Renewable electricity is becoming increasingly accessible for companies striving to meet their sustainability goals. They can either generate it themselves or procure it from third-party providers. There are seven options a chemical company can use to obtain renewable electricity such as owned on-site generation, owned off-site generation, on-site Power Purchase Agreements (PPAs) / operating leases, traditional PPA, synthetic PPA, utility products / green tariffs, and unbundled Renewable Energy Certificates (RECs). Each of these options is unique and is designed to meet the varying needs of companies. This variety allows businesses to choose the most appropriate method for integrating renewable energy based on their financial, operational, and sustainability goals. Below, we will discuss the benefits and limitations of these options.

- Owned on-site generation

Owned on-site generation provides direct power to the facility, reducing electricity costs and potentially generating revenue by selling surplus energy back to the grid. It offers high project visibility with potential cost savings through tax incentives and competitive prices, supporting new green power projects and protecting against price volatility.

However, this option requires significant up-front capital investment and places the responsibility for renewable energy system operation and maintenance on the organization. It may also not fully meet the facility’s energy demands as it is dependent on the availability of local renewable resources. Companies will also need land for such projects, which is scarce, especially for Asian and European chemical companies.

- Owned off-site generation

This option allows companies to invest in renewable projects like wind and solar farms located away from their facilities, providing access to renewable electricity without needing on-site infrastructure. It offers high visibility, potential electricity cost reductions, and flexibility in renewable energy system location and scale, while also shielding against electricity price volatility.

Similar to on-site generation, it requires substantial capital investment and maintenance. Its energy generation also depends on the availability of local renewable resources. This option is more complicated to implement compared to owned on-site generation, as the renewable system must be installed far from the powered facilities. However, this opens up possibilities of contracting with a larger pool of projects.

- On-site PPAs / operating leases

On-site PPAs or operating leases involve third-party developers who install and maintain renewable systems on the company’s property. This setup provides renewable energy benefits without upfront capital costs or maintenance responsibilities. It also offers high visibility and potential cost savings through tax incentives and competitive contracted prices.

However, these agreements typically require long-term commitments and may not fully meet the facility’s energy demand. They are dependent on local renewable resources and may not be available in all states or markets. They also offer less financial benefit compared to direct ownership of the renewable energy system, as some of the value has to be shared with project developers.

- Traditional PPA

PPAs provide a stable, long-term supply of renewable electricity from specific off-site renewable projects, often at competitive rates. Companies do not have to worry about operation and maintenance, which are covered by the provider. They encourage new green power projects and lower costs through economies of scale. Bulk electricity volumes can also be secured in a single transaction.

However, they typically require significant internal stakeholder alignment and are generally available only in certain markets, with long-term commitments required. Companies may also be subject to penalties for early termination of the contract. Companies who procure a PPA will also bear the risk if future electricity prices fall below the agreed contract prices.

- Synthetic PPA

Synthetic PPAs, or virtual PPAs, provide financial support to renewable projects by guaranteeing a floor price for electricity. They are ideal for companies with distributed electricity loads or in regulated markets and do not require physical consumption of electricity. They also offer potential revenue during high electricity prices.

However, synthetic PPAs require substantial stakeholder alignment and long-term commitment, even if the companies do not directly consume the renewable electricity. Similarly, companies may also be subject to penalties for early termination of the contract. Companies who procure a PPA will also bear the risk if future electricity prices fall below the agreed contract prices.

- Utility products / green tariffs

Utility products/green tariffs offer a simple way to procure green power through local utilities, often with a lower transaction cost and/or shorter commitment term. Companies can source renewable energy from the utility’s existing green power projects.

However, these options generally do not offer control to the company over the specific sources of the green power. Companies also do not own the renewable system. This option has an indirect impact on the development of new green power projects and does not provide protection against future increases in electricity prices. They are also not available in all markets and do not offer direct financial returns.

- Unbundled RECs

Unbundled RECs allow companies to claim the environmental benefits of renewable energy generation without directly consuming renewable electricity. They can be purchased in any market, regardless of location, and large volumes can be secured at relatively low costs.

