The refining panel session at the 2020 ADI Forum – our consulting firm’s annual oil & gas conference – in January this year was brimming with justified optimism. After several years of questioning and cross-questioning, IMO 2020 – the International Maritime Organization’s rule limiting sulfur in marine fuel oil – was finally here and refiners were getting ready for a strong year with robust diesel margins.

Production planners at many refineries had advanced maintenance into 2019 so they could operate throughout 2020 and take full advantage of the higher margins they were anticipating. Forecasting higher demand for low-sulfur diesel as blendstock for marine fuels, many refiners in the U.S. had also started tweaking their product mix to favor diesel over gasoline.

Coronavirus has interrupted this party in a brutal manner. Forget higher margins, refiners today are struggling to maintain operations, find storage for growing inventories, and service debt as refinery margins have plummeted.

Global fuel demand collapse

As illustrated in a prior note from ADI’s on-going research on the oil & gas “perfect storm”, nearly two-thirds of oil demand is in countries that are under lockdowns collapsing demand for refined products. In the U.S., the most recent weekly demand for gasoline was ~45% lower than normal demand of ~9.2 million bpd averaged over 2019.

Inventories of fuels and oil, therefore, are now building quickly across the world to the point that in some places storage capacity is running out. India’s Bharat Petroleum has disclosed storage capacity constraints as fuel demand has fallen dramatically in a lockdown that was recently extended again. Along with crude oil, fuel inventories in the U.S. too jumped and the market is finding creative solutions. Enterprise Products reported that it is storing gasoline and diesel in NGL wells and operating the Seaway pipeline in bidirectional model. Someone has also proposed using pipelines as short-term storage vessels.

Losing money on gasoline

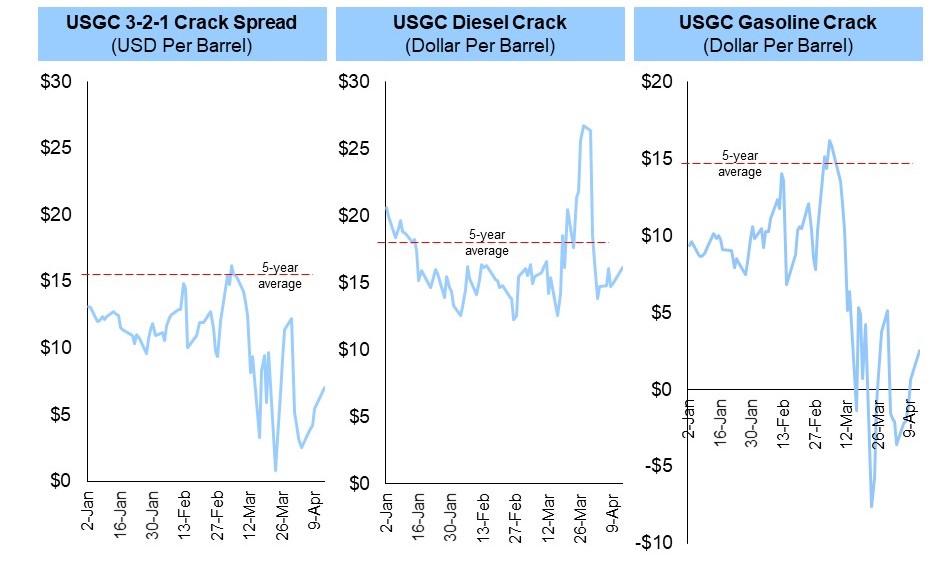

Refining margins have been decimated in this environment as we show in Exhibit 1. Demand destruction coupled with high inventories typical of this season put the gasoline crack spread into negative territory late March on the U.S. Gulf Coast and has just swung into positive territory below $5 a barrel this past week. Diesel margins have, however, jumped higher as its demand has been resilient and likely buoyant during COVID-19 lockdowns.

Exhibit 1. U.S. Gulf Coast refining crack spreads

How are refiners coping?

