In 2018-19, midstream players in the Permian Basin rushed to satisfy the demand for pipeline capacity driven by booming oil and gas production. The associated natural gas production had reached ~17 billion cubic feet per day (bcfd) and robust drilling activity and moderate gas prices had pressurized the midstream operators to expand the existing pipeline infrastructure network, particularly in the Delaware basin. By early 2020, Gulf Coast Express and Carlsbad Gateway Pipeline came online and the natural gas transport capacity outstripped supply, albeit by a much smaller margin due to comparatively robust gas prices, as well as increased gas-to-oil ratios from aging wells in the Permian.

During the COVID-19 lockdown phase, demand disruption suddenly forced operators to cut on capital spending which resulted in a decline in the associated gas production from 18 bcfd in January 2020 to ~15.7 bcfd in the second quarter of 2020. In April 2020, amidst heavy turbulence in global oil and gas markets, several pipeline projects were canceled or put on hold. NAmerico recently decided to put on hold the proposed Pecos Trail pipeline project. Kinder Morgan recently confirmed that the Permian Pass gas pipeline which will transport natural gas from the West Texas shale play to interstate pipelines and LNG export terminals in Louisiana and East Texas was also put on hold.

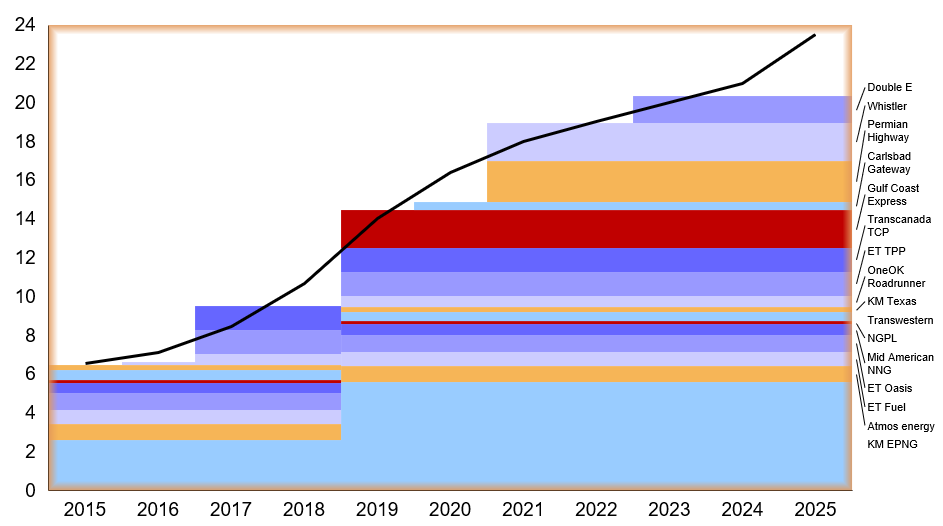

In 2020, associated gas production declined in the four major oil-producing regions- Bakken, Eagle Ford, Niobrara, and Anadarko, but not in the Permian. Permian associated gas production increased from 15.7 bcfd in 2020 to 18.2 bcfd in 2021. It surpassed the pre-Covid natural gas production levels of ~17.4 bcfd in March 2020. Most of the increase in associated gas production is attributed to the increase in takeaway capacity recently. In 2021, two major gas pipeline projects, the Permian Highway and Whistler projects, came online to increase takeaway capacity from the Permian Basin by roughly a quarter, as shown in Exhibit 1. The new pipeline projects are expected to exert downward pressure on both basis differentials and transportation prices of natural gas and bolstered the Waha prices.

Exhibit 1: Permian Gas Production and Pipeline Takeaway Capacity in Billion Cubic Feet per Day

Going forward, Summit Midstream’s Double E Pipeline is under construction and on track to be commissioned by the end of the year. The Double E system will provide firm natural gas transportation service from various receipt points in the Delaware Basin in the Permian Shale in New Mexico and Texas to various delivery points in and around the Waha Hub transporting about 1.3 bcfd of gas.

We expect the Permian rig count to increase with new drilling expected to restart soon. Some of the majors and E&P companies have already announced capital spending targets for 2022 which direct towards more drilling activity as compared to 2021 levels. Permian is becoming gassier which will keep or increase the gas-oil ratio at higher levels giving rise to more associated gas production. Current natural gas pipeline capacity may look sufficient, but no new pipeline announcement or upcoming project might result in a similar shortage in takeaway capacity by 2024.

Our team at ADI Analytics has supported a wide range of clients focused on oil and gas, power and utilities, renewables, and energy transition. Please reach out to learn more about how we can help.

-Utkarsh Gupta