ADI has so far, provided a snapshot of the refining industry landscape in Latin American countries in a series of blogs covering Brazil, Mexico, and Chile. In today’s blog, we will be discussing Ecuador, which also relies on imports to meet the country’s fuel demand. This blog series draws on our extensive research and consulting on refining in Latin America from our recent multi-client study, “Market Outlook for U.S. Refined Products Exports to Latin America”.

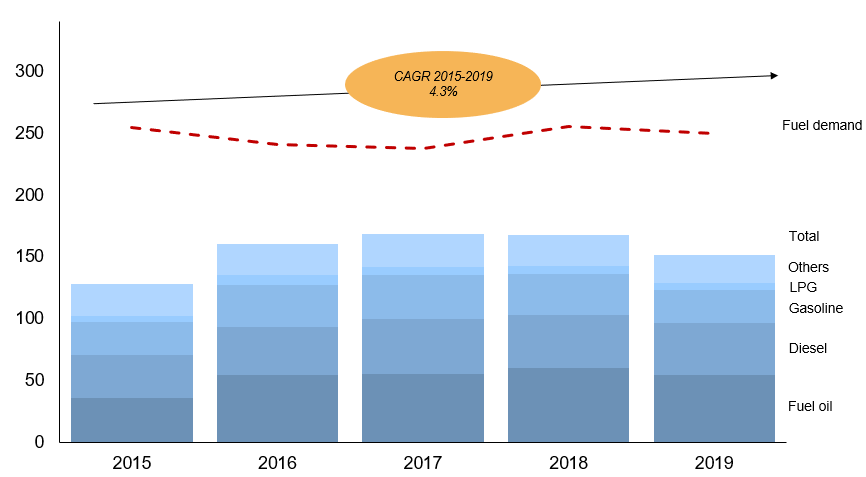

Road transportation takes ~60% of Ecuador’s fuel demand followed by 13% for household consumption and 9% for industrial sectors. Ecuador’s total fuel demand fell over the past five years but gasoline and diesel demand have continued to grow. Gasoline and diesel had ~70% share in Ecuador’s fuel demand and most growth followed by LPG over the past five years (Exhibit 1). However, Ecuador’s fuel supply has remained relatively flat with minimal upgrades or additions to refining capacity and the country is unable to meet its fuel needs. As a result, Ecuador is highly dependent on imports mainly from the U.S. to meet its fuel demand especially for diesel, gasoline, and LPG. The share of fuel imports in Ecuador from U.S. was over 75% between 2015-2019.

Exhibit 1: Ecuador’s refined products production by type in thousand barrels per day.

An uptick in the number of passenger cars over the past five years has supported Ecuador’s gasoline consumption and the trend is likely to continue supported by Ecuador’s GDP growth. Further, diesel demand in Ecuador will also be supported by transportation and industrial sectors as well as Euro V fuel standards and IMO 2020 low-sulfur regulations.

Ecuador is reforming the energy sector to drive private investments to import and sell fuels at unregulated prices with a vision to meet future Euro V standards fuel. This move may offset diesel usage in industrial plants to some extent by allowing the private sector to introduce new fuels such as LNG amid falling local gas production in the Amistad gas field. However, there will be a small impact from biofuels and electric vehicles on Ecuador’s fuel demand in the near term.

In addition, LPG is the primary fuel for cooking in Ecuador due to long-standing government subsidies which will remain supported by population growth. LPG consumption in automobiles and agriculture has also remained consistent in Ecuador since 2015. Although, rising fuel prices in Ecuador after the announcement by the government to end fuel subsidies has lowered fuel demand in Ecuador in 2019, a national protest later resulted in the withdrawal of the decision by the Ecuadorian government.

On the supply side, Ecuador has three oil refineries with a combined capacity of ~175,000 barrels per day all owned by Petroecuador. In addition, Ecuador has 14 fuel storage terminals with 3.8 million barrels of capacity and 8 LPG storage terminals with 853,000 barrels of capacity. Esmeraldas refinery is the largest refinery in Ecuador which accounts for ~67% of Ecuador’s fuel production followed by ~19% from the La Libertad refinery. Ecuador’s refining capacity has remained flat over the past five years and only one new refinery has been planned. It is a 300,000-bpd new refinery in Manabi on the Pacific Coast but the project has been facing delays due to financial issues.

All three of Ecuador’s refineries have had some improvement in their utilization in recent years. But in 2016, Esmeraldas refinery’s rehabilitation improved its utilization drastically. However, Ecuador’s refinery utilization fell in 2019 to limit fuel oil production amid falling international demand in response to IMO 2020. All refineries in Ecuador process domestic heavy crude resulting in a high yield of fuel oil followed by diesel and gasoline and are unable to meet the country’s fuel needs.

Further, utilization of Ecuador’s refineries has been able to meet only half of the country’s diesel demand and only a third of the nation’s gasoline demand. As a result, in September 2020, Ecuador’s government allowed private companies to import and sell some fuels for industrial and commercial use, ending a monopoly state-owned Petroecuador had in the sector. In addition, to meet future fuel demand growth and support private companies’ fuel imports, several new fuel storage terminals have been planned by Ecuador’s government with some under construction.

With limited growth in domestic fuel supply and uptick in fuel demand, Ecuador will continue to rely on imports to bridge the fuel supply-demand gap in the coming years. U.S. has been the main fuel supplier to Ecuador over the past decade and the trend is likely to continue going forward.

ADI’s recent multi-client study addresses several strategic questions and forecasts the outlook for U.S. fuel exports to Latin America through 2030 by analyzing the region’s fuel market drivers, refining capacity, utilization outlook, and export/import infrastructure analysis. The study provides fuel-wise and country-wise deep dives for Latin America with competitive strategies for U.S. fuel exporters. Download the study prospectus to learn more.

– Swati Singh and Uday Turaga