The North American downstream market — refiners and petrochemical producers — has greatly benefited from growing supply of light tight oil and NGLs, pricing disconnects due to lack of midstream infrastructure, and rapid emergence of export markets. Refiners and petrochemical producers have adopted various operational, commercial, and competitive strategies to take advantage of these trends.

Monitoring these downstream industry trends, metrics, and players can yield important insights and opportunities. So ADI has launched a new monthly subscription service covering the North American downstream market. Our goal is to provide research, market intelligence, analytics, and insights to help subscribers build a strategic, forward-looking view of downstream markets, operations, assets, and supply chain.

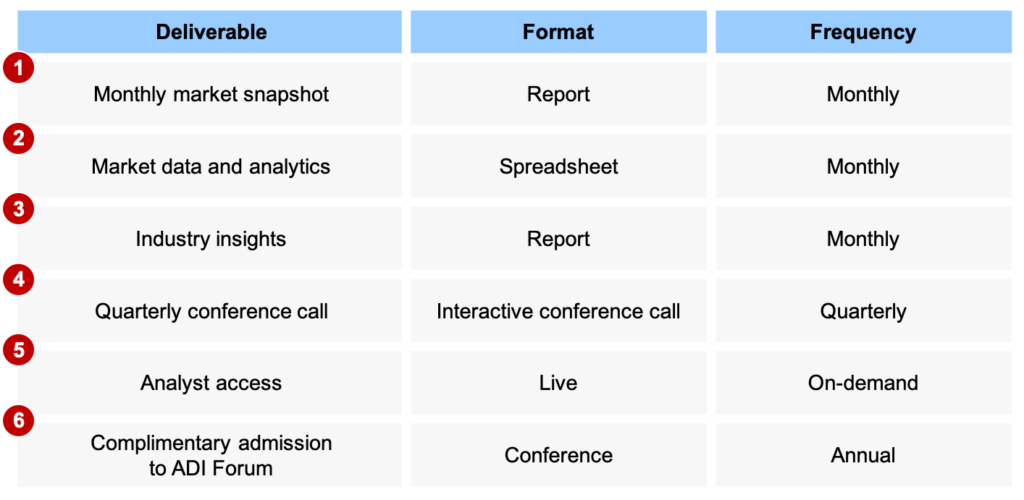

Key deliverables of our research service will include the following:

- Monthly market snapshot reviewing key downstream market data and metrics

- Monthly insight with comprehensive analysis and coverage of a topical issue

- Market data and analytics behind our research, reports, and deliverables

- Conference calls to present and have a live discussion of each quarter

- Analyst access for subscribers to call our analysts with questions and requests

- Complimentary admission the ADI Forum, our annual oil and gas conference

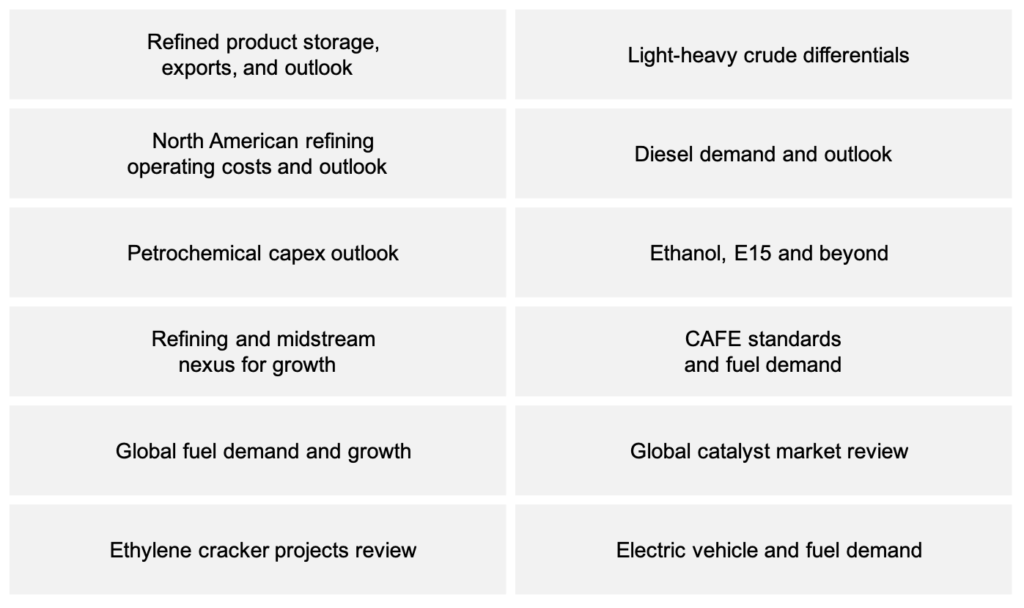

Our research service provides a monthly report comprising two parts. The first reviews historical data and forecasts on key downstream industry metrics including oil and gas prices, domestic and export demand for fuels, capital spending, refining margins, turnaround activity, and near- to medium-term outlook. The second part of the monthly report will feature insights and in-depth analysis on a topical downstream industry theme. The table below lists a few examples of key downstream industry themes our service will monitor and analyze.

A wide range of stakeholders can benefit from ADI’s North American Downstream Market Advisory. Refiners and chemical and petrochemical companies can track key industry metrics and competitors. Traders, investors, financial institutions, and government agencies can understand key market dynamics and outlook. EPC companies, process licensors, catalyst vendors, industrial gas players, equipment manufacturers, and service providers can understand the target market they are serving and develop appropriate go-to-market strategies.

Download the research service prospectus research service prospectus and our recent service deliverables to learn more

- Jaunary 2021 “Future of Refining – Rationalize, Reduce, and Repurpose”

- November 2020 “Digital Transformation at DCP Midstream”

- October 2020 “Renewable Natural Gas”

- September 2020 “Mexican Fuel Terminals Review”

- August 2020 “Global Plastics Recycling Market”

- July 2020 “Ecuador Refining Market Review”

- June 2020 “Refining Capex Outlook Post-COVID”

- May 2020 “Refineries’ Road to Recovery – PADD Level Analysis”

- April 2020 “Riches to Rags – Downstream O&G in Perfect Storm”

- March 2020 “Global Crude Oil Supply-Demand Scenarios Post COVID”

- February 2020 “LNG in Transportation”

- January 2020 “Refinery Insights from 2020 ADI Forum”

- December 2019 “Hydrogen Market Outlook”

- November 2019 “Refining and Petrochemicals Capex Outlook”

- October 2019 “Digital Initiatives in Downstream Oil and Gas”

- September 2019 “Global Methanol Outlook”

- August 2019 “Crude Oil to Chemicals”

- July 2019 “Rising Octane Value and Aromatics Markets”

- June 2019 “Strategic Issues in U.S. West Coast Refining Market”

- May 2019 “Canadian Oil Production and Outlook”

- April 2019 “Global Biodiesel and Renewable Diesel Markets’ Outlook”

- March 2019 “Venezuelan Sanctions’ Impact on Heavy Oil Supply”

- February 2019 “Where is Ethanol Headed?”

- January 2019 “The Wave Isn’t Temporary – Cracker Cycle Continues”

- December 2018 “Trends And Outlook For Global Fuel Demand”

- November 2018 “Refining Industry Performance in 3Q 2018”

- October 2018 “Compliance Strategies for IMO 2020”

Please contact Uday Turaga at +1.832.768.8806 or via e-mail to learn more and subscribe.