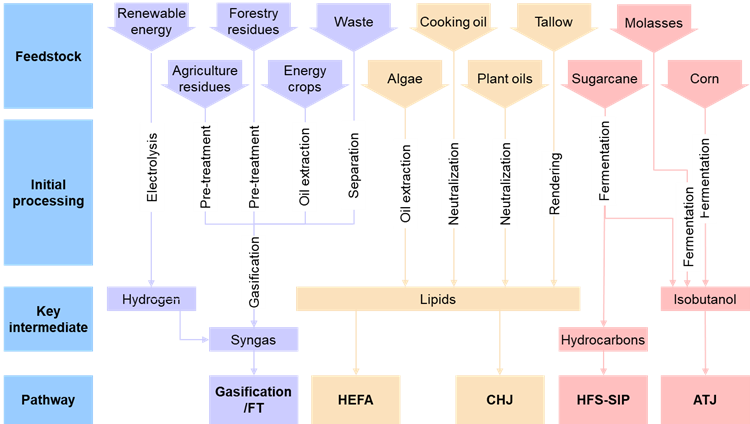

We discussed the COVID-impact on aviation, regulatory drivers of decarbonization in aviation, and several commitments and investments made by airlines globally in the previous blog. In this blog, we will discuss how growing supply, techno-economic advancements, and feedstock supply will drive global sustainable aviation fuel (SAF) demand growth. There are several ways to manufacture SAF from feedstock ranging from renewable energy, agriculture or forest residue, energy crops, waste, algae, used cooking or plant oils or tallow, and sugarcane, molasses, or corn. The figure below summarizes key approved ‘pathways’ for SAF production by feedstock, initial processing required, and key intermediates in each.

Exhibit 1. Mapping feedstocks to SAF pathways

HEFA-SPK or synthetic paraffinic kerosene produced from hydro-processed esters and fatty acids uses camelina, jatropha, castor oil, and used cooking oil as feedstock. Alcohol-to-jet (ATJ)-SPK or synthetic paraffinic kerosene uses sugarcane, cassava, sorghum, or corn to make ethanol or isobutanol to be converted into SAF. Gasification/FT-SPK or Fischer-Tropsch synthetic paraffinic kerosene uses agricultural forestry residues, and municipal waste. CHJ is catalytic hydrothermolysis synthetic jet fuel that uses triglyceride-based feedstocks such as waste oil, algae, soybean, and camelina while HHC-SPK uses biologically derived hydrocarbons such as algae. Each of these different feedstocks and pathways have varying feed conversion rates and product slates and there is significant research underway to maximize feed conversion. The exhibit below summarizes conversion rates and product slates of key SAF pathways.

Exhibit 2. Feed conversion rate and product slate for key production pathways

Talking about production costs, depending on the technology and process, HEFA is the most cost-competitive pathway followed by gasification/FT and alcohol-to-jet. Considerable production costs in HEFA comes from feedstock costs. Gasification/FT production costs are high mainly due to high capex of a gasifier. Power-to-liquid is currently one of the most expensive SAF pathways and requires significant renewable hydrogen capacity and is extremely inefficient in terms of electricity application owing to high cost of direct air capture. Exhibit 3 summarizes average global SAF production costs by pathway.

Exhibit 3. Average global SAF production costs by pathway in U.S. dollars per ton

While SAF can be produced from various feedstocks there are several limitations around these competing with food sources, high carbon footprint and land waste, as well as availability in terms of volume and location. Exhibit 4 below summarizes various feedstock options and several advanced and waste feedstocks have higher sustainability potential than others. Additionally, while SAF demand is driven mainly by North America and Europe, a lot of the feedstocks available today are grown in Asia. Thus, producers as well as end-users are going to have to invest in feedstock availability.

Exhibit 4. Feedstocks for SAF production

ADI recently published a multi-client study on jet fuel and sustainable aviation fuel markets which is available immediately and continues to track the very dynamic market. Contact us for an updated view on SAF production pathways, technological developments, production costs, and feedstock availability, GHG saving potential, and sustainability concerns.

By Panuswee Dwivedi