The flurry of consolidation amongst operators in the shale patch that began last year is continuing in 2024 as well. Mergers and acquisitions (M&A) activity has been particularly brisk, with deals varying in size and scope. For instance, Chevron acquired PDC Energy exactly a year ago for $7.6 billion and followed up with an offer for Hess in a $53 billion deal in October. ExxonMobil made two acquisitions – Denbury Resources and Pioneer Natural Resources – as well last year albeit for different reasons.

Shale and E&P independents have also been prolific with transactions. A few examples include Chesapeake and Southwestern Energy planning to come together; Diamondback acquiring Firebird Energy and Endeavor Energy Resources; and now ConocoPhillips announcing its acquisition of Marathon Oil for $22.5 billion. What can we learn from these transactions on the future of shale in North America?

The oil & gas team at ADI Analytics sees five key implications from these transactions:

- These transactions are an implicit acceptance – even if public commentary highlights growth opportunities – that shale is maturing as ADI Analytics has discussed in recent client work, blogs, and at our annual conference, the ADI Forum. With prime acreage becoming scarce, companies are increasingly looking to M&A to access new reserves and production opportunities. Consider the following:

- Flat drilling activity: Drilling activity is substantially higher than the lows seen during the pandemic, but it’s currently in line with 2022 levels. There was an approximately 15% increase in the number of wells drilled across all basins in 2023 compared to the same period in 2021 but with no growth relative to 2022. Completions intensity also shows a similar flat trend when comparing 2023 with 2022.

- Public and private activity are both now highly elastic to oil prices: Public operators are gaining market share in the Delaware Basin and, more recently, the Midland Basin. In 2023, public operators increased their output share by 1% in the Delaware and 4% in the Midland compared to private operators since 2022. This suggests private operators are quicker to react to changes in oil prices than public operators. It was not so in the past when private players were far more aggressive with production growth as oil prices declined. This was when a large spread of premium acreage was still available for the taking.

- Well decline rates are generally increasing: The most concerning is production data. New well production decline rates remain very high. Looking at wells drilled in 2022, the best performing wells in the DJ Basin see a 52% decline in production from the end of year 1 to the end of year 2, while the worst performing wells in the Anadarko Basin see an 80% decline. However, underlying well decline rates have stabilized after a period of significant acceleration between 2014 and 2018. The average production decline rate from year 2 to year 3 across the seven major shale basins increased by 1% annually between 2017 and 2021. For comparison, the oil decline rate jumped from 42% in 2016 to 47% in 2017.

These trends are reflected in the ConocoPhillips-Marathon deal. For example, Marathon Oil’s inventory of best locations for drilling activity is limited to approximately 10 years versus almost twice for ConocoPhillips. Further, in recognition of growing investor concern on the maturity of shale, ConocoPhillips specifically pointed out that its combination with Marathon Oil offered numerous “refrac opportunities,” a well stimulation technique used to rejuvenate production from existing wells. This focus on maximizing value from existing assets reflects the reality of a maturing shale resource base.

- Although companies are spending significant sums of money in chasing M&A, shareholder returns continue their primacy on the agenda of c-suites across operators, and this is influencing how these transactions are being structured.

Despite the shift towards consolidation, the primary driver for shale operators remains shareholder returns. In an effort to rationalize its acquisition of Marathon Oil, ConocoPhillips has increased both its dividend by 34% and share buybacks by $2 billion to $7 billion annually, reflecting the company’s confidence in its ability to generate significant free cash flow. Further, this was a bow to Marathon’s investors who had benefited from a unique capital structure that prioritized dividends from operating cash flow as opposed to free cash flow.

This focus on shareholder returns is not unique. The Chevron-Hess deal, for example, was also structured to deliver significant synergies and shareholder value creation. Occidental leadership emphasized CrownRock as “a strategic fit to drive value creation for our shareholders with immediate free cash flow accretion.”

- As the number of material shale players falls, differences and distinctions between the operators will be magnified.

