In a series of blogs, ADI has provided a snapshot of the refining industry landscape in major Latin American that rely on imports to meet fuel demand. We have covered Brazil, Mexico, Chile, and Ecuador so far. In the last blog of this series, today we will be discussing Peru. This blog series draws on our extensive research and consulting on refining in Latin America from our recent multi-client study, “Market Outlook for U.S. Refined Products Exports to Latin America”.

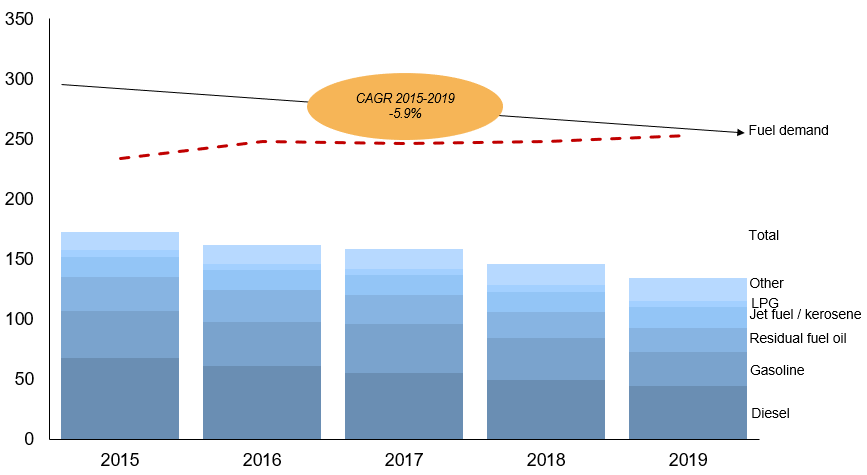

Road transportation accounts for ~70% of Peru’s fuel demand followed by 16% for industrial and 13% from buildings. Diesel accounted for ~40% of fuel demand in Peru followed by ~17% for gasoline and ~22% for LPG over the past five years (Exhibit 1). Peru’s fuel production fell sharply over the past few years due to the shutdown of several units at the company’s Talara refinery for upgrades and modernization. Peru’s refineries cater to only half of the country’s fuel demand making it dependent on imports especially from the U.S. to bridge the supply-demand gap. Low-sulfur diesel accounts for almost 60% of Peru’s fuel imports followed by 16% for gasoline to support growing transportation fuel demand and lack of growth in domestic fuel supply.

Growth in the number of passenger cars over the past five years has supported Peru’s gasoline consumption. Peru imports most of its vehicles and increasing currency exchange rates slowed Peru’s vehicle sales and gasoline demand in 2018. However, an uptick in light-duty vehicle sales in Peru is expected over the next decade supported by its growing middle class population, innovative vehicle financing products, and overall economic growth. Further, diesel demand in Peru is also expected to remain supported by freight as well as increased demand in public transportation.

LPG consumption in Peru is mainly for heating and cooking and has remained consistent over the past five years. Peru’s residential sector will continue to heavily consume LPG for cooking and heating supported by the country’s subsidized LPG package that promotes switching from traditional fuel to LPG for household applications. In addition, LPG usage in transportation is also expected to grow.

On the flip side, Peru is planning new regulations aimed at promoting electric and hybrid vehicles and power supply infrastructure. Peru’s 2019-30 National Competitiveness and Productivity Plan will help the country meet electric mobility milestones between now and 2030 and includes goals such as decentralized pilot projects by 2021, Peruvian technical standards for charging stations by 2025, and electric buses operating in Lima, Arequipa, and Trujillo by 2030. Primax and Shell have opened their first electric vehicle rapid charging station at a service station in San Isidro, Peru which will be able to charge up to 80% of a battery in 30 minutes. However, electric vehicle penetration and mobility transformation will take some time and the impact of EVs on oil products will remain limited in the near term.

Unlike electric vehicles, Peru’s biofuels market will witness slower growth. Peru has 7.8% ethanol and 5.0% biodiesel blending mandates which were reached in 2013 and 2012, respectively. However, growth in the volume of biofuels in the total fuel mix has remained low amid lower biofuel production and storage capacity.

On the supply side, Peru has altogether six oil refineries with a combined capacity of 214,000 barrels per day. State-owned Petroperu operates five of the refineries and Repsol operates the largest 117,000-bpd La Pampilla refinery. Further, Repsol has ~2.6 million barrels of fuel storage capacity at its La Pampilla refinery while Petroperu has a ~3.7 million barrels of oil products storage capacity located at its 10 fuel terminals and over 2.5 million barrels of fuel and crude oil storage capacity at its refineries.

Peru’s refining utilization picked up consistently between 2015 and 2018 but started to decline afterwards. Peru’s refinery utilization has fallen due to upgrades at the Talara refinery coupled with lower fuel demand. Peru’s refining capacity has remained flat over the past five years but will increase by 14% reaching 244,000 barrels per day after its Talara refinery upgrade. Petroperu is expanding and modernizing its 65,000-Talara refinery to a 95,000-bpd refinery by mid-2022. The project will add new process units, industrial services, and facilities at the refinery that currently has a 28,000-bpd vacuum distillation and a 19,000-bpd catalytic cracker along with crude distillation capacity. Upon completion the upgraded Talara refinery will help in producing low-sulfur fuels, processing heavier and less expensive crude, producing high-octane naphtha, reducing residual fuel oil production, and securing Peru’s fuel supply and storage.

In addition, Petroperú will also build a fuel storage infrastructure at the Talara refinery site that includes two 163,000-barrel tanks to hold diesel and will dismantle older smaller tanks. Furthermore, Petroperu is building a new terminal in Ilo with an initial fuel storage capacity of 293,000 barrels reaching 1,050,000 barrels to resolve its fuel storage bottlenecks.

U.S. refiners are showing interest in investing in fuel supply and trading platforms to capture market share in Peru. Companies are demonstrating interest in Peru for investment opportunities in fuel supply including biofuels. U.S. has been the main fuel exporter to Peru over the past five years to fill the country’s fuel supply-demand gap and will continue to remain the low-cost supplier of fuel to Peru going forward despite increase in the country’s refining capacity although there are considerate uncertainties.

ADI’s recent multi-client study addresses several strategic questions and forecasts the outlook for U.S. fuel exports to Latin America through 2030 by analyzing the region’s fuel market drivers, refining capacity, utilization outlook, and export/import infrastructure analysis. The study provides fuel-wise and country-wise deep dives for Latin America with competitive strategies for U.S. fuel exporters. Download the study prospectus to learn more.

– Swati Singh and Uday Turaga