The Vaca Muerta shale play in Argentina has one of the greatest oil reserves in the world. The field has attracted investments from global majors such as Chevron, ExxonMobil, and Shell, many of which have started shifting into full development on their blocks in the play last year. There has been study progress in Vaca Muerta shale, and oil production is accelerating with production of 79,000 barrels of oil per day in 2018.

Most players are actively testing their acreage positions with pilot projects and 5 out of 26 basins commercially producing shale oil and gas. Presently, over 30 integrated oil companies and national operators hold Vaca Muerta positions, many through legacy conventional project. Operators are continuously pouring money in technology and innovation to develop these fields to achieve profitability. YPF and Petronas recently signed a four-year $2.3 billion agreement to fully develop a shale project in the Vaca Muerta formation. YPF, Total, Pan American, and Wintershall have plans to invest ~$1.1 billion in shale gas exploration at their three newly awarded areas in the Vaca Muerta field. ExxonMobil aims to produce one million barrels per day by 2024 at a breakeven cost of the mid-$30’s per barrel. Despite surface risks, the time it takes to drill in the play fell to a record low of 16 days in 2018, down from 54 days in 2014.

With soaring investments by major operators, the revenue model for Vaca Muerta will be attractive but profitability will depend on various factors including global price scenarios. Drilling costs have declined in recent years and well performance for horizontal wells has also increased. Loma Campana, a flagship development field of Vaca Muerta saw an increase in average lateral length of a horizontal well from 4,200 feet three years ago to 6,200 feet in 2018. The average number of frac stages per horizontal well also increased from 16 to 21 stages in the past three years.

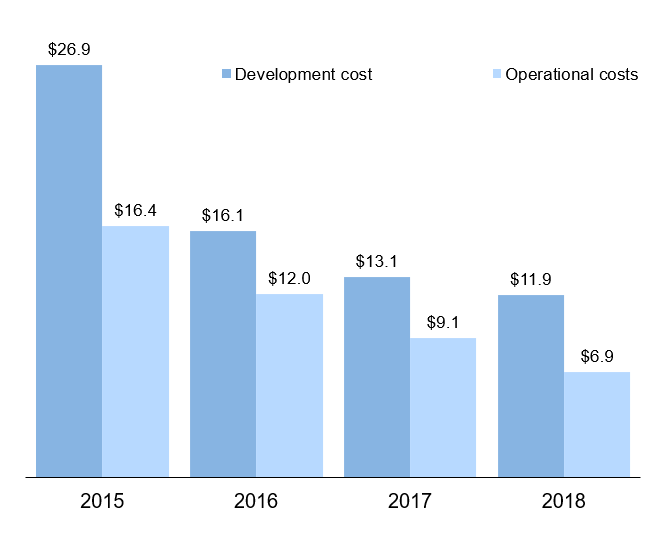

Exhibit 1: Shale oil costs in Loma Campana in dollars per barrel of oil produced

Companies are continuously innovating, and the experiences gained from U.S. shale are being implemented in Argentina to improve well economics. Operational costs have decreased from $16.4 in 2015 to $6.9 last year per barrel of oil production as shown in Exhibit 1. While well costs in Vaca Muerta have fallen as rapidly as those in US shale basins, they are still not competitive in absolute terms with U.S. light tight oil. With future cost reductions by 10%, wells in Vaca Muerta can offer returns over 20% as estimated in a report by Ministry of Energy, Argentina. To continue growing, Vaca Muerta needs greater investment in exploration and production and infrastructure including pipelines, storage terminals, and railways to transport and ship crude and gas.

-Utkarsh Gupta and Uday Turaga