The demand for lithium is on the rise due to its role as a crucial component in electric vehicle (EV) batteries and energy storage systems. Major oil and gas companies such as Equinor and ExxonMobil are seizing opportunities in this growing market. ExxonMobil is constructing a lithium production facility in Arkansas and has recently secured an offtake agreement with SK On for up to 100,000 metric tons of lithium supply. Meanwhile, Equinor is collaborating with Standard Lithium on a lithium manufacturing project in Southwest Arkansas. Additionally, Equinor has been selected for potential award negotiations of up to $225 million from the U.S. Department of Energy (DOE) to support the project. Therefore, there is an increasing need for innovative and more efficient methods to extract lithium beyond the traditional brine evaporation process.

The traditional brine evaporation method has been a long-standing approach to produce lithium. In this process, lithium-rich brine is extracted from salars or basins and left in large evaporation ponds for up to 18 months, allowing the water to evaporate and leave behind a concentrated lithium brine. This brine is then processed to convert the lithium into lithium carbonate (Li2CO3). While effective, this method is highly dependent on environmental factors such as temperature, humidity, and solar intensity. It also requires vast amounts of land and water, making it less sustainable.

Direct lithium extraction (DLE), in contrast, offers a more efficient and sustainable way to extract lithium from salars or basins. In DLE, the brine is processed through separation modules where lithium is selectively removed with recovery rates of up to 90%. The extracted lithium is then sent to a downstream plant to be converted into Li2CO3. This process eliminates the need for large land areas and lengthy evaporation times. It also enables water recovery from the brine, reducing both land and water usage, making DLE a more sustainable solution.

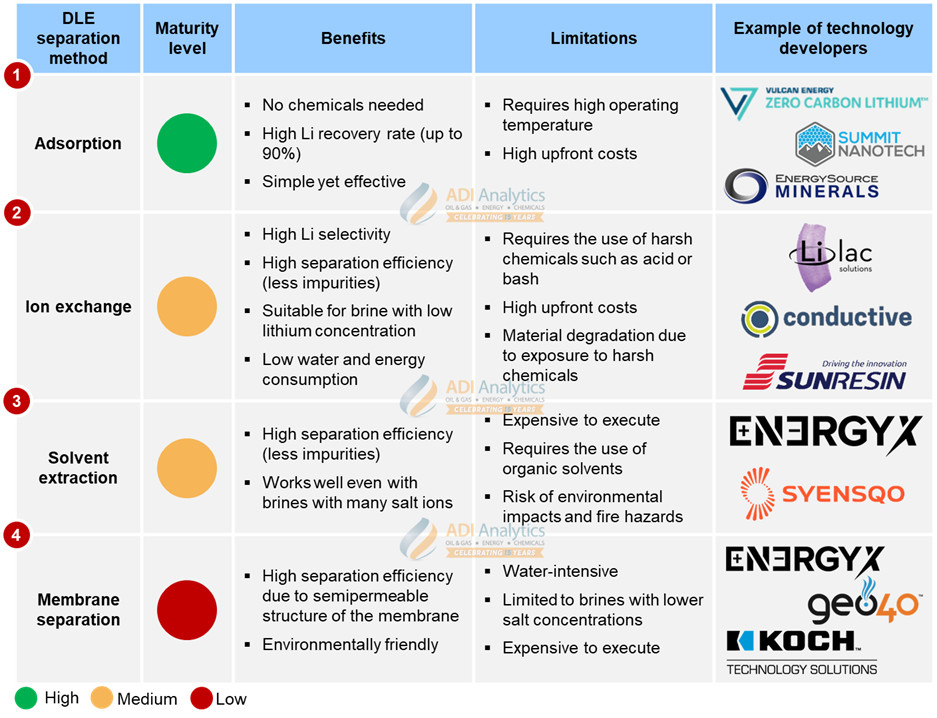

There are four common types of separation used in DLE technology: (1) adsorption, (2) ion exchange, (3) solvent extraction, and (4) membrane separation. Exhibit 1 presents the maturity level, key characteristics, and examples of technology developers for each separation method.

Exhibit 1: Characteristics of different DLE separation methods and their respective technology developers

- Adsorption

This method uses synthetic materials including ceramic beads as adsorbents to capture lithium from the brine. It is a widely used technology in DLE due to its simplicity and effectiveness, achieving recovery rates of over 90%. Adsorption systems don’t require harsh chemicals, but they do need high temperatures for optimal performance and involve high upfront costs for the adsorbent materials. Key players developing this technology pathway include Summit Nanotech, EnergySource Minerals, and Vulcan Energy.

- Ion exchange

In this method, lithium ions are swapped with undesirable ions of the same charge through a resin-based process. Ion exchange is highly selective and well-suited for low-lithium concentration brines. It also minimizes impurities and uses low amounts of water and energy. However, the process usually requires an acid or base wash to release lithium from the resin, which can increase costs and environmental concerns. Companies working on ion exchange include Lilac Solutions, Sunresin, and Conductive Energy.