However, unbundled RECs have an indirect impact on promoting new green power projects and offer no protection against future electricity price increases. There is no direct energy sourcing and ownership of the renewable system, and ongoing procurement is necessary to maintain the environmental benefits.

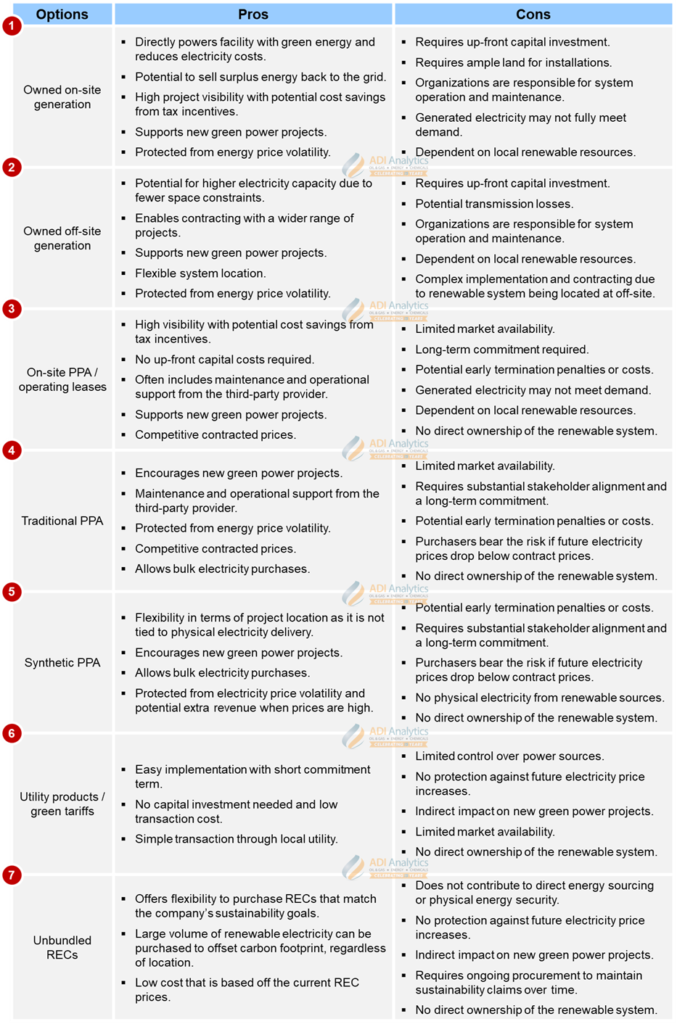

Exhibit 1 below shows a comprehensive summary of the pros and cons of the seven renewable energy options discussed above.

Exhibit 1: Pros and cons of renewable electricity options

There are several key factors a chemical company should take into account when deciding which renewable electricity option is more suitable for their needs. These includes:

- Location: The geographical location of the facility can greatly influence the availability and cost-effectiveness of renewable energy sources. For example, areas with high solar irradiance are ideal for solar panels, while windy regions are better suited for wind turbines. Local availability of renewable resources will impact the feasibility of options like owned on-site generation and on-site PPAs.

- Capital investment: The company’s financial capacity to invest in up-front capital costs is a crucial factor. Owned on-site or off-site generation requires significant initial investments, whereas options like PPAs and utility green tariffs often involve lower or no upfront costs which are more catered for companies with smaller capital or start-ups.

- Short- vs. long-term needs: Companies need to consider whether they are looking for a long-term solution or a short-term arrangement. Options like traditional and synthetic PPAs typically involve long-term commitments, while utility green tariffs and unbundled RECs can offer more flexibility for chemical companies to switch their methods of obtaining renewable electricity as needed.

- Energy demand: Companies with consistent high energy demand from energy intensive operations (e.g. ethylene cracking, ammonia synthesis, reforming) may benefit more from stable supply options like traditional or synthetic PPAs compared to on-site or off-site generation.

- Space availability: The physical space available at the chemical facility will determine the feasibility of installing on-site renewable systems such as solar panels or wind turbines. Facilities with ample space may consider owned on-site generation, while those with limited space might lean towards off-site options such as owned off-site generation, traditional or synthetic PPA, utility green tariffs, etc.

