Natural gas markets and prices are boiling these days with European and Asian buyers falling over themselves to secure supplies.

- LNG prices in the U.K. were a little short of $25 a million Btu yesterday …

- … but Asian markets were willing to pay as much as $27.

- Henry Hub price in the U.S. is set to breach $5.

The boil is roiling global markets through a domino effect that is impacting everything including power and heating bills, fertilizer and aluminum plants, carbonated sodas and turkeys for Christmas feasts, energy transition, and global economic recovery.

- Gas and power utilities in Europe and Asia are announcing price increases impacting both industrial and consumer markets. Gujarat Gas has raised prices by 12% for industrial customers, while price hikes by as much as 40% are being reported in Europe …

- … even after some countries resorted to restarting coal-fired power plants, which have traditionally been cheaper sources of electricity but not this time due to high coal prices from falling global supply as well as expensive carbon credits.

- Collectively, households will likely have to pay $150 to $250 more this winter for heating and electricity needs and …

- … Governments are intervening to cushion the hit. Italy is planning to increase its $1.3-billion subsidy to as much as $5.3 billion while France and U.K. have announced plans to support low-income homes and small businesses.

- It’s not just small companies that apparently need support at this time. U.K. agreed to cover costs for CF Industries’ Teesside ammonia plant that had shut down due to high natural gas prices …

- … inadvertently cutting off crucial volumes of carbon dioxide supply to the country impacting healthcare and food and beverage industries highlighting the short, fragile, and low-redundancy supply chains that dominate the modern global economy.

- Although most pronounced in Europe and Asia, the Americas are also feeling the heat. Mexican steel and aluminum producers have shut down this year due to high natural gas prices.

So why are we here? Classic supply, demand, and, of course, some geopolitics.

- The world had a difficult winter in 2020-21 draining significant volumes of natural gas storage – apparently even in major natural gas producing countries – refilling which has been slower than usual raising the specter of gas shortages and exorbitant prices this coming winter.

- Natural gas supply has had a difficult year for various reasons with a number of small cuts adding up to a significant shortfall. Domestic production in Europe has been on a steady decline over the past decade with roughly a third of its 2010 output of ~30 bcfd lost over the past decade. In 2021, European production likely fell by 10-15% relative to the same timeframe in 2019. Dutch production led the decline with the Groningen field, which is closing ahead of schedule due to seismicity concerns. Norway is ramping up on gas exports to Europe in the wake of current prices but has traditionally been a seasonal supplier also challenged by declining production and gas processing capacity bottlenecks. Further, deferrals in 2020 on maintenance of LNG plants around the world were conducted this year adding up to supply disruptions.

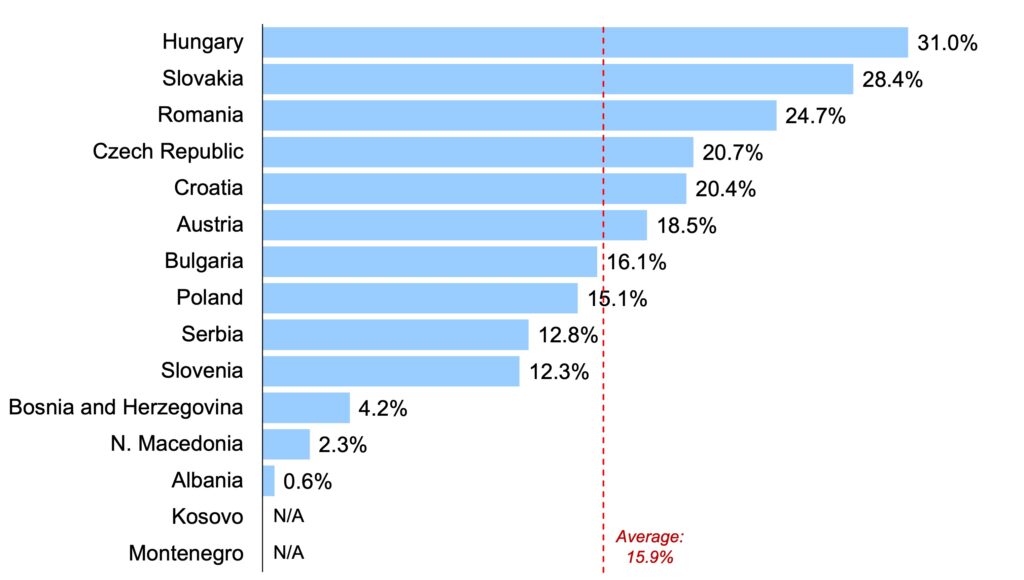

- At the same time, demand for LNG grew far more than anticipated and also around the world. For example, sub-par wind power generation during the summer in Europe supplemented with a drought in Brazil that cut hydropower production increased both countries’ need for LNG. Although Europe has a significant level of reliance on natural gas (see Exhibit 1 for an illustrative example), Asia led by Japan, Korea, and China have a greater reliance on LNG for their energy needs. Although Korea and China have responded to higher LNG spot prices by ramping up imports of their oil-linked contracts and cutting back on demand, respectively, Japan has continued to build its supplies with purchases from the spot market contributing to a higher price marker in Asia relative to Europe.

- Geopolitics cannot be far behind supply and demand in any energy crisis, and this one is no exception. Gazprom has, unlike in prior years, refused to go beyond its contractual commitment to supply natural gas via pipeline to Europe. This has been attributed to multiple reasons that are being debated extensively. A popular explanation ties this to Russia’s desire to clear roadblocks for Nord Stream 2 which is expected to start up soon. Another explanation is attributed to Russia’s desire to influence global gas pricing and markets in the way OPEC does oil.

So what? Reading too much into one episode of supply-demand imbalance and price volatility to draw implications would be an overreaction. Even so, there are important implications to consider.

- There will likely be renewed interest in sourcing and signing up for long-term sales and purchase agreements for U.S. LNG supplies …

- … Creating favorable opportunities to finance some of the second wave of LNG projects although the global LNG market dynamics are significantly different than those nearly a decade ago.

- Natural gas’ role as a “bridge fuel,” which has increasingly been challenged in the past year or two will likely be revisited more favorably and …

- … A lot of initiative around carbon-neutral LNG, responsible gas sourcing, and initiatives to cut methane emissions across the value chain will help stabilize and enhance natural gas’ value proposition.

- The commoditization of global gas and LNG markets has led to a growing share of spot volumes and shorter contracts. This crisis has reflected advantages of long-term contracts and those along with flexibility will likely command new interest going forward.

- Broad support for energy transition in Europe and increasingly Asia and North America is unlikely to change although policy makers would be more willing to accommodate training wheels as they begin the journey.

ADI Analytics is a leader in research and consulting across natural gas and LNG markets. Our team has covered upstream supply, midstream and LNG, gas monetization and conversion to power, chemicals, and fuels, demand, pricing, policies, and regulations. See some of our research and contact us to learn more.

– Uday Turaga