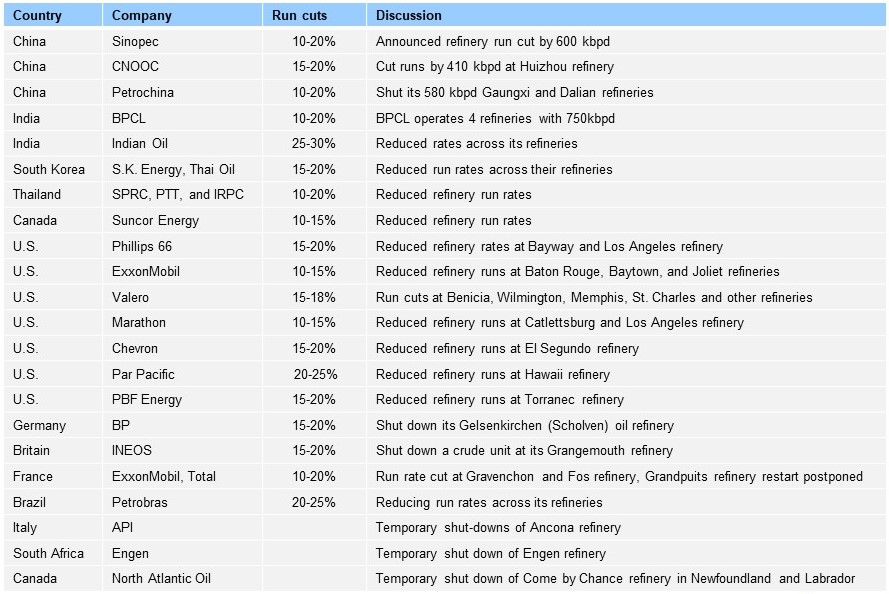

ADI’s research and interviews with operators is showing a much deeper cut to operations than is being anticipated or fully appreciated. Based on a mix of primary and secondary research, ADI estimates that nearly 12.5 million barrels per day (bpd) i.e. almost 15% of global refining capacity has been cut over the past few weeks. Most of these refining cuts have occurred in Asia where operators have typically reduced utilization by 20% to 25% followed by nearly similar amounts of capacity reductions in North America – U.S. capacity cuts totaled 1.1 million bpd – and Europe as shown in Exhibit 2.

Exhibit 2. Cuts to global refining runs in thousand barrels per day as of early April 2020.

Exhibit 3 lists a few of the refiners that have announced operational changes following COVID-19. In general, refiners have been cutting utilization rates by 15% to 20%. Although most players are reporting cuts to refinery runs, some refineries will shut down as well. For example, North Atlantic Refining’s 130,000-bpd Come-by-Chance refinery is closing while API’s 85,000-bpd Ancona refinery owned by APD in Italy is also shutting down. More shutdowns are expected, and, similar to the marginal stripper wells that are shutting in – see the first article of our oil & gas “perfect storm” series – smaller refineries or those without access to export markets are at grave risk of permanent closure. In the U.S., a lot of such refineries are in the Midwest, while overseas they are spread across Asia, Europe, and Latin America.

Exhibit 3. Non-comprehensive list of refiners that have announced cuts to their runs.