- Solvent extraction

This method uses organic solvents to capture lithium from the brine, converting it into lithium chloride (LiCl) or lithium ions (Li+). Solvent extraction is highly efficient and works well for complex brines, producing high-purity lithium. However, it can be expensive due to the cost of solvents and equipment, and there are environmental risks and fire hazards associated with the use of organic chemicals. Notable companies in this space include EnergyX and Syensqo.

- Membrane separation

This method uses semipermeable membranes made from ceramic, polymer, or composite materials to selectively filter lithium ions from other salts in the brine. While relatively new in DLE technology, membrane separation is often used as a pre-treatment to lower operating costs and reduce resin regeneration frequency in ion exchange systems. However, it’s only effective for brines with lower salt concentrations. Key players in membrane technology include EnergyX, Koch Technology Solutions, and Geo40.

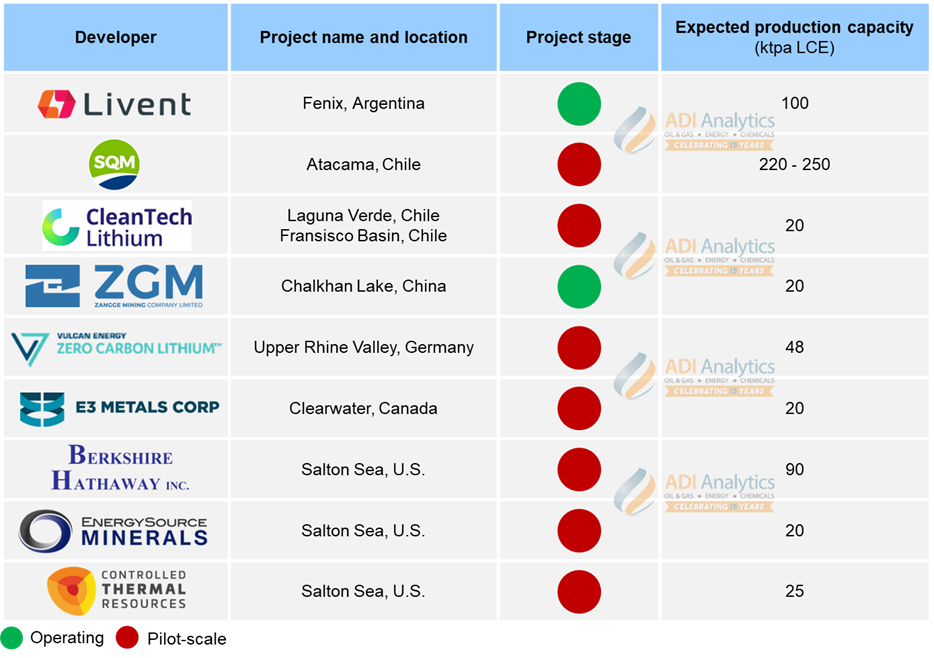

Exhibit 2: Example of DLE projects and their project stage and expected production capacity, ktpa LCE

To date, several brine projects have adopted DLE technology, with the majority concentrated in the Lithium Triangle of Latin America. Argentina is leading with notable projects such as Livent’s Project Fenix in the Western Subbasin of the Salar del Hombre Muerto, which is undergoing multiple expansions to reach a total production capacity of 100 kilotons per annum Li2CO3-equivalent (ktpa LCE). In Chile, following the National Lithium Strategy announced in early 2023, which aims to boost lithium production and promote the use of DLE technologies for sustainability, there has been a rise in DLE adoption. Key projects include one by SQM, with an expected production capacity of up to 250 ktpa LCE, and two projects by CleanTech Lithium with a production capacity of 20 ktpa LCE.

In China, several projects already utilize DLE technology, with SunResin being a prominent player. For instance, Zangge Lithium is operating a lithium production plant with a capacity of 20 ktpa LCE, utilizing SunResin’s resin technology. There is also a shift away from the salar brines and spodumene reserves to geothermal brine in Europe and North America. In Europe and North America, DLE is being implemented to extract lithium from geothermal brine while simultaneously harvesting geothermal energy. Notable projects include Vulcan Energy’s Upper Rhine Valley project, E3 Metals’ Clearwater project, and several initiatives at the Salton Sea led by developers such as Energy Source Minerals, Berkshire Hathaway, and Controlled Thermal Resources. Exhibit 2 summarizes the aforementioned DLE projects and their expected production capacities.

As the world shifts towards a more sustainable future, DLE will likely become the primary method for lithium extraction. A robust and sustainable lithium supply is essential for the large-scale production of Li-ion batteries, which are critical for the growing demand in clean technologies such as EVs and energy storage systems. We have also published a series of blogs discussing the new materials and demand for Li-ion batteries and how EV growth will influence Li-ion battery prices. In summary, DLE provides a more sustainable and efficient alternative to traditional evaporation methods, using less land and water while offering valuable environmental, social, and governance (ESG) benefits for both developers and consumers.

– Edmund Lam

Please contact ADI at info@adi-analytics.com if you would like to learn more about the market for critical minerals, including lithium in the energy transition, the economics of DLE technologies, and how DLE could impact lithium supply and demand, as well as the landscape of separation materials such as adsorbents, resins, solvents, and membranes.

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including critical minerals such as lithium, specialty chemicals including adsorbents and membranes, and energy transition, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.