The price of crude oil has been on an upward trend over the last few months and rose sharply last week after OPEC+ failed to agree to output increases. Brent crude oil futures prices reached a high of $75 earlier this month with a year-to-date gain of nearly 36%. While the burst of global economic demand is well understood, supply and demand dynamics have more recently further supported crude oil price rally.

The sharp rally in petroleum prices in 2021 is due to two primary factors. One, the novel COVID-19 virus seems to have been contained quite effectively since the beginning of the year, especially in developed economies like the U.S. and Canada, and other OECD countries which account for ~47% of the total crude oil demand. Travel and mobility were among the worst affected by the lockdowns, constricting petroleum consumption which has now revived and is expected to reach pre-pandemic levels later this year.

Second, while demand is expected to revive, there are concerns oversupply of crude oil keeping pace due to the ongoing spat between UAE and OPEC+. The Middle East-dominated alliance announced massive crude production cuts in 2020 in an effort to support prices when the Coronavirus pandemic led to a historic demand shock. Now, Saudi Arabia has proposed that OPEC+ should further increase combined production by two million barrels per day (MMbpd) over August to December 2021 but extend the rest of the cuts until the end of 2022. However, UAE wants to agree to such a deal only if its baseline for output is revised upwards.

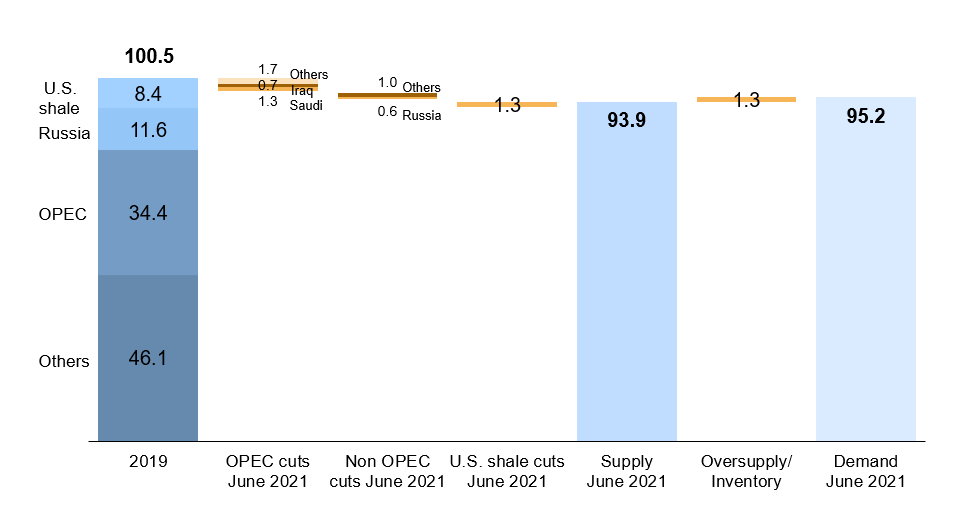

Global supply for oil declined from 100.5 MMbpd in 2019 to 91 MMbpd in 2020 as the COVID-19 pandemic dealt a sharp blow. The International Energy Agency (IEA) expects global oil demand to return to pre-pandemic levels by the end of 2022, rising 5.4 mb/d in 2021 and a further 3.1 mb/d in 2022. As of June, this year, the world crude oil demand has reached to 95.2 MMbpd already increasing the demand by 4.2 MMbpd from 2020 lows as shown in Exhibit 1. Major oil producers such as Russia, Saudi Arabia, and Iran have still cut their production by ~0.6 MMbpd, ~1.6 MMbpd, and ~0.7 MMbpd, respectively relative to 2019 levels. With major capex cuts announced by U.S. shale players in 2020, crude production in the U.S. has a long way to go before it reaches record levels of 12.9 MMbpd in February 2020.

Exhibit 1: Global Crude Oil Supply-Demand Balance

Going forward, Iran is in discussions with global powers to revive the nuclear deal which could lead to more oil on the global market in the coming months. Of the non-OPEC countries, the U.S. is expected to add 0.9 MMbpd by 2022 with Canada, Brazil, and Norway also contributing to the increase next year. The U.S. crude output is forecast to grow by 60,000 barrels per day to 11.5 MMbpd in July and remain at the same levels for the next few months. Given the uncertainty in demand with a potential third wave of COVID-19 expected to touch countries like India and other developing nations in 2021, crude oil demand projections may need downward revisions in the coming months. OPEC+ will most likely adjust its policy to prevent the addition of Iranian barrels from derailing its market balancing strategy. With no geopolitical crisis brewing in the current times, we expect a stable price outlook for the coming months with prices hovering between $60 to $75 levels.

Our team at ADI Analytics is continuously monitoring the global oil supply-demand balance and has supported a wide range of clients including oil and gas producers, midstream companies, and refiners. Please reach out to learn more about how we can help.

-Utkarsh Gupta