Sustainability risks of renewable energy procurement

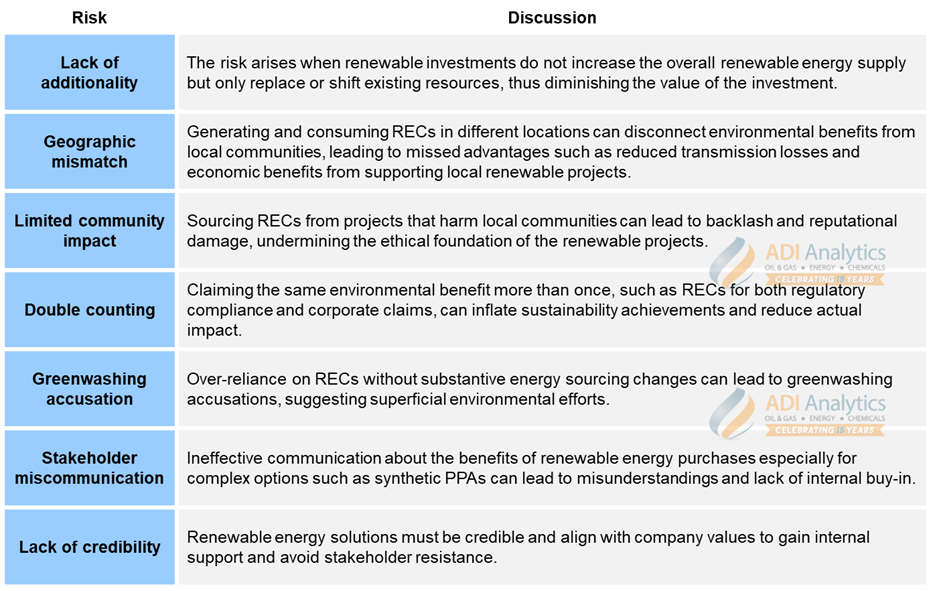

Besides that, there are several sustainability risks that a chemical company should consider when choosing renewable energy options (see Exhibit 2). One risk is a lack of additionality, which occurs when investments do not increase overall renewable capacity but merely replace existing resources, therefore diminishing the investment’s value. Geographic mismatch is a second risks that happens when RECs are generated and consumed in different locations, disconnecting environmental benefits from local communities and may cause transmission losses.

A third risk is limited community impact which can result from sourcing RECs from projects that negatively affect local communities, potentially causing backlash and reputational damage to the chemical company. Double counting is another risk that can inflate sustainability claims if the same benefits, such as RECs, are claimed multiple times.

Over-reliance on RECs without making actual energy changes presents the risk of accusations of greenwashing. Additionally, stakeholder miscommunication risk occurs if the benefits of renewable energy purchases are not clearly communicated, leading to misunderstandings and a lack of internal buy-in. Lastly, lack of credibility is a risk that can happen if the renewable energy solutions a chemical company invests in do not align with the company’s values.

Exhibit 2 below summarizes the seven sustainability risks discussed above that a company may need to consider when procuring renewable energy.

Exhibit 2: Sustainability risks associated with renewable electricity options

In conclusion, each of the seven renewable electricity options offers unique benefits, limitations, and risks. Together, they provide a comprehensive approach to reducing Scope 2 emissions not only in the chemical industry but also across other industries, including oil & gas and industrial sectors. These options range from owned on-site and off-site generation to various forms of PPAs and unbundled RECs, allowing companies to customize their renewable energy strategies according to their specific needs and resources. However, it is crucial to address sustainability risks and maintain transparency and integrity in renewable energy initiatives. Doing so will not only help companies meet their decarbonization goals but also contribute positively to the broader transition towards greener operations.

– Edmund Lam

Please contact ADI at info@adi-analytics.com if you would like to understand Scope 2 emissions across chemicals, policies and regulations on their mitigation globally, and developing business, operational, technology, and sustainability strategies including green power procurement to mitigate them.

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including green energy procurement and Scope 2 emission reduction strategies, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.