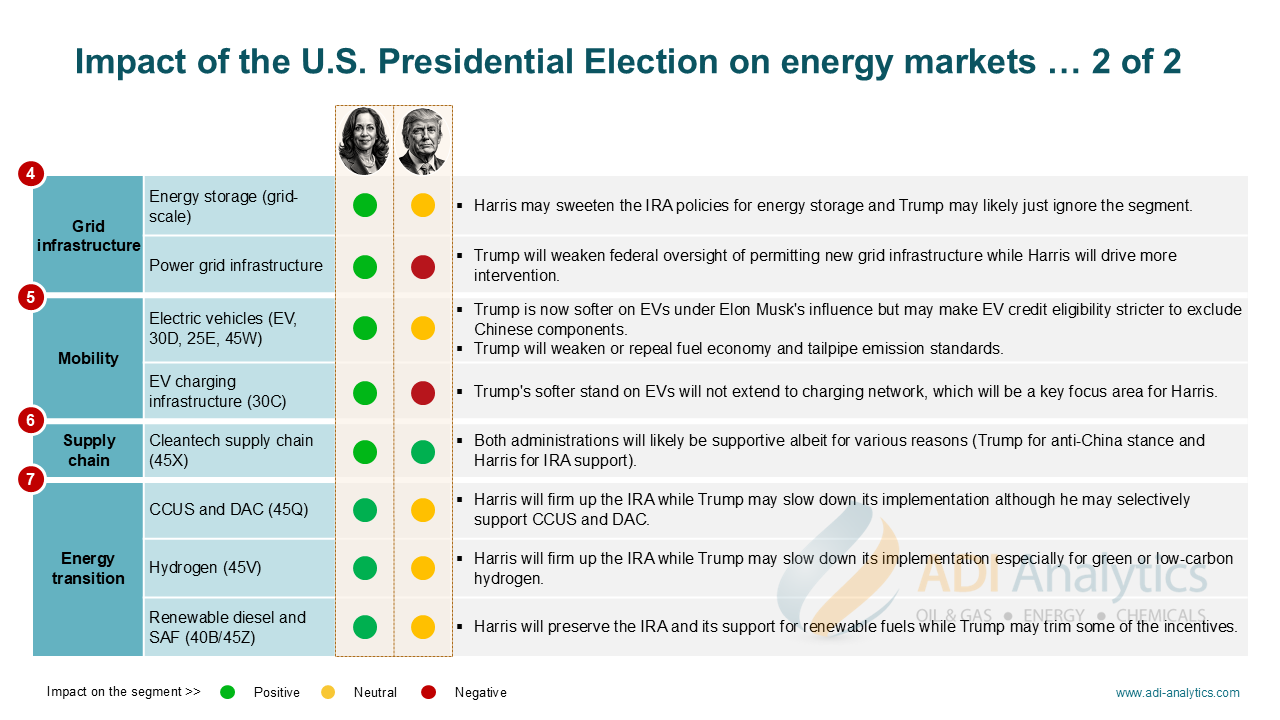

We tried attempting the same this year but were held back because neither Vice President Kamala Harris nor former President Donald Trump have articulated their energy policy proposals in any specific depth to allow for a comprehensive summary. Even so, our clients have been asking us for our thoughts on the implications from the Presidential election given the importance of policy on energy. Considering this, ADI has chosen to develop an assessment of the impact either candidate is likely to have as President on key energy topics and segments.

You can download this assessment here, while a few overarching thoughts are discussed below:

- Both candidates have agreed on sidestepping detail on energy policy. Harris and Trump have both chosen to avoid stating their positions on energy topics and policies in any substantive fashion. Harris mentioned climate change once in her acceptance speech at the Democratic National Convention, while Trump has chosen to emphasize his support for oil & gas through slogans such as “Drill, baby, drill.” Harris’ campaign staff have told journalists that their decision to avoid specifics was on purpose. This strategic ambiguity on energy policies was necessary because of the complexity of the topics and wide variance in positions held on specific aspects of energy policy across the aisle but also within various sections of the individual parties.

- Energy prices and costs to consumers are driving underlying positions on energy policies. Both candidates have chosen to frame their positions on energy policies as strategies to reduce energy prices and help consumers cut their spending on energy. Harris, however, has made climate another key driver in determining her energy policies. While pursuing similar outcomes, both candidates are taking very different approaches. At a high level, Trump is favoring fossil fuels with limited and seemingly arbitrary support to specific aspects of clean energy. Harris, on the other hand, has a more consistent theme around strongly supporting renewables and clean power and professing a more pragmatic approach to oil & gas that includes a change in her prior views, for example, on fracking.

- We can’t emphasize enough that the actual impact on energy policy will be limited, and any shifts will occur over a long period of time. Market forces and the laws of supply and demand, division of power in Congress, rapid growth in litigiousness of policy changes, and the long timelines of effecting policy changes will all reduce both the scope and bite of changes to energy policies by Presidential administrations. As a result, Trump’s decision to open leasing of federal lands for more drilling is unlikely to have a huge impact on oil and gas production. Further, notwithstanding the criticism of the Inflation Reduction Act (IRA), we think it is unlikely Trump will repeal it as discussed in Part 1 of the blog. Similarly, we are confident that Harris will not ban fracking and will also end President Joe Biden’s pause of LNG export permits — for a wide variety of reasons that we have addressed previously.

- Even so, there will be some transaction costs for the energy industry with a new President. A new Presidential Administration will extract some costs — even if we see them as limited and spread over a long time — from the energy industry. This will manifest mainly through additional hurdles in the day-to-day blocking and tackling of operating energy assets and businesses. For example, although Harris will most likely end the pause of LNG export permits, her Administration may require additional diligence and new steps for new export permits. Similarly, her strong support for Environmental Justice could delay permitting of new infrastructure projects or nuclear energy and overall scrutiny by the various agencies will likely rise. Finally, Trump may in his second term choose to slow roll appropriations to some elements of the IRA even if not completely repealing it.

ADI Analytics is carefully watching the U.S. Presidential Election for its impact on energy policies. Please stay tuned for future updates, and we welcome your feedback. Meanwhile, please download our assessment of the impact Trump and Harris may have as President on various energy topics.

— Uday Turaga

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets and policies, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics , with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.