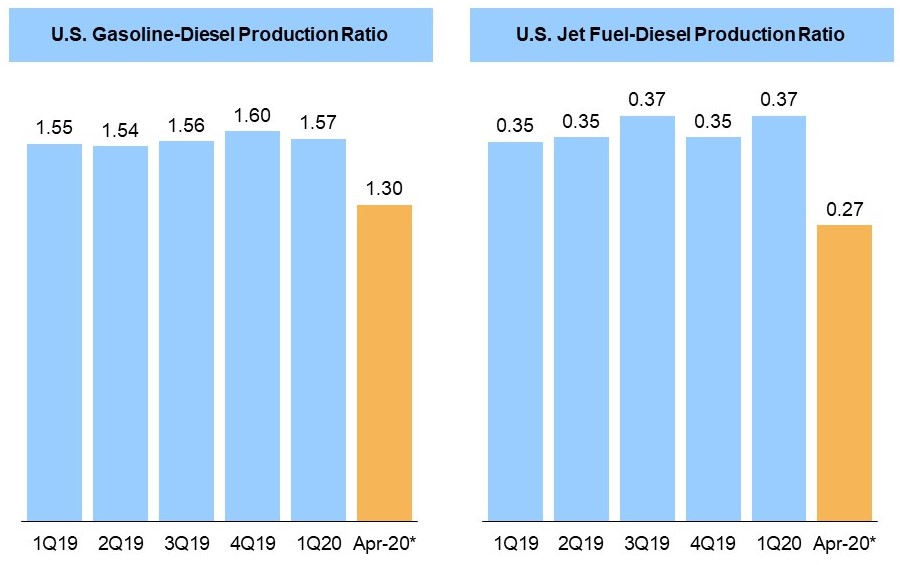

In addition to cutting runs and utilization, refiners are also exercising other options. A key strategy has been to shift product mix in favor of diesel where demand destruction has been limited. Refiners can tweak fluidized catalytic cracking (FCC) unit operations and severity to decrease gasoline output to a certain but limited extent. In addition, refiners have rapidly adjusted distillation cut points to move jet fuel volumes into the diesel pool. Exhibit 4 reflects this trend in the declining gasoline-diesel and jet fuel-diesel production ratios. Even so, there are limits to how much gasoline and jet fuel supply can be reduced with the latter already at historical lows.

Exhibit 4. U.S. refining industry’s product mix changes

Given the difficult economic conditions, an optimal solution would have been to advance maintenance and turnarounds during these shutdowns. Social distancing policies and health impacts of COVID-19 have, however, impacted the availability of skilled contract labor for these activities. For examples, Delta Airlines’ refinery in Trainer, PA has significantly reduced on-site staff by asking contractors and other personnel to leave the site.

Refining’s challenges today are transmitting down through the value chain. Refined product pipeline and terminal companies, traders, and wholesale and retail fuel outlets are all struggling with rapid demand declines. Refined product pipelines such as Colonial Pipeline have announced plans to cut capacity. Traders have been stranded with off-spec product such as high-RVP gasoline from longstanding inventories that cannot be sold without waivers in the summer. Finally, wholesale and retail distribution channels are suffering significant revenue losses not just from lost fuel sales but also diminished pull-through revenue.

So what?

In the wake of a very difficult business landscape that has hobbled the global refining industry, we look for strategic insights and implications for the c-suite’s consideration. A few of them are discussed below:

- Refiners highly dependent on export markets such as those on the U.S. Gulf Coast need to carefully track and monitor how various global markets recover post-COVID. Recovery paths will vary globally impacting fuel demand recoveries as well. A scenario-based approach to the recovery of these fuel markets will be critical, and is part of ADI’s new study focused on oil & gas navigating the “perfect storm”.

- Recovery in a post-COVID world will be highly heterogenous and refiners with diverse assets and robust supply chain and maintenance and turnaround programs will be better positioned. ADI anticipates significant bottlenecks around the availability of craft and maintenance labor, technical and optimization consulting services from licensors and OEMs, and catalyst and refinery chemical vendors.

- Large capital projects will certainly be delayed but some sustaining capital investments will also face delays that could impact reliability and utilization rates in the longer run unless they are addressed proactively as recovery gains momentum.

- Dramatic declines in fuel demand will impact regulatory compliance strategies such as ethanol volumes that will have to be blended into gasoline. The U.S. Environmental Protection Agency is reportedly considering suspending blending mandates although it will not be easy in an election year. Even so, commercial trading teams at refiners need to monitor these developments to identify opportunities in a rapidly changing environment.

- Refiners that will struggle in this environment are likely disadvantaged in a peak-demand environment going forward. These will include refiners with low complexity indices (i.e. limited conversion capacity and diversity), assets in landlocked regions without access to water, and, therefore, export markets, and dated automation and process control systems.

- A record number of refineries are now available for sale, and their performance in this distressed environment will shed significant light on their valuations and prospects. In addition, smaller refineries may shut down and some of them may be permanent closures.

- Finally, understanding the new normal will be critical for the entire refining industry including equipment, chemical, and service vendors serving this market. We anticipate significant changes in the scale and scope of capital and operating spending – as our new study explains in greater detail – that will be geared toward improving preparedness for such events including investments in product yield flexibility, automation, remote operations, and digital and virtual capabilities.

ADI has a new study about navigating oil & gas through this “perfect storm”. The report includes granular forecasts for upstream (shale and offshore), midstream (gas processing, NGLs, and pipelines), LNG, refining, and petrochemicals. Learn more by downloading the study prospectus and contact us at info@adi-analytics.com or +1 (832) 768-8806 to learn more.