Copper is an important metal that we heavily rely on for power, lighting, heating, communications, and more. It conducts both heat and electricity very well, and it can be formed and stretched into complex surfaces without breaking due to its high ductility and malleability. These physical properties make copper highly favorable for electrical equipment and industrial machinery, such as wiring and motors.

The use of copper is widespread, and its demand is expected to grow as industries that support the transition to low-carbon energy and green infrastructure, such as the electric vehicle industry, flourish. In fact, just a typical battery electric vehicle contains 183 pounds of copper in everything from wiring to rotors. Goldman Sachs in a recent report has even termed copper as “the new oil”, but will copper supply be able to meet future demand?

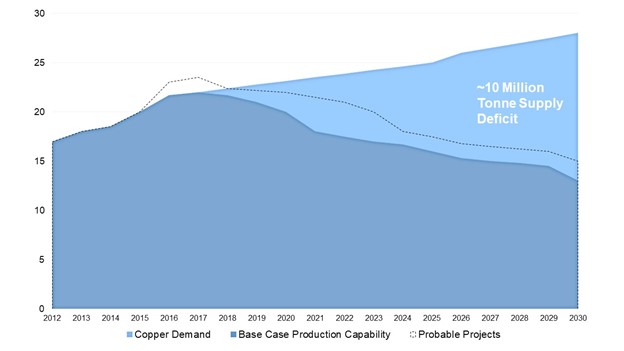

Disruptions caused by the coronavirus pandemic resulted in a 2.0% decrease in refined output from 2019 to 2020. During this time, capacity stalled, and investments to expand copper supply were delayed. Looking beyond 2020, many analysts see a supply deficit in the copper market that is set to worsen over the next several years as growing demand from the power and construction sectors is compounded by the proliferation of electric vehicles. To balance the copper market by 2030, it is estimated that approximately 10 million metric tons of additional copper production is required (Exhibit 1). Closing such a gap would require building the equivalent of eight projects the size of BHP Group’s Escondida mine in Chile. The Escondida mine is the world’s largest copper mine with an annual capacity of 1.4 million metric tons of copper production.

New projects are being developed that may ease copper deficits between 2020 and 2025. Most of the attention is drawn towards Freeport McMoRan Inc.’s Grasberg mine in Indonesia. The underground mine is set to be completed by year-end, which will help ease global supplies that were disrupted by the pandemic. Following Grasberg is the Kamoa-Kakula Copper Project, which is a joint venture between Ivanhoe Mines, Zijin Mining Group, Crystal River Global Limited, and the government of the Democratic Republic of the Congo. It is projected to be the world’s largest highest-grade major copper mine. On May 25, 2021, initial production of copper concentrate at the Kakula Mine processing plant began and plans to accelerate expansion are underway.

On July 15, 2021, Riverside Resources Inc. received $5.4 million in funding from BHP to advance and drill copper projects in Sonora, Mexico. The two companies are collaborating under the BHP-Riverside Exploration Funding Agreement (EFA) program which aims to evaluate and drill four mine sites that have giant scale exploration discovery potential. The mine sites have been approved for full funding to move toward drilling on the Chuin and Palofierro projects and deep geophysical studies on the Sinoquipe and Peñitas projects. Southern Copper Corp. has stated their intentions to almost double their copper output by 2028 by tapping into the industry’s biggest reserves. Other mining companies are also initiating mine exploration projects of their own knowing that copper is a key metal in electric vehicles, prices will increase in the long term, and the market outlook is favorable.

However, the cost and financial risk of initiating projects for new supply cannot be overlooked. The copper industry would need to spend upwards of $100 billion to close what could be an annual supply deficit of 4.7 million metric tons by 2030. Plus, mining companies are wary of repeating oversupply mistakes of past cycles, especially at a time when mines are increasing in complexity and expense.

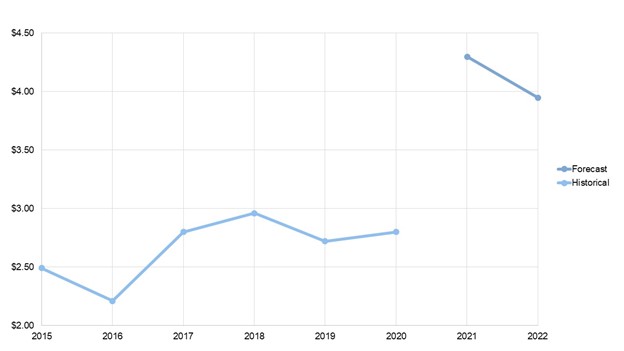

This is one of the reasons why copper prices are currently nearing record highs in the last decade at above $4 a pound. This past May, Chile’s Cochilco shared new unit price predictions for copper for the short-term outlook (Exhibit 2). They predict that the average copper price for 2021 is $4.30/lb and $3.95/lb for 2022. Cochilco expects that the supply deficit in 2021 along with reduced inventories in metal exchanges will provide fundamental price support. The supply deficit in 2021 is projected to be in the range of 145,000 metric tons. On the other hand, Cochilco forecasted a surplus of 46,000 metric tons by the end of 2022. There are wide disparities in forecast prices by brokers, economists, and investment banks, especially for 2022.

Some expect a bull market and others expect a bear market, but the consensus forecast for the last quarter of 2022 is $4.07/lb. Looking past 2022, the push toward sustainability is expected to drive copper prices between $6.00/lb to $7.50/lb over the coming decade. A growing emphasis in technology and innovation has emerged amongst mining operators to prepare for the anticipated competitive landscape.

ADI is launching a multi-client study – “The New Frontier: Critical Minerals & the Energy Transition” – which is focused on a comprehensive assessment and outlook for critical minerals supply and demand through 2030. This 12-week long multi-client study process builds on ADI’s extensive research and deep expertise in metals, minerals, mining, mineral processing, and energy transition. The study will be based on in-depth primary and secondary research and supply and demand modeling and analytics. Please download the multi-client study prospectus – “The New Frontier: Critical Minerals & the Energy Transition”– and contact us to learn more.

More detail about the broader metals and mining industry will be discussed in upcoming blogs as a part of our new blog series, Mining and Metals.

– Jacqueline Unzueta & Swati Singh