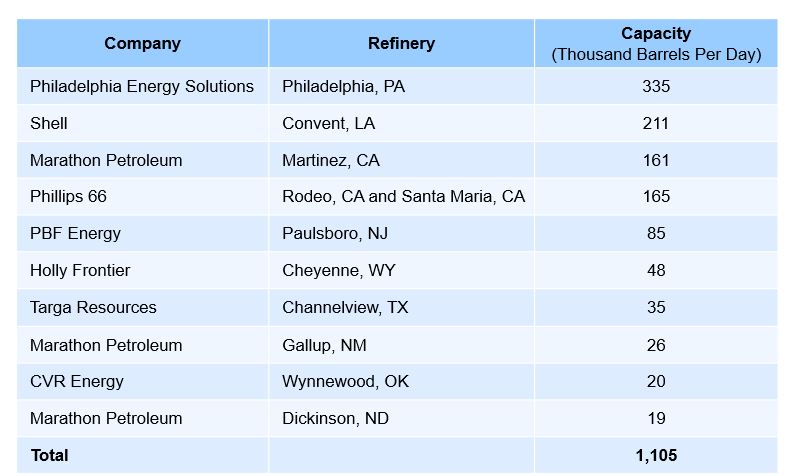

U.S. refiners and integrated oil majors have announced several permanent closures of refineries with some planning to convert them into renewable fuels plants. The trend that started in 2019 has accelerated recently due to extended transportation fuel demand losses induced by the COVID-19 pandemic. Over the past year, U.S. refiners and integrated majors have announced closure of 1.1 million barrels per day (Exhibit 1) of refining capacity which is around 6% of the total U.S. operable refining capacity in January 2020. Further, refiners have also put almost half a million barrels per day of refining capacity up for sale and some refineries have been idled or shut down temporarily by advancing turnarounds to cope with losses amid low refining margins.

Exhibit 1: U.S. refinery closure announcements

As U.S. refiners continue to struggle with lower refining margins, some are shifting towards renewable diesel for higher growth and attractive returns. For instance, Marathon Petroleum will convert its 166,000 bpd Martinez, CA refinery into a terminal and add a 48,000-bpd renewable diesel plant by 2022. The company is also planning to convert its 19,000-bpd Dickinson, North Dakota facility into a renewable diesel plant by 2020. Another major refiner, Phillips 66, is converting its 120,200-bpd Rodeo refinery near San Francisco into a renewable fuels plant by 2024 and HollyFrontier is turning its 48,000-bpd Cheyenne, Wyoming, refinery into a renewable diesel plant by 2022. Other refiners such as Delek and PBF Energy are also evaluating opportunities to invest in renewable fuels. With growing focus towards sustainability, government policy and subsidies are supporting over 30-40% of returns on renewable fuels projects, making it a robust business opportunity.

Refiners closure or shift to renewable fuels have traditionally occurred on the East and West Coasts. But the pandemic has impacted margins and profitability enough that even refiners on the U.S. Gulf Coast are shutting plants down as seen with Shell’s refinery in Convent, LA. This put into sharp fears how the pandemic is accelerating the rationalization of capacity by targeting marginal refineries. Similar trends are underway globally which we will cover in an upcoming blogpost.

Lockdowns and slowdown in personal commute and travel activities have also forced refiners to step forward with rationalization of their assets to survive through the current environment. Refining players have proactively cut their capital spending by delaying or suspending growth projects to sustain through the global economic downturn. For instance, ExxonMobil has delayed its planned 250,000-bpd expansion of its Beaumont, Texas, refinery until 2023 and opening of 525,000-bpd Limetree Bay plant in St. Croix has also been delayed. In addition, other new small refinery projects planned for North Dakota and Texas over the past few years will likely struggle to attract investment and face construction delays in the near-term as we have discussed in recent reports from the ADI Downstream Market Advisory.

The bottom line is that U.S. refiners produce more than the domestic market need so the key to recovery lies in exporting to meet international demand. Except for liquid petroleum gases largely exported to Asia, most refined product exports in 2019 were to Central or South America. And LPG exports are largely produced by natural gas processing plants, not refineries. That means U.S. refined products export recovery depends heavily on Latin America, Mexico, and Brazil. Typically, these countries buy from the lowest-cost supplier, so U.S. refineries need to remain competitive to keep their business.

ADI has launched a new multi-client study – “Market Outlook for U.S. Refined Products Exports to Latin America” − which is focused on a comprehensive assessment and forecast of U.S. fuel and refined product exports to Latin America through 2030. The study will address several strategic questions that arise on the Latin American fuel market’s outlook over the next decade including forecast for U.S. fuel exports to Latin America through 2030, opportunities, risk, and competitive strategy that U.S. refiners and traders will need to consider especially post-COVID. Please download the multi-client study prospectus for the ADI study, “Market Outlook for U.S. Refined Products Exports to Latin America”, and contact us to learn more.

– Swati Singh and Uday Turaga