As the world moves towards a more sustainable energy future, ethanol and methanol could play a key role in powering not just vehicles but also airplanes. With mandates in place in the U.S. and EU for the use of sustainable aviation fuel (SAF) and initiatives by organizations such as the International Air Transport Association (IATA) and International Civil Aviation Organization (ICAO) to limit CO2 emissions from aviation, the transition to cleaner energy in the aviation industry is set to pick up pace in the coming years. Additionally, tax credits under the Inflation Reduction Act (IRA) encourage the production of new SAF capacity, further incentivizing the shift towards a more sustainable future. ADI tracks SAF markets globally through our biweekly SAF Tracker newsletter.

In our previous blog post, we talked about different ways to produce SAF and their corresponding techno-economic assessments. Among the most established, ASTM-approved methods are hydroprocessed esters and fatty acids (HEFA) and hydrogenated vegetable oil (HVO). These pathways use feedstocks like camelina, jatropha, castor oil, and used cooking oil to create synthetic paraffinic kerosene. At present, the HEFA/HVO pathway supplies over 80% of SAF demand. However, the limited availability of waste oils, which are already heavily used by the road transport sector, presents a significant obstacle for SAF production via the HEFA/HVO pathway to meet the demand in the future. A detailed feedstock assessment is available in ADI’s multi-client offering on SAF markets.

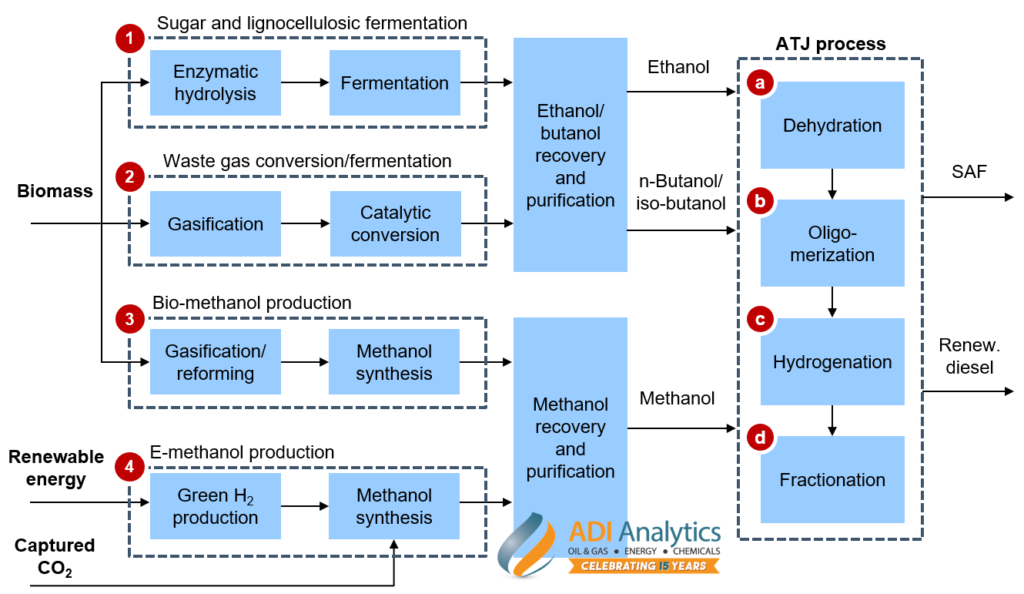

The alcohol-to-jet (ATJ) pathway is a promising alternative to fill this gap. Within the ATJ process technologies, there are three production pathways, namely ethanol-to-jet (ETJ), butanol-to-jet (BTJ), and methanol-to-jet (MTJ). The ETJ and BTJ pathways use bio-based feedstocks like sugarcane, cassava, grain, and corn stover to produce ethanol and butanol for the ATJ process. These feedstocks undergo fermentation or gasification to produce ethanol or butanol. In contrast, MTJ focuses on methanol produced from renewable hydrogen, captured CO2, or biomass-derived syn-gas via biomass gasification. These alcohols then go through a series of processes, starting with dehydration, followed by oligomerization, hydrogenation, and fractionalization to produce SAF (see Exhibit 1).

Exhibit 1. ETJ, BTJ, and MTJ production pathways in ATJ.

Out of all the pathways in the ATJ family, ETJ has gained the most attention from established technology licensors such as Axens, Lummus Technology, and Honeywell UOP. Several start-ups are developing the ETJ technology and constructing their own plants, including LanzaJet (a subsidiary of LanzaTech), Byogy, and SAFFiRE Renewables. LanzaJet is the most advanced commercially, having built the world’s first ETJ biorefinery with a production capacity of 10 million gallons per year in Soperton, Georgia, in early 2024. The SAF production via ETJ pathway is expected to reach up to a total of about 1,230 million gallons per year by 2025.

While ETJ has gained traction, BTJ seems to lag in commercial interest, with only KBR acting as the licensor and Gevo and Swedish Biofuels as the technology developers in the space. Gevo currently operates a BTJ production facility in Silsbee, Texas, with a production capacity of 10 million gallons per year. Gevo is also building a second SAF production facility using butanol feedstock in Lake Preston, South Dakota, which is expected to produce 55 million gallons per year of SAF but is planned to be operational in 2026. Besides Gevo, Swedish Biofuels is also working on building three SAF production facilities in Sweden with a total capacity of about 130 million gallons per year. The SAF production via the BTJ pathway will account for a total of 245 million gallons per year of production capacity by 2025.

MTJ, on the other hand, is a new addition to the ATJ family. Recently, companies like TotalEnergies and Masdar have demonstrated the feasibility of methanol as an aviation fuel blend during COP28. Though MTJ is not ASTM-approved like ETJ and BTJ, it is emerging as a promising addition to the ATJ technology family to meet the growing demand. Established industry players such as Honeywell UOP and Axens, with existing ETJ technology, are actively diversifying their portfolios to incorporate MTJ. Notably, Topsoe and ExxonMobil recently developed and launched their MTJ processes, extending their existing methanol synthesis and methanol-to-gasoline technologies respectively. Currently, only Metafuels and SPIC have announced MTJ projects, accounting for a total of 4 million gallons per year of production capacity by earliest 2025.

For more information on the SAF market outlook, ADI Analytics has previously posted a blog which can be viewed here. ADI has also published a multi-client study on jet fuel and sustainable aviation fuel markets, which is available immediately and continues to track this dynamic market using our biweekly SAF Tracker newsletter. Contact us for an updated view on SAF commitments by airlines, off-take agreements, and partnerships for commercialization.

– Edmund Lam, Maria Lopes, and Panuswee Dwivedi

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including sustainable aviation fuels, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.