Large capital projects are critical drivers of growth in the oil and gas industry. Over the next two decades there will be an estimated $22 trillion dollars of investment into oil and gas projects worldwide. North America, Europe, and Asia account for ~14 billion dollars of planned investment spend. Capital projects, however, routinely face cost overruns and schedule delays on a worldwide basis. Every region sees over half of all projects facing cost overruns and scheduling delays.

Problems with projects stem from both internal and external factors. Internal factors include project development, commercial context, and project delivery. Problems with project development occur when there is inadequate planning and poor procurement. Commercial context problems include lack of access to funding and poor portfolio management. Finally, poor project management and poor contractor management can lead to project delivery problems.

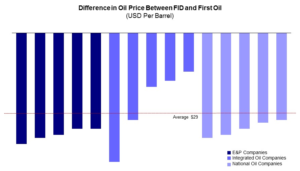

External factors include commodity prices, geopolitical changes, and regulatory challenges. It is easy to see how changing commodity prices can have a negative impact on large capital projects. Below, a graph is shown for recent capital projects and the difference in commodity prices from the time a final investment decision was taken on them and when the first barrel of oil was produced. The average difference is $29 per barrel. Such a change in the price of oil will impact project profitability. Although operators cannot time projects, they do have the ability to cut delays and reduce the risk of such exposure to commodity price cycles. Geopolitical challenges include problems with security in politically sensitive regions as well as diplomatic issues. Lastly, regulatory challenges can halt projects in their tracks. An example of this is with the planned LNG export projects in the U.S. that are waiting on FERC and DOE approval in order to start construction.

Oil and gas operators can use four key levers to reduce the likelihood of cost overruns and schedule delays on capital projects. These include standardized modularization, new business models, collaboration, and innovation. Standardized modularization is using as many standardized processes and pieces of equipment as possible. Creating industry wide standards for things like contract procurement and safety regulations would reduce the amount of time that they must screen and sort through contractors. Additionally, developing a project that can use already designed or fabricated equipment can reduce both the amount of time and the cost associated with the project.

Second, new business models can accelerate capital projects. One trend is that of leasing equipment rather than owning it. Leasing equipment keeps them off of the balance sheet where companies do not have to account for their depreciation. Additionally, repairs and equipment failures can be handled by specialized staff from the equipment leaser.

Third, companies can use collaboration for mutual benefit. Sharing infrastructure and developing joint standards can be of benefit to all capital projects in a region. Lastly, companies can use innovation. An example of this was in the late 1990s when U.S. EPA regulations required diesel fuel to contain less sulfur. At first, refiners anticipated building all new hydrotreaters in order to meet the new regulation, but innovation and advances by catalyst manufacturers allowed several refineries to meet the new sulfur rule simply by replacing catalyst loads in existing hydrotreaters along with some internal reactor replacements.

ADI Analytics has advised a number of clients in oil and gas and chemicals on optimizing and improving capital project delivery and performance. A recent presentation on this topic is also available here.

-Tyler Wilson and Uday Turaga