Oilfield services demand is strongly correlated to upstream exploration and production spending and activity patterns. However, we see significant play-wise variations in oilfield services spending. With advancing technology to increase oil and gas recovery, shale plays are becoming more specialized and unrelated to other plays in terms of lithology, fluid properties (e.g. water cut, gas-oil ratio, and paraffin content), infrastructure (e.g. well design, artificial lift methods, fracking design, and surface facilities), and logistics including transportation methods and gas processing capabilities. Each type of play therefore requires a different development strategy especially as operators have significantly worked to consolidate assets in specific plays.

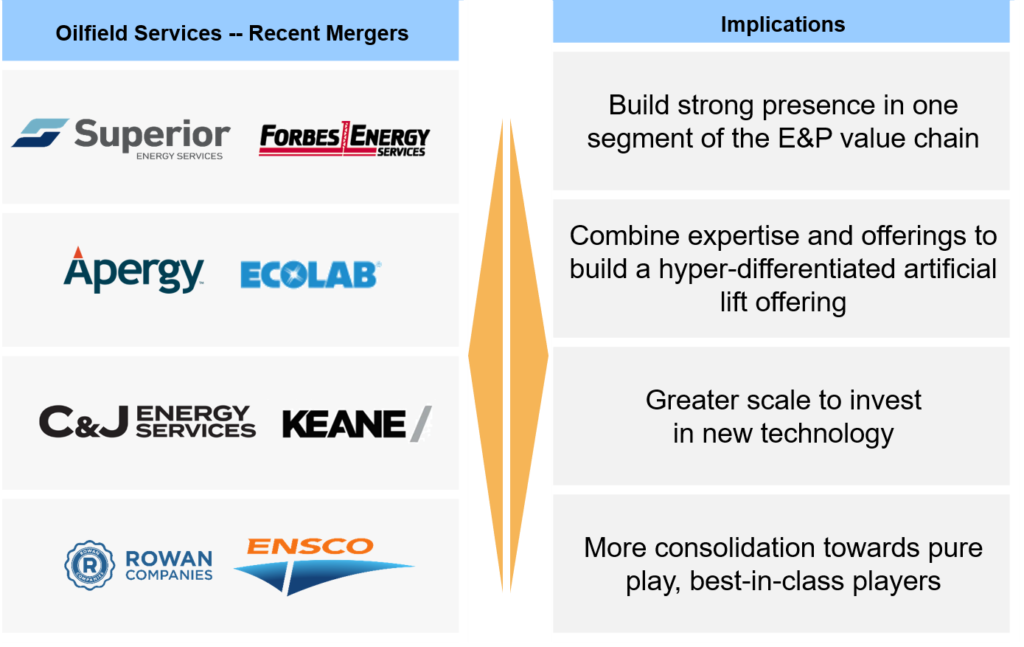

Oilfield service companies are also realizing the need for specialization resulting in business model changes and consolidation strategies. These are changing from one player providing various services addressing a wide range of ‘cookie cutter’ offerings to expertise-driven business models, where one specialized service is bundled with other complementary specialized service catering to a focused set of needs on play-to-play basis.

ADI has recently conducted several projects in the oilfield chemicals market, where this trend is resonating. Exhibit 1 below shows some examples of oilfield service companies’ consolidation towards this market trend. Nalco EcoLab spun off their upstream chemicals business to Apergy, Flotek transformed into a specialized oilfield chemicals business, and Nouryon was sold by Akzo Nobel to U.S. based Carlyle Group in 2018.

Historically, oilfield chemicals have been a part of wider offerings at large- to mid-sized chemical companies. Despite having similar chemistry, characteristics such as downhole temperature and pressure, water cut, and paraffin or wax content play a major role in deciding how effective these chemicals will be in their respective operations. In addition to performance criteria, the customer service aspect of the business such as product customization, delivery time, inventory maintenance, and response time are becoming more important for the small to mid-size operators who need these chemicals in smaller quantities and on a flexible time-scale. Baker Hughes, Schlumberger, Halliburton, EcoLab, Clariant, and Flotek have introduced digital monitoring technologies to enhance the service aspect of their oilfield chemicals offering.

Given these trends, we see more oilfield service companies consolidating on the basis of offerings and specialization. ADI has been supporting clients in oilfield services and upstream and we expect similar consolidation and business model trends to continue as shale evolves into the next phase. To learn more, please visit us at www.adi-analytics.com or contact us at info@adi-analytics.com or + (281) 506-8234.

By Panuswee Dwivedi and Uday Turaga