Around the world, lithium mining practices are under scrutiny, especially in the salt flats of Argentina and Chile where more than half the world’s lithium resources are located. Locals of these areas have observed an increase in droughts and suspect that lithium mining is behind it since brine is pumped from below the surface of the salt flats to extract lithium. To experts, it is still unclear to what extent the drought is related to lithium mining, which is known to be a water intensive process. Approximately 500,000 gallons of water is required to extract a metric ton of lithium. In Chile’s Salar de Atacama, mining activities consumed 65% of the region’s water. Apart from being a water intensive process, lithium mining poses other problems to the environment which puts the sustainability of its practice into question. With the demand for electric vehicles projected to grow, how can lithium-ion battery manufacturers diverge from “dirty” lithium mining and source their lithium from “clean” alternatives?

Tesla co-founder JB Straubel thinks he knows the answer. Straubel is blazing a new trail in the electric vehicle industry by aiming to create a “closed-loop supply chain for electric vehicles” in the United States. His new start-up company, Redwood Materials, raised over $700 million dollars in a funding round and is said to be valued at $3.7 billion dollars. Redwood Materials is focusing its attention towards building a future where primary production of metals is no longer necessary for the EV industry. This eases tensions for electric car manufacturers who are concerned about projected metal supply deficits caused by strong demand from the EV industry.

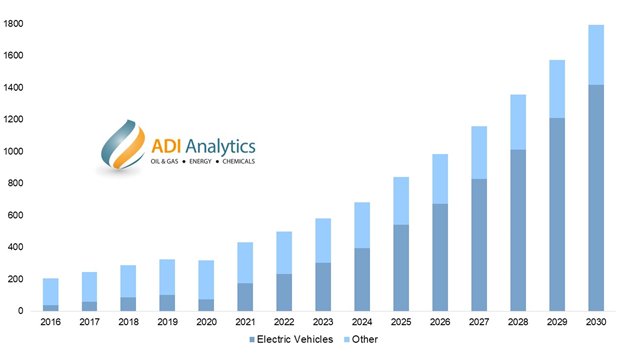

Lithium demand projections need to account for the growth of the lithium-ion battery market and the growth of other applications that use lithium. As discussed, lithium-ion batteries are used in the EV industry, but they are also used in electronic devices and in energy storage systems. Other applications of lithium include glass and ceramics, lubricants, air conditioning systems, and pharmaceutical products. In August 2020, Cochilco, a Chilean miner, announced lithium demand projections from 2020 to 2030 that accounted for the growth of lithium from the electric vehicle industry (Exhibit 1).

The demand for lithium driven by the electric vehicle industry and other applications is estimated to grow at an annual growth rate of 34.2% and 4.5%, respectively, as seen in Exhibit 1. However, some factors could impede the growth of lithium demand. In the short-term, disruptions caused by the COVID-19 pandemic could last longer than anticipated, which would continue to negatively impact global supply chains. In the mid-term, slow growth in technological improvements that make EVs more affordable to manufacture could lower future demand for lithium. In the long term, technological advancements in hydrogen or other power alternatives could delay lithium demand growth.

On the supply side, there are sources of lithium worldwide: rock mineral or pegmatites, brines, and sedimentary rocks. Pegmatites account for 26% of the worldwide lithium resources while brines and sedimentary rocks account for 66% and 8%, respectively. Major pegmatite deposits can be found in Australia, U.S., the Democratic Republic of the Congo, and Canada. Brines are underground, aquatic sources of lithium that are found at the Lithium Triangle in South America. Sedimentary rocks such as smectite and jadarite are abundant in the U.S., Mexico, Serbia, and Peru. Key lithium raw materials and chemicals such as lithium carbonate and lithium hydroxide vary significantly in their lithium content. As a result, lithium market data is often reported in terms of “lithium carbonate equivalent” or LCE to easily compare on a like-for-like basis. For example, the projected lithium supply from 2020 to 2030 is expected to grow at an annual growth rate of 15.4% from 327,000 metric tons of LCE to 1,367,000 metric tons of LCE compared to the projected lithium demand from 2020 to 2030 which is expected to grow at an annual growth rate of 18.9% from 317,000 metric tons of LCE to 1,793,000 metric tons of LCE (Exhibit 2).

The lithium market was in a deficit from 2016 to 2017 and there were expectations for electric vehicle sales to grow during that time causing lithium prices to increase. New projects were initiated to close the gap between supply and demand, but in 2018 and 2019 the market was over-supplied by 17,000 metric tons and 2,000 metric tons, respectively. Disruptions caused by the COVID-19 pandemic slightly reduced demand by 6,000 metric tons increasing the surplus to 10,000 metric tons in 2020.

The recovery of electric vehicle sales and manufacturing is anticipated to surge lithium demand by 35.6% causing the market to enter a slight deficit. From 2023 and 2026, a growing surplus is expected as new mining projects are brought into operation. However, demand is projected to continue growing at a faster rate than supply, so the lithium market will enter in what some call “the perpetual lithium deficit”.

According to the US Department of Energy, less than 5% of lithium-ion batteries are currently recycled, and companies like Redwood Materials could help tackle the expected lithium supply deficit without depending on primary production. However, it is unlikely for Redwood Materials to truly make a sizable impact on the deficit until 2030, when used batteries will be returned in large quantities.

ADI is launching a multi-client study – “The New Frontier: Critical Minerals & the Energy Transition” – which is focused on a comprehensive assessment and outlook for critical minerals supply and demand through 2030. This 12-week long multi-client study process builds on ADI’s extensive research and deep expertise in metals, minerals, mining, mineral processing, and energy transition. The study will be based on in-depth primary and secondary research and supply and demand modeling and analytics. Please download the multi-client study prospectus – “The New Frontier: Critical Minerals & the Energy Transition”– and contact us to learn more.

Stay tuned and read our previous blogs a part of our new blog series, Mining and Metals.

– Jacqueline Unzueta and Swati Singh