The Voluntary Carbon Market (VCM) is a dynamic space brimming with potential to combat climate change. It facilitates the trade of carbon credits, each representing one ton of verified CO2 equivalent emissions reduction. Companies and individuals can purchase these credits to offset their unavoidable emissions and contribute to climate action. However, like any nascent market, the VCM is experiencing growing pains that require attention. This blog series delves into the current challenges and explores promising developments that could usher in the next version of a more robust VCM.

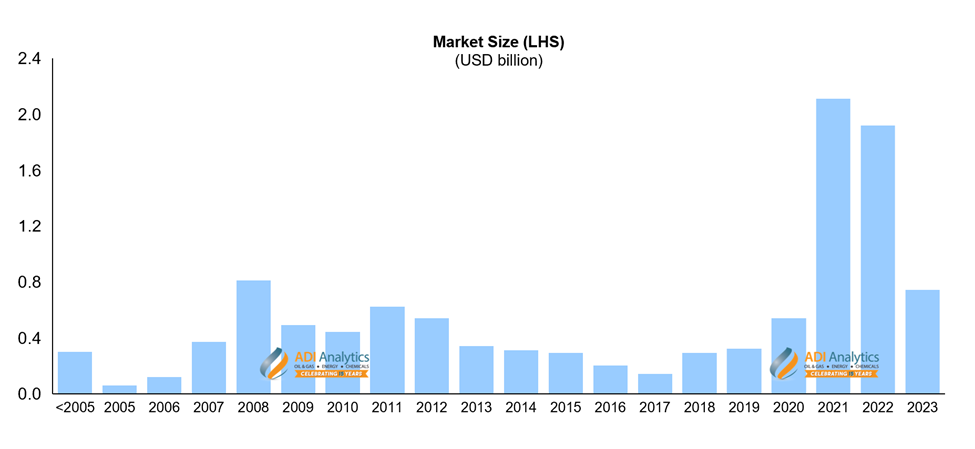

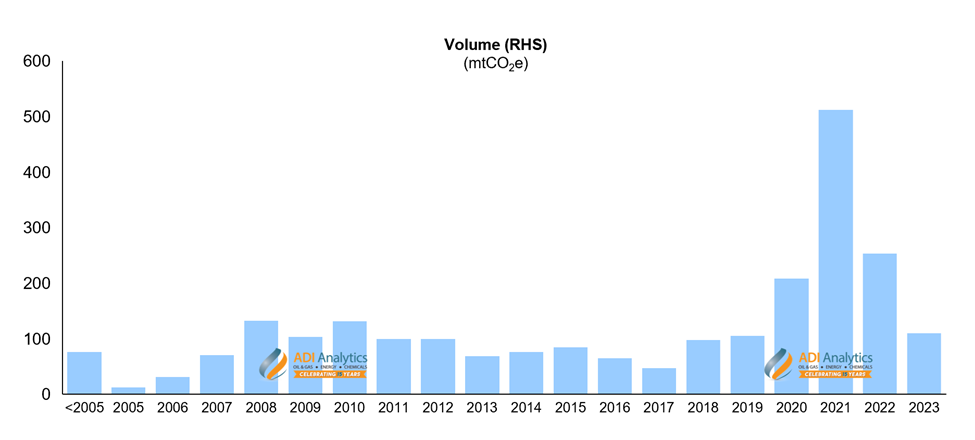

The initial years of the VCM witnessed a surge in activity, fueled by growing corporate climate commitments and increasing public awareness of climate change. Companies across various sectors actively sought to offset their carbon footprints by purchasing carbon credits. However, this initial momentum has plateaued recently, revealing some underlying issues that need to be addressed (see Exhibits 1 and 2).

One of the key challenges is market stagnation. Macroeconomic uncertainties, such as global inflation and geopolitical tensions, have created a cautious investment climate. Companies are re-evaluating their budgets and prioritizing short-term needs, leading to a decline in voluntary carbon offset purchases. Additionally, a lack of clear policy direction from governments has dampened enthusiasm. Without a strong framework outlining emissions reduction targets and the role of carbon offsets, companies are hesitant to make long-term commitments in the VCM.

Another significant hurdle is the issue of credibility concerns. The effectiveness of the VCM hinges on the quality and integrity of the carbon credits traded. However, the market has faced criticism regarding the additionality of some credits. Additionality ensures that the emissions reductions achieved wouldn’t have happened anyway without the carbon project generating the credit. Concerns exist about the rigor of verification processes for certain projects, raising questions about the actual environmental impact of the offsets being sold.

For instance, some forestry projects might involve protecting forests that were already unlikely to be cleared. In such cases, the carbon credits generated wouldn’t represent additional emissions reductions, undermining the overall effectiveness of the VCM. Additionally, the lack of standardized methodologies for project evaluation and verification creates inconsistencies across the market. This makes it difficult for buyers to assess the true environmental benefit of different carbon credits, further eroding confidence in the system. It must be emphasized that REDD+ forestry and nature-based projects suffered the most declines in volume.

Furthermore, the opaque supply side of the VCM raises concerns about “greenwashing.” Companies might use offsets as a quick fix to project a climate-conscious image while neglecting internal efforts to reduce their own emissions. The lack of transparency on the supply side can make it challenging for potential buyers to distinguish between legitimate projects with a strong environmental impact and those with questionable benefits. Difficulty in accessing clear and detailed information about offset projects discourages potential buyers from entering the market, hindering its growth.

Despite these challenges, there’s a ray of hope. The recent release of the U.S. VCM guidelines by the government offers a potential turning point. Stay tuned for Part 2, where we explore how these guidelines aim to address these concerns and promote high-integrity carbon credits.

— Uday Turaga

Please contact ADI at info@adi-analytics.com if you would like to understand how to leverage carbon markets for your energy transition and decarbonization strategies or learn more about subscribing to our multi-client study on natural climate solutions.

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in these segments including voluntary and compliance carbon markets and carbon dioxide removal, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.