The United States has become a top player in global energy, especially in ethane exports. This position comes from its large domestic supply, good prices, and significant investments in export facilities, all supported by long-term contracts with international buyers. U.S. upstream and midstream players currently export about 0.5 million barrels per day (MMBPD) of ethane, which is about 20% of the country’s total production.

However, a new challenge has emerged. The U.S. government recently announced that certain ethane and butane shipments to China will now need special licenses. This decision from the U.S. Bureau of Industry and Security (BIS) mentions a “security concern” that requires closer review. Companies like Enterprise Products Partners are unsure if they can get these new permits quickly. Other major ethane and LPG exporters, including Energy Transfer, Targa Resources, and Phillips 66, likely face similar issues.

This change materially disadvantages U.S. ethane exports. In 2024, the U.S. exported nearly half a million barrels of ethane daily. Nearly 60% of that, over 225,000 barrels per day, went to China. Ethane trade works through specific, long-term deals and dedicated, special ships. There are few other markets ready to take such large volumes if this key trade route is affected. This could influence prices and affect exporter profits.

For butane, the situation is less concerning. Only a small part of U.S. butane exports, about 5% or over 26,000 barrels per day in 2024, typically goes to China. These volumes can be redirected more easily to other countries like India, Japan, or nations in Africa, where butane and LPG are used for heating and cooking. It’s notable that propane, another important NGL shipped to China in even larger amounts and also used for plastics, was not part of these new rules, although this might change quickly.

Exports are critical to the U.S. oil and gas upstream and midstream sector as domestic production contributes to a consistent ethane surplus. U.S. operators could extract an estimated 4.3 MMBPD of ethane in 2024, but only about 65-70% is recovered. The rest either stays in the natural gas stream or is not extracted and instead rejected. Even with domestic use by ethylene plants at over 2.0 MMBPD, the U.S. has a growing surplus of 0.6-0.7 MMBPD available for export. This extra supply helps keep U.S. ethane prices competitive.

Global demand for U.S. ethane continues to be strong. European companies, like INEOS, have invested heavily in U.S. ethane-fed cracking capacity to produce olefins. A new cracker in Belgium, for example, is expected to increase U.S. ethane demand by over 100,000 barrels per day by 2027. In Mexico, the new Terminal Química Puerto México (TQPM) in Coatzacoalcos, which opened in May 2025, is a partnership between Advario and Braskem Idesa. This $500 million project can import up to 80,000 barrels per day of U.S. ethane for its petrochemical complex. Other nations in South and Southeast Asia are also showing more interest in using ethane to feed their local steam cracking capacity.

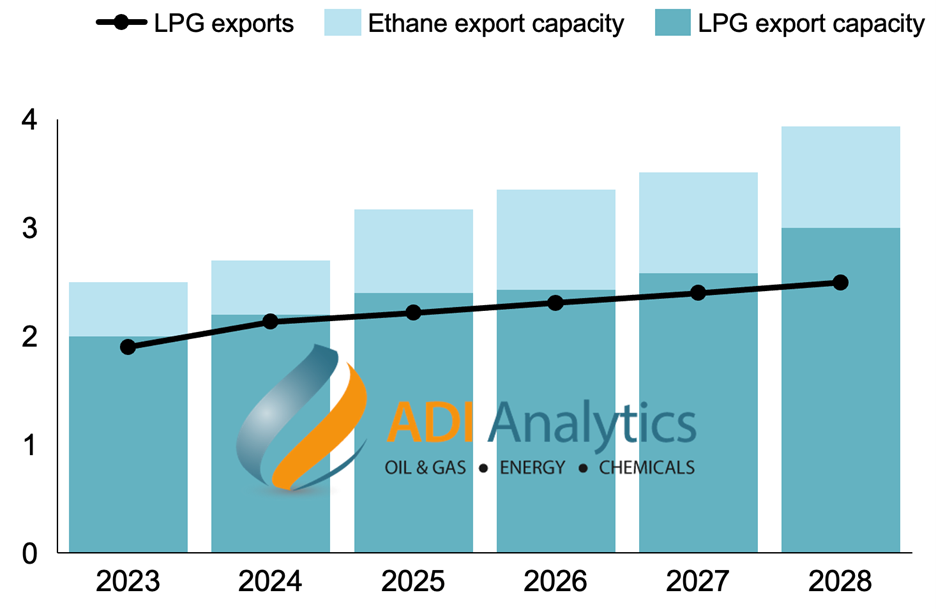

To meet this rising global need, more U.S. ethane export capacity is being built. Enterprise Products Partners is on track to add a 120,000 barrel per day ethane train at its Neches River facility by late 2025. A flexible train for 180,000 barrels per day of ethane (or 360,000 barrels per day of propane/butane) will follow in early 2026. Energy Transfer will also start its Nederland Flex port project by late 2025, adding 250,000 barrels per day of flexible NGL export capacity, with about 150,000 barrels per day for ethane. Some of these terminal start dates may be delayed if ethane exports are curbed, potentially impacting the outlook for LPG exports from the U.S. (see Figure 1).

Figure 1. U.S. LPG exports and forecast in million barrels per day.

The uncertainty around these new licensing rules creates an immediate challenge. If getting licenses becomes difficult or takes too long, the full effect on the growing U.S. NGL export industry and its important trade ties, especially with Asian markets, remains a key question. This situation could also accelerate efforts to develop new demand centers for ethane. For example, in Latin America, ethane could be used as a cost-effective feedstock for power generation, offering a cheaper solution compared to diesel or fuel oil in areas where LNG infrastructure is too costly.

In summary, this development presents several strategic implications:

- China’s supply crisis: The U.S. is China’s sole long-distance ethane source. New license requirements threaten China’s huge petrochemical investments, risking feedstock shortages and plant viability.

- U.S. ethane market turmoil: Without China, there are no immediate alternative markets for vast U.S. ethane exports, directly impacting prices and profit for major U.S. producers due to specialized trade contracts.

- Jeopardy for U.S. export growth: Planned multi-billion dollar U.S. ethane export expansions are now in doubt, as license issues could halt new projects and undermine significant capital outlays.

- Higher costs for Chinese firms: China’s petrochemical sector faces rising feedstock costs and the need to find expensive alternatives or new suppliers, forcing a rapid strategic overhaul of their U.S.-dependent operations.

- Urgent export diversification: This policy shift pushes U.S. exporters to urgently seek new, less politically sensitive markets (e.g., Latin America, India) to reduce reliance on China and secure future demand.

— Uday Turaga

If you’re interested in understanding natural gas liquid (NGL), ethane, propane, butane, and LPG markets, including global demand, supply, U.S. exports, trade flows, and infrastructure outlook, as well as strategic implications for your business operations, please contact ADI at info@adi-analytics.com.

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in these segments including natural gas liquids, ethane, propane, butane, LPG, and midstream and export infrastructure, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.