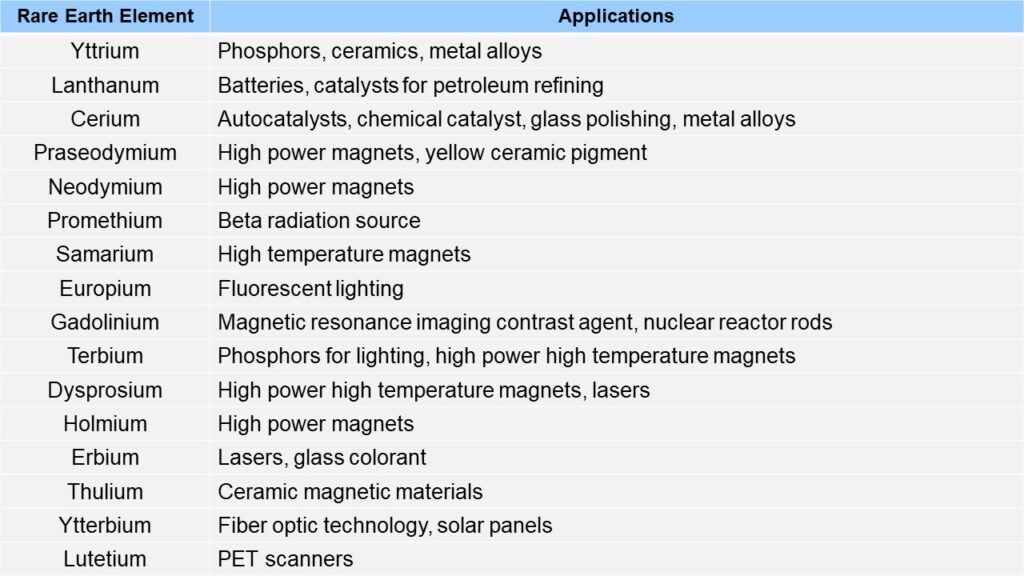

What do electric cars, wind turbines, air conditioners, LED lighting, smartphones, and jet engines have in common? They all require rare earth metals and alloys in their manufacturing. Rare earth metals include yttrium and a group of 15 elements known as the Lanthanide series. These metals have similar properties but vary in applications (Exhibit 1). Within clean energy, rare earth metals are used in wind turbines and electric vehicle (EV) batteries.

Exhibit 1: A list of various rare earth metals applications (Source: Lynas Rare Earths)

Rare earth metals are used in the generators of permanent magnet-based wind turbines. Despite the technical advantages of permanent magnets in wind turbine design, past spikes in global prices of rare earths, caused by Chinese export restrictions, have made countries that rely on rare earth metals consider alternative designs to circumvent supply risks. Permanent magnets made from rare earth metals, mostly neodymium, are used to power electric engines. They are widely seen as the most efficient way to power electric vehicles making them highly desirable. In fact, over 80% of the electric vehicles sold globally utilized permanent magnet-based motors in 2019.

The demand for rare earths from magnets is expected to reach even greater heights. The global consumption of rare earths for magnets is projected to be worth $15.7 billion by 2030, approximately four times this year’s value. Similarly, the global demand for rare earths in wind turbines could increase 8-9 times in 2030 and 11-14 times in 2050 compared to 2018 values, according to the European Union. Despite the strong demand outlook for rare earths from both wind turbines and electric vehicles, many countries are struggling to secure reliable supply.

Currently, China controls the global market of critical minerals, including rare earths, as the leading producer and consumer. In 2020, China’s mine production reached 140,000 metric tons of rare-earth-oxide equivalent compared to the global mine production of 240,000 metric tons of rare-earth-oxide equivalent. From 2016 to 2020, China had the highest annual growth rate of 7.5%, which surpassed the world’s annual growth rate of 6.2% (Exhibit 2). Mine production of the United States, Burma, Burundi, Malaysia, and Madagascar are not included in the figure below.

Exhibit 2: Rare earths mine production from the top five producing countries and others. Note: Mine production of the United States, Burma, Burundi, Malaysia, and Madagascar are not included in this figure. (Source: USGS)

Apart from supply, China accounted for 80% of rare earth imports in 2019 and tensions in trade between the United States and China have exacerbated concerns of supply shortages. In the past, China has restricted its exports which led to erratic price volatility. One instance was during 2011 when the price of neodymium and dysprosium rose by approximately 750% and 2,000%, respectively. Given this history, leading governments and private companies are looking to reduce their dependency on China’s supply of rare earth metals by initiating new projects and by diversifying their sources of rare earth metals.

In February 2021, Biden signed an executive order designed to review gaps in domestic supply chains, including that of rare earth metals. In the next month, the U.S. Department of Energy announced a $30 million dollar initiative to research and secure U.S. domestic supply chains for rare earths and other critical minerals needed in battery technology. MP Materials, a company based in Nevada, is currently restoring the domestic refining capability of California’s Mountain Pass mine. Their goals are to finish the Mountain Pass project by 2022, restore the full rare earth supply chain to the United States by 2025, and become the lowest-cost producer of permanent magnets.

Lynas Corporation is a mining company that processes rare earths in Australia. They received $30.4 million in funding from the Pentagon to build a light rare earths processing facility in Texas. The company also formed a partnership with Texas-based Blue Line Corp. to build a heavy rare earths separation facility. Apart from these projects, Lynas is also expanding their domestic production by executing the Kalgoorlie project. It is the first downstream operation for rare earths in Western Australia and it gives Lynas the opportunity to treat third-party rare earths feedstocks. Iluka Resources, Australian Strategic Materials, and Energy Fuels are amongst the other prominent companies striving to supply rare earths outside of the Chinese market, but are prices high enough to incentivize new supply?

The incentive price for neodymium and praseodymium is estimated to be around $60 per kilogram to sufficiently motivate supply growth to triple by 2030 to meet future demand. The incentive price is $19 per kilogram higher than the average price of neodymium and praseodymium for the past nine years. The growing demand for electric vehicles could shift the neodymium and praseodymium market into a supply deficit, which would drive prices close to the $100 per kilogram range by 2023. Prices for neodymium and praseodymium are expected to double from $50 per kilogram to $100 per kilogram by 2024. However, high prices can cause EV manufacturers and other end-users to reduce the material intensity of rare earth minerals in their products, seek alternative materials to use in place of rare earth minerals, and create products that do not require rare earth minerals.

ADI is launching a multi-client study – “The New Frontier: Critical Minerals & the Energy Transition” – which is focused on a comprehensive assessment and outlook for critical minerals supply and demand through 2030. This 12-week long multi-client study process builds on ADI’s extensive research and deep expertise in metals, minerals, mining, mineral processing, and energy transition. The study will be based on in-depth primary and secondary research and supply and demand modeling and analytics. Please download the multi-client study prospectus – “The New Frontier: Critical Minerals & the Energy Transition”– and contact us to learn more.

Visit the rest of our blog series, Mining and Metals, to learn more about other critical minerals for the energy transition and stay tuned for upcoming blog posts.

– Jacqueline Unzueta & Swati Singh