In early July, my flight back home to Houston after my first trip following the COVID-19 pandemic was canceled because the Colorado Springs airport ran out of jet fuel. What then seemed to me like a fluke event was actually part of a pattern that was replicated over the summer this year at several tourist hotspots in western U.S. In addition to volatile jet fuel supply-demand balances, COVID-19 has also created severe logistical challenges. For example, there is now a scarcity of trucks to ferry jet fuel volumes from terminals to airports. In addition, pipelines are short on capacity after shifting to other fuels following sharp decline in jet fuel production at refineries during COVID-19.

These issues are accentuating the larger challenge with jet fuel markets that are now preparing for a much longer and painful post-COVID recovery. The initial euphoria of a prompt recovery led by pent-up economic demand has been led astray with recurring waves of infection impacting consumer and business travel. U.S. jet fuel demand last averaged 1.3 million barrels per day in August 2021 and is almost 30% below the 1.7 million bpd high seen in 2019.

In light of this, a key question animating oil & gas markets is, “When will jet fuel demand recover?” This is important because demand for other transportation fuels such as gasoline and diesel have recovered faster while jet fuel lags thereby impacting the recovery of the overall oil markets. In order to address this question for various clients, ADI Analytics has been evaluating historical trends associated with demand disruption in jet fuel markets.

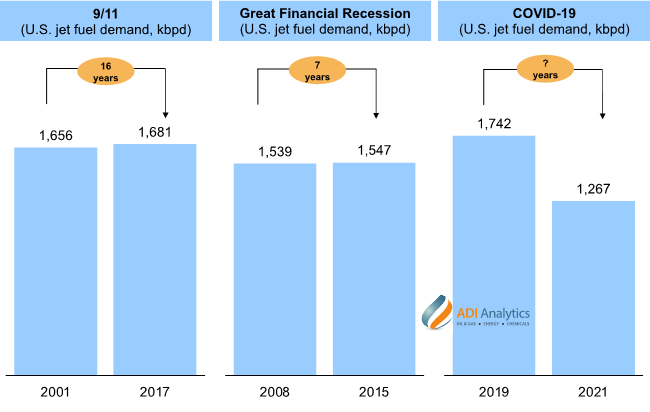

Past performance, unfortunately, is not promising. For example, jet fuel demand in the U.S. took a whopping 16 years to get back to the levels seen prior to the 9/11 terrorist attack (see Exhibit 1). Of course, multiple crises such as the 2008-09 recession and the 2014 oil price collapse overlapped with that recovery trajectory. Focusing on the Great Financial Recession in 2008-09, jet fuel demand did not recover for seven years as also shown in Exhibit 1. Given this track record, it is difficult to be optimistic for a medium- let alone near-term recovery of jet fuel demand.

Exhibit 1. U.S. jet fuel demand recovery across multiple crises since 2000.

In addition to near- and medium-term challenges, jet fuel markets also have to grapple with serious long-term challenges from climate change. The aviation industry contributes to ~3% of global greenhouse gas emissions, and those emissions hard to abate along with those from freight and trucking, shipping, petrochemicals, steel, and cement. At the same time, aviation serves consumer markets and are likely to face significant direct pressure around decarbonization similar to what a number of business-to-consumer industries have experienced.

Collectively, there a several critical challenges that jet fuel markets and aviation will face in the near- and long-term. Leveraging extensive prior research and consulting work for a wide range of clients, ADI Analytics is offering a new multi-client study focused on addressing these issues. Specifically, ADI’s new multi-client study, “The Future of Jet Fuel,” will address a number of critical questions across the following three major topics:

- Demand and supply

- What will post-COVID jet fuel demand look like? Will it recover to 2019 levels?

- What do post-COVID demand drivers for jet fuel looks by region and why?

- What is jet fuel supply outlook including sustainability aviation fuels?

- Policy, regulations, and innovation

- How are policies and regulations shaping aviation and jet fuel markets? Why?

- What innovation and technologies will allow decarbonization in aviation fuels?

- Which technologies are likely to achieve commercial status and scale?

- Value chain participants and strategic implications

- How are jet fuel customers and suppliers adjusting strategies? Why?

- Who is likely and succeed and where? Implications for supply and demand?

- What should jet fuel value chain participants do and prepare for the future?

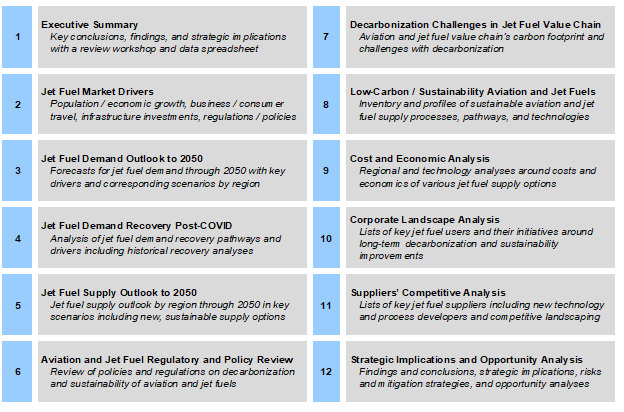

Deliverables from this multi-client study will include an in-depth 100+ page report – see Exhibit 2 for the table of contents – along with a 20-page executive summary deck, a spreadsheet data package, and a review workshop and access to the team for additional questions and insights. Please download the study prospectus, and contact us to learn more and join the multi-client study.

-Swati Singh and Uday Turaga