After creating a new business unit, ExxonMobil Low Carbon Solutions in February, ExxonMobil announced plans to create a $100 billion multiuser carbon capture, utilization, sequestration, and storage (CCUS) hub in the Houston Ship Channel on the Gulf Coast of Texas in April 2021. The plan takes a collective approach to combatting climate change by leveraging industrial complexes, government incentives, and private sector investments. CCUS hubs are critical as they can leverage economies of scale and reduce the cost of capturing, storing, and transporting carbon which has been the most significant hindrance to adoption. While ExxonMobil is not the first organization to propose CCUS hubs, their announcement does signal a shift in sentiment around the energy transition here in the U.S.

Carbon capture, utilization, and sequestration (CCUS) has been around since the early 1970s, but interest has surged recently with growing decarbonization pressure. CO2 emissions have come under scrutiny since the Paris Climate Agreement in 2015 and the Intergovernmental Panel on Climate Change (IPCC) report on global warming emphasizing the need to limit global temperature rise to 1.5 ℃. This has thrusted CCUS into the spotlight as adoption of CCUS solutions is needed to meet Net-Zero targets. Other drivers of CCUS adoption are regulatory and investor pressure, declining cost, demand for clean hydrogen, and the rise of storage hubs. While CCUS technology has been around since the early 1970s, primarily used to separate CO2 from natural gas, it is now finding use in new applications seeking to decarbonize power generation, cement, waste to energy, and iron & steel.

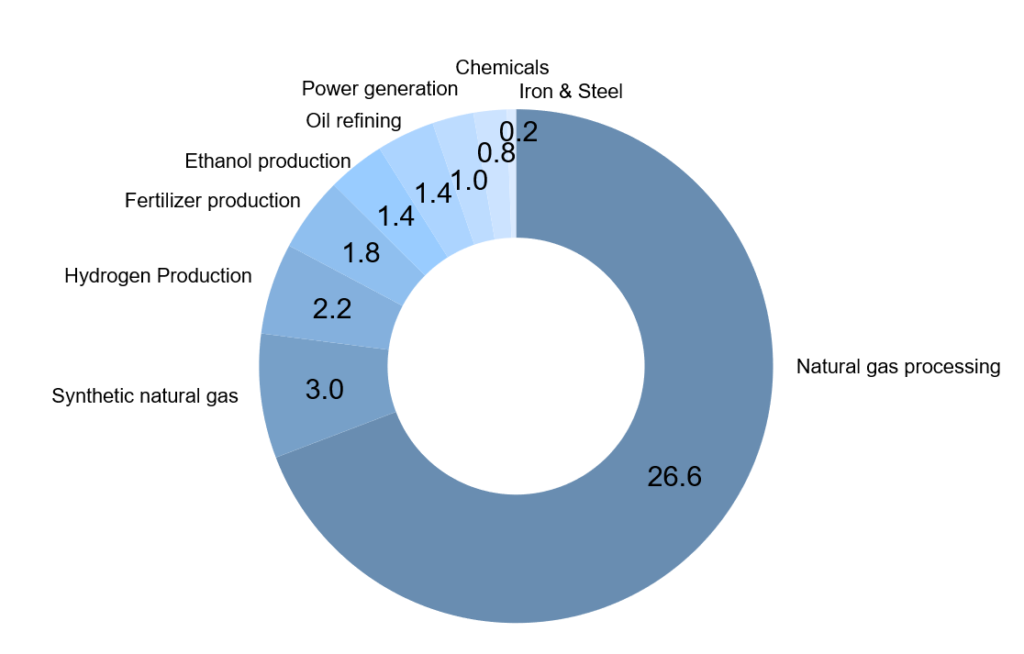

Natural gas processing accounts for nearly 70% of operating CCUS capacity with the remaining 30% highly fragmented with limited capacity across the other segments. While CCUS adoption will lead to emission reductions across the oil and gas value chain, the impact will be limited as these industries face significant substitution risks from renewables. Adoption of CCUS is most important in hard-to-abate segments as fuel switching will not make a significant impact on their carbon footprints. These segments include petrochemicals, concrete, fertilizers, iron & steel industries which currently account for a small share of operating carbon capture capacity. A breakdown of operating capacity by industry is shown in Figure 1.

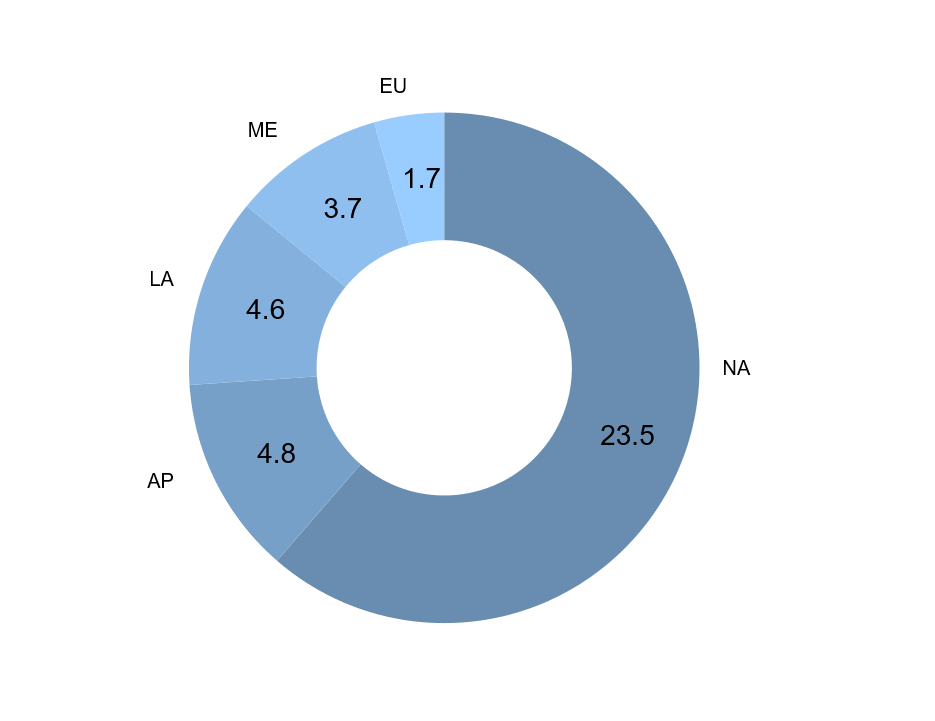

North America accounts for over 60% of operating capacity followed by Asia, Latin America, and Middle East. A breakdown of regional carbon capture capacity is given in Figure 2. A growing commitment to CCUS from industrial companies, increased private capital, and regulatory incentives are driving investments in CCUS in the U.S. and Canada. The U.S. itself accounts for nearly 51% of operating capacity. In Europe, aggressive climate ambitions have led to 11 project announcements which are expected to be completed by 2030, up from two which are currently operating. Asia is expected to have the most growth in CCUS capacity as current coal-fired power capacity has come under scrutiny and CCUS provides an opportunity to significantly reduce emissions. The bulk of the CO2 emissions (two-thirds) in the Middle East come from Saudi Arabia and United Arab Emirates (UAE). Both Saudi Arabia and UAE have committed to action on climate change and are seeking to decarbonize their oil and gas value chains as it is a vital part of their economies.

This blog is a part of a series of posts focused on the CCUS market. Upcoming blogs will focus on announced projects, technologies, costs and economics, and infrastructure. ADI Analytics has been closely monitoring developments in the energy transition and has recently conducted a global study on its outlook and implications. Please contact us to learn more.

-Brandon Johnson