The U.S. natural gas sector is witnessing another transformation and ready for growth even if limited in pipeline infrastructure primarily as a way to prepare for increasing demand for natural gas and, meanwhile, addressing transportation constraints. Last year alone, new pipelines with a combined capacity of ~7 billion cubic feet per day (Bcf/d) came online, and more projects are on the horizon. After all, natural gas production in the U.S. is on the rise, with ADI forecasting an annual growth rate of about 1.7%. through 2030, when the production is anticipated to reach ~115 Bcf/d. Gas production growth in U.S. shale plays, specifically from Haynesville and Permian, is driving medium-term demand for new pipeline takeaway capacity.

Several factors are contributing to the long-term surge in natural gas demand. A significant driver is the anticipated increase in liquefied natural gas (LNG) export capacity, with around 9.7 Bcf/d of new LNG export facilities currently under construction. Additionally, the proliferation of gas-fired power plants—especially to support energy-intensive data centers—will further escalate natural gas demand. To tackle the pipeline capacity constraints and support rising natural gas demand, many pipeline projects are underway across U.S. shale plays.

Exhibit 1 represents the gas production and takeaway capacity in the Permian Basin. Permian gas production averaged ~25 Bcf/d in 2024 and is expected to grow ~2% annually through 2028. With the recent startup of the Matterhorn Express pipeline, three new pipelines are set to be operational in the coming years.

- The Matterhorn Express Pipeline: The Matterhorn Express Pipeline, designed to transport up to 2.5 Bcf/d of natural gas from the Permian Basin to the Katy area near Houston, Texas, has begun service this month and will help alleviate takeaway constraints in the Permian Basin.

- Apex Pipeline: Targa Resources’ APEX gas pipeline with a capacity of ~2 Bcf/d will transport natural gas from the Permian Basin to Port Arthur, Texas by 2026.

- Blackcomb Pipeline: Whitewater Midstream is building the Blackcomb pipeline with a takeaway capacity of 2 Bcf/d from the Permian Basin to Agua Dulce in South Texas. It is expected to be completed by 2026.

- Warrior Pipeline: Energy Transfer is developing the Warrior Pipeline and is projected to provide ~1.5 to 2 Bcf/d of takeaway capacity from the Permian Basin by the end of 2026.

Exhibit 1: Permian gas production and takeaway capacity (Bcf/d)

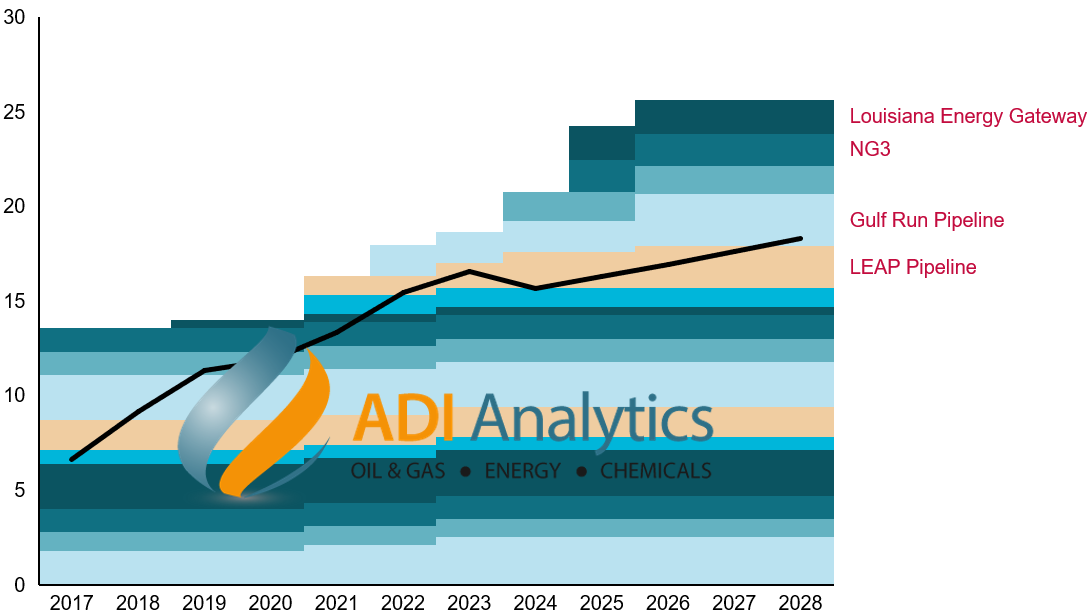

Haynesville gas production is anticipated to grow much faster than Permian’s at ~4% annually from ~16 Bcf/d in 2024 to ~18 Bcf/d in 2028. A lot of this supply growth is due to Haynesville’s proximity to numerous LNG exporting terminals. Gas production growth in the Haynesville Basin is driving demand for new pipeline capacity. Exhibit 2 illustrates the gas production and takeaway capacity in the Haynesville Basin. Key pipeline projects are detailed below.

