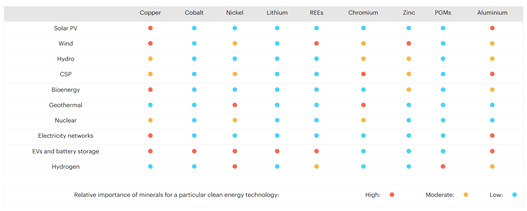

Critical minerals are metals and non-metals that are considered vital for the economy and whose supply may be disrupted due to various factors such as supply scarcity, geopolitical risk, environmental factors, recycling potential, and trade policy. Rare earth elements (REEs), lithium, copper, cobalt, nickel, and platinum group metals (PGMs) have become critical minerals as they are key enablers of several energy transition-related technologies (Exhibit 1). For example, REEs find application in permanent magnets used in wind turbines and electric vehicle (EV) motors and are also used in high-tech devices for solar panels. Further, metals such as lithium, nickel, and cobalt are vital to battery efficiency and performance while copper is extensively used as a conductor in electricity networks.

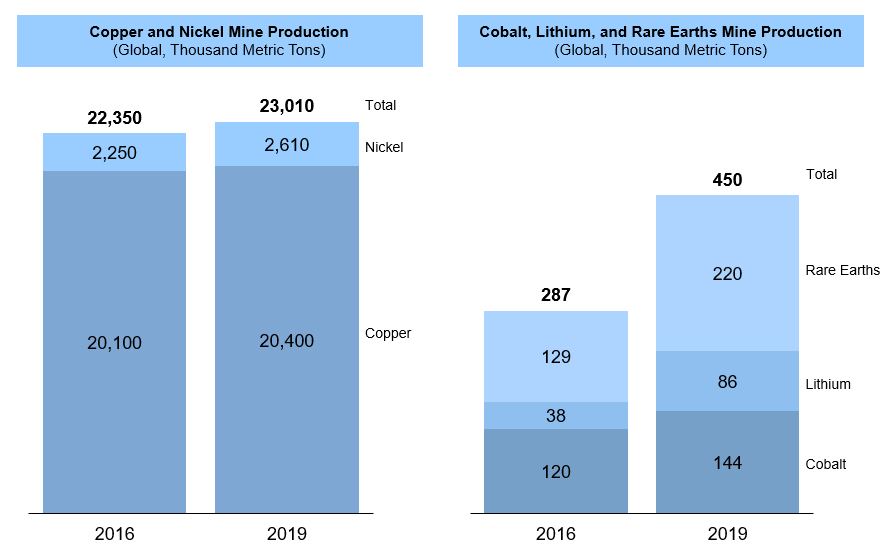

Mineral demand for clean energy technologies is expected to grow significantly over the next two decades aligned with the emission reduction goals adopted by several countries globally. For instance, according to the International Energy Agency (IEA), by 2040, demand for copper and REEs will rise by 40%, nickel and cobalt by 60-70%, and lithium by 90%. However, supply of these critical minerals is under scrutiny as mine production growth of critical minerals since 2016 (Exhibit 2) is not keeping pace with growing demand and can soon lead to scarcities.

Critical minerals offer a distinct set of challenges which need to be addressed in a timely manner to meet their rapidly growing demand in energy transition scenarios. Some of the factors that will have a high impact on creating conditions conducive to supply growth are listed below:

- Supply security and predictability

Production of critical metals are largely dominated by a few countries which makes their supply challenging amid any disruption. This further brings additional price volatility in the international market. For example, globally, ~70% of cobalt production comes from the Democratic Republic of Congo (DRC), ~60% REEs and ~40% molybdenum comes from China, ~52% each of lithium and platinum group metals (PGM) comes from Australia and South Africa respectively. New innovation that taps into sourcing these minerals from other sources including recycling can help reduce supply volatility concerns.

- Ensure adequate investment via vertical integration

There have been insufficient investments to boost supply of some critical metals. For example, metals such as copper, nickel, lithium, and cobalt are expected to have shortfalls by 2025 amid minimal capital spending today. This has led to interesting partnerships between customers and mine operators.

- International collaboration and supply chain transparency

International policies can be vital to provide reliable information on supply and demand data and supply chain issues as well as promoting a safe and reliable environment for mining investments. Regular market assessments can improve the resilience of supply chains for these critical minerals and prevent any potential supply disruptions in a timely fashion.

- Mining technology innovation

Mining companies should accelerate mineral recovery via R&D efforts to upgrade mining facilities and adopt more customized and sustainable mining pathways. For example, mining companies can use site-specific customized chemicals to maximize metal production from degrading ores. Mining companies should also explore new mines economically and safely to meet regulations which can be promoted by incentivizing higher environmental and social performance.

- Accelerate greenfield mining projects

Mining projects take much longer to move from a planning phase to an actual plant with first production. In the past these have taken almost a decade or even more. This might not be feasible going forward where the demand for critical metals is growing much more rapidly. Timely investment in new projects can prevent market constraints and price volatility.

ADI is launching a multi-client study – “The New Frontier: Critical Minerals & the Energy Transition” – which is focused on a comprehensive assessment and outlook for critical minerals supply and demand through 2030. This 12-week long multi-client study process builds on ADI’s extensive research and deep expertise in metals, minerals, mining, mineral processing, and energy transition. The study will be based on in-depth primary and secondary research and supply and demand modeling and analytics. Please download the multi-client study prospectus – “The New Frontier: Critical Minerals & the Energy Transition”– and contact us to learn more.

This is the first in a new series of blog posts on mining and metals. Our team at ADI Analytics has supported a wide range of clients focused on metals, minerals, mining, and mineral processing. Please reach out to learn more about how we can help.

– Swati Singh and Uday Turaga