The U.S. has imposed sanctions on OPEC’s third-largest oil producer, Iran, which are expected to come into effect November 4, 2018. The oil market has already started seeing a shortfall in global supply even as overall global oil demand has been rising rapidly and, in fact, anticipated to top 100 million barrels per day (bpd) for the first time in the fourth quarter of 2018. In response, the market is speculating that oil prices will rise to as much as $100 a barrel.

The effect of upcoming U.S. sanctions on Iran can already be seen in terms of a declining appetite for Iran’s crude oil amongst its major customers. For Instance, South Korea, which relies heavily on crude oil from Iran has currently suspended importing from that country. Additionally, Japan and India are also likely to cut Iranian crude imports in the coming months. This loss in momentum is primarily driven by the risk of sanctions associated with the U.S. financial system under a non-compliance situation. Overall, we are expecting anywhere from 500,000 to 1 million bpd of oil to vanish from the oil market creating a significant supply-demand imbalance as we get closer to the beginning of the mandate in early November.

On the other hand, OPEC and other oil producers are considering increasing oil output by 500,000 bpd to maintain supply. OPEC crude oil production ramped up by 278,000 bpd in August 2018 mostly from Libya, Iraq, Nigeria, and Saudi Arabia. However, declining production output from countries including Venezuela and Algeria along with unplanned outages from Libya can limit OPEC production.

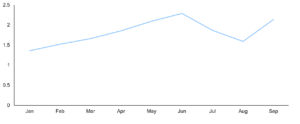

Exhibit 1: U.S. export of crude oil in 2018 in million barrels per day

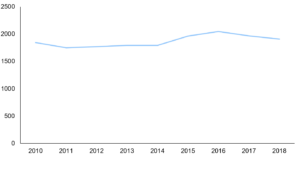

Further, U.S. crude exports in September 2018 increased significantly which indicates the existing global demand and the effect of U.S. sanctions on Iran. This can be seen in Exhibit 1 above, where U.S. crude exports rose dramatically in the month of September. Furthermore, significant export demand has caused U.S. crude and petroleum inventories to plummet swiftly as shown in Exhibit 2. This decline was likely also triggered by infrastructure and pipeline bottlenecks that are currently constraining U.S. shale production.

Exhibit 2: U.S. crude stocks at the end of September in each year in million barrels per day

Will U.S. provide any exemptions post November 4, 2018, is yet to be seen. The balance in compliance with the sanctions and low-price crude resource availability will play a significant role in shaping the future global crude market.

Overall, we feel that OPEC production will not be enough to offset the Iranian cut and the U.S. will play a significant role in balancing supply. This creates an opportunity to capture market share in the upcoming months for U.S. crude producers and exporters if the regional pipeline bottlenecks are sorted out. Collectively, we expect prices to increase beyond current levels but likely stay well below $100 as U.S. and potentially new OPEC supply will fill the void.

– Swati Singh and Uday Turaga