- Louisiana Energy Gateway: Williams sanctioned the Louisiana Energy Gateway (LEG) project, designed to move ~1.8 Bcf/d of Haynesville natural gas to the Gulf Coast markets. It is expected to be operational by 2025.

- New Generation Gas Gathering (NG3): NG3 achieved final investment decision in late 2022 and is anticipated to be placed in service in 2025. It will transport ~1.7 Bcf/d of natural gas from the Haynesville Basin to the Gulf Coast LNG markets.

- Gulf Run Pipeline expansion: Expansion of the Gulf Run Pipeline will add ~1.1 Bcf/d of takeaway capacity by 2026 and carry gas from northern Louisiana to the coast.

- LEAP Pipeline expansion: DT Midstream’s LEAP Pipeline Phase 4 expansion will add ~0.3 Bcf/d of additional capacity by 2026.

Exhibit 2: Haynesville gas production and takeaway capacity (Bcf/d)

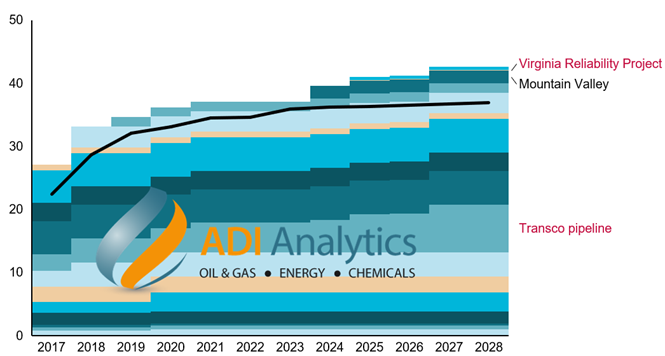

Exhibit 3 shows the gas production and takeaway capacity in the Appalachia Basin. Appalachia gas production averaged ~36 Bcf/d in 2024 and is expected to grow at only ~0.6% annually through 2028. Key pipeline projects outlined below including the Mountain Valley Pipeline, Transco Pipelines, and Virginia Reliability Project.

- Mountain Valley Pipeline: In the Appalachian region, the highly anticipated Mountain Valley Pipeline became operational this summer with a capacity of 2 Bcf/d. The startup of this pipeline resulted in a ~2% decrease in U.S. natural gas prices in June 2024. The pipeline allows Appalachian producers to slowly boost output and improves access to premium markets in the Mid-Continent and Gulf Coast regions.

- Transco pipelines: The Transco Regional Energy Access, with a capacity of 0.83 Bcf/d, is set to come online by the end of 2024 and the 0.11 Bcf/D Transco Commonwealth Energy Connector is scheduled for late 2025.

- Virginia Reliability Project: The Virginia Reliability Project will replace 48 miles of 12-inch pipe with a 24-inch pipe and add ~0.1 Bcf/d of capacity which is targeted to become operational by 2025.

Exhibit 3: Appalachia gas production and takeaway capacity (Bcf/d)

Energy Transfer and Kinder Morgan are examples of midstream companies making strategic infrastructure investments. Energy Transfer is making a substantial investment in pipeline and processing infrastructure, particularly in the Permian. The company plans to enhance its processing capacity to 5 Bcf/d within two years from ~3.4 Bcf/d today in the Permian. Additionally, with the recent acquisition of WTG Midstream, Energy Transfer added a vast network of gathering pipelines and eight processing facilities with a collective capacity of ~1.3 Bcf/d in the Midland Basin.

Kinder Morgan is also executing multiple projects to enhance its pipeline systems, including the EvangelinePass project, which aims to boost capacity on the Tennessee Gas Pipeline and the Southern Natural Gas systems in Mississippi and Louisiana. This will enable the delivery of up to 2 Bcf/d of gas to the Venture Global LNG facility in Louisiana.

The trajectory for U.S. natural gas is optimistic, with ongoing investments in pipeline infrastructure designed to meet both current and future demands. As these pipeline projects come online, they will not only enhance supply reliability but also support the growing demand for natural gas, both domestically and internationally.

— Bhautik Gajera and Uday Turaga

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including oil and gas production, pipeline capacity buildout and maintenance, and oil and gas prices, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives together for meaningful dialogue and strategic insights across the oil & gas, energy transition, and chemicals value chains. Learn more about the ADI Forum, which is chaired by Uday Turaga, Founder & CEO, ADI Analytics, at www.adi-forum.com.

Subscribe to our newsletter or contact us to learn more.