Liquefied natural gas (LNG) is increasingly seen as one of several catalysts to the energy transition. As countries seek to reach their decarbonization goals, they will have to go beyond switching from coal- to natural gas-fired power generation, and explore carbon-efficient options across all energy demand segments. Many countries around the world are now seeing small-scale LNG — plants and applications that can be served with capacities of 1 million tons per annum (mmtpa) or less — as one such carbon-efficient option. For example, ADI’s recent consulting work includes a project for the U.S. Department of Energy exploring the strong support for small-scale and containerized LNG in Central & Eastern Europe.

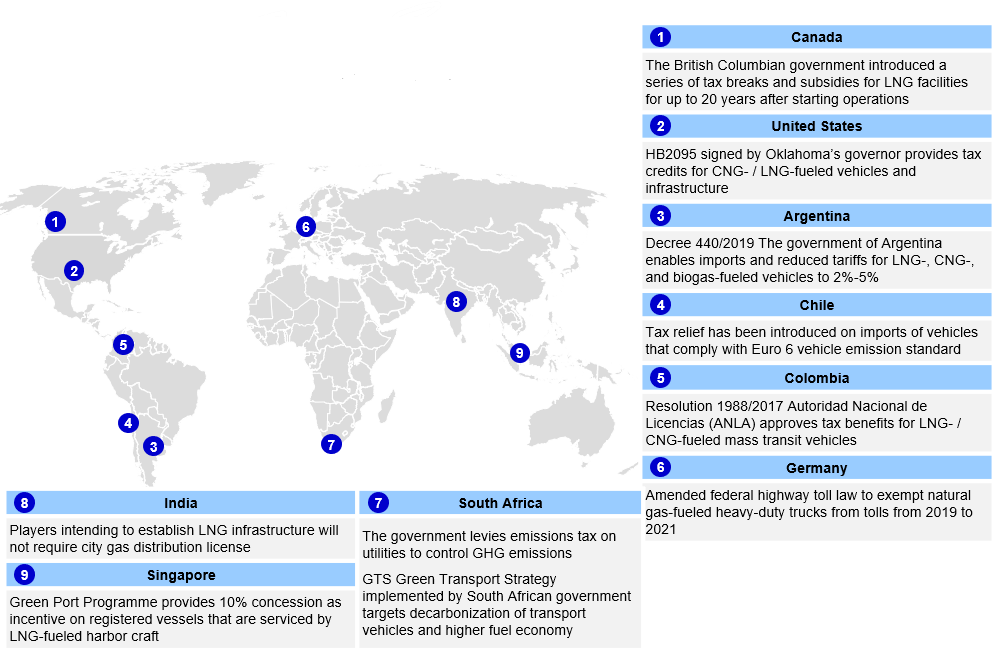

There are three major drivers for LNG demand and demand growth globally: Growing societal and, therefore, policy and regulatory pressure towards decarbonization and energy supply security. Second, falling LNG prices and growing supply from expanding natural gas liquefaction capacity is accelerating adoption of LNG as well as creating new LNG demand in new regions and applications. Finally, technological innovation has increased the favorability for small-scale LNG. The primary accelerator for small-scale LNG adoption continues to be policy and regulatory pressure towards decarbonization. This is especially true in China where the government has issued regulations on vehicle and power plant emissions, and in Europe where policies are aimed at decarbonization and phasing out coal-fired power generation. There are also global policies aiding adoption such as the International Maritime Organization’s regulation limiting sulfur on marine fuels. ADI Analytics has closely followed decarbonization regulations and has assessed their impacts on small-scale LNG adoption. Figure 1 is taken from ADI’s Micro- and Small-Scale LNG Global Market Assessment and highlights recent policy initiatives impacting small-scale LNG adoption

Cheap and abundant supply, cost-effective transportation at small-scale, and growing use in various applications is also aiding growth. While large-scale LNG is primarily used to serve power markets, the cost competitiveness of small-scale LNG has made it attractive for trucking, marine, and industrial applications as well as for power. In the U.S., LNG is a peak shaving fuel used for power plants to produce power during peak utilization season in the winter and summer months. In Europe and Asia interest in small-scale LNG is focused on trucking, marine, and even industrial applications as it is increasingly replacing diesel and fuel-oil. As the cost competitiveness of small-scale LNG grows, adoption will as well.

There are also technological innovations increasing interest in small-scale LNG as well. While LNG technology is mature, a significant amount of innovation is underway for small-scale LNG and is driving down cost of production, storage, regasification, and transportation. This includes small-scale floating storage and regasification units (FSRUs), floating regasification units (FRUs), floating storage units (FSUs), and pump-less refueling stations. These innovations have significantly reduced capex and are low-footprint alternatives which increase the attractiveness of small-scale LNG for smaller countries.

There is significant opportunity long-term due to growing infrastructure, regulatory pressure, and falling supply costs. As the price of natural gas remains low, and nations double down on decarbonization initiatives, small-scale LNG will play an instrumental role in the energy transition. ADI closely follows decarbonization initiatives and has recently concluded a study on global small-scale LNG. The report takes a comprehensive look at regional demand, supply, infrastructure, costs, economics, and pricing, projects and players, and the technology landscape. Contact us here to learn more.

-Brandon Johnson & Uday Turaga