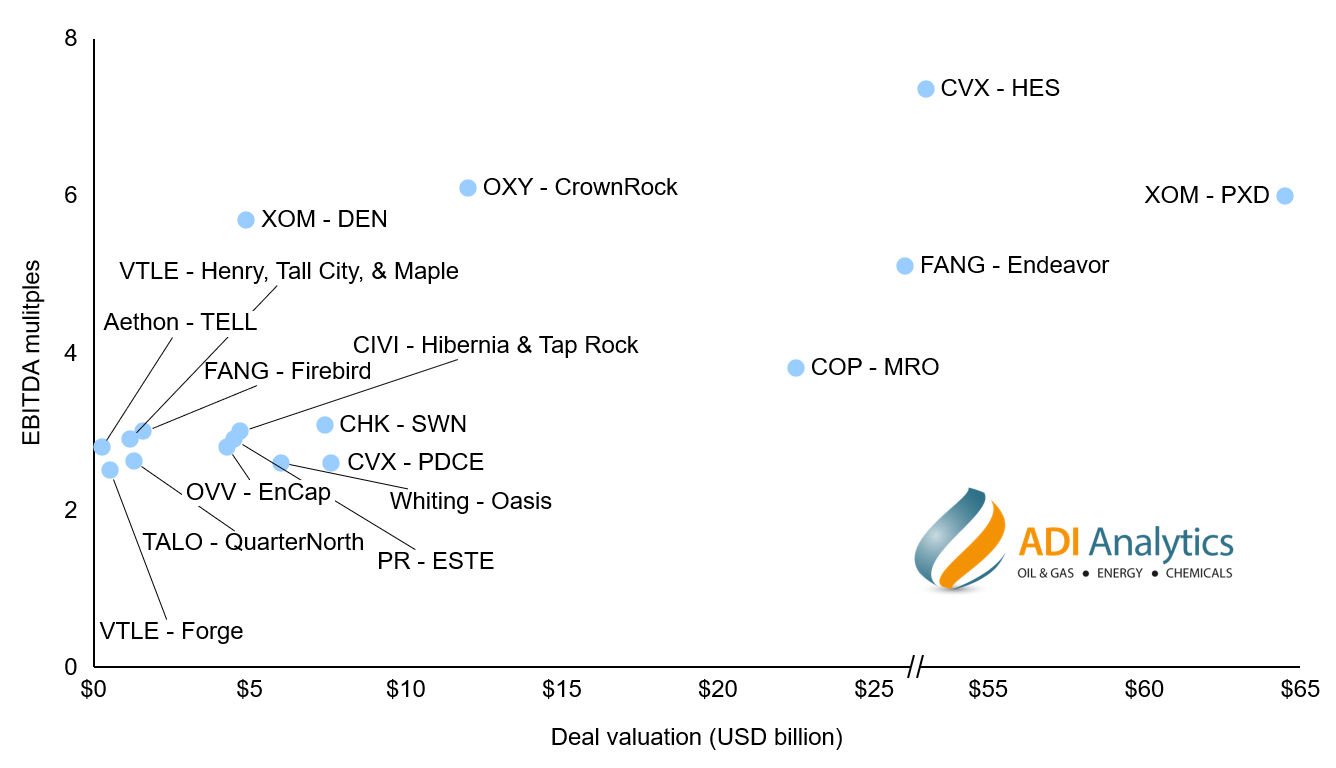

However, not all M&A deals are created equal. The valuation placed on a target company during an acquisition is heavily influenced by its perceived growth potential. ConocoPhillips valued Marathon Oil at a 3.8x of its 2024 EBITDA. This was sharply lower relative to the Oxy-CrownRock and Diamondback-Endeavor Energy deals both of which had EBITDA multiples in excess of 5.1x (see Exhibit 1). A lot of this “discount” is explained by the latter deals being for acreage in the Permian where productivity is higher versus the Eagle Ford and Bakken plays where Marathon has the most activity.

Exhibit 1. EBITDA multiples for recent M&A in oil and gas upstream

Even so, some of the discount has to be attributed to the limited growth potential, e.g., fewer years of inventory for Marathon Oil relative to that for ConocoPhillips. Conceptually, consolidation of acreage in non-Permian plays as a multi-basin consolidator could help ConocoPhillips accelerate productivity with a smaller inventory but it will attract greater scrutiny on operational excellence, capital and operating costs, and sustainability performance as investors seek to differentiate what is a shrinking set of E&P operators in the shale patch.

- Operational excellence will continue to be important but consolidation will drive renewed focus on technology and innovation where larger E&P operators will enjoy an advantage

ConocoPhillips seeks to achieve $500 million in synergies from acquiring Marathon, and 30% of these come from reductions in operating costs. Companies that can consistently deliver high production volumes at low costs will be seen as more valuable by investors. This coupled with a shrinking universe of major shale players will drive a premium on operational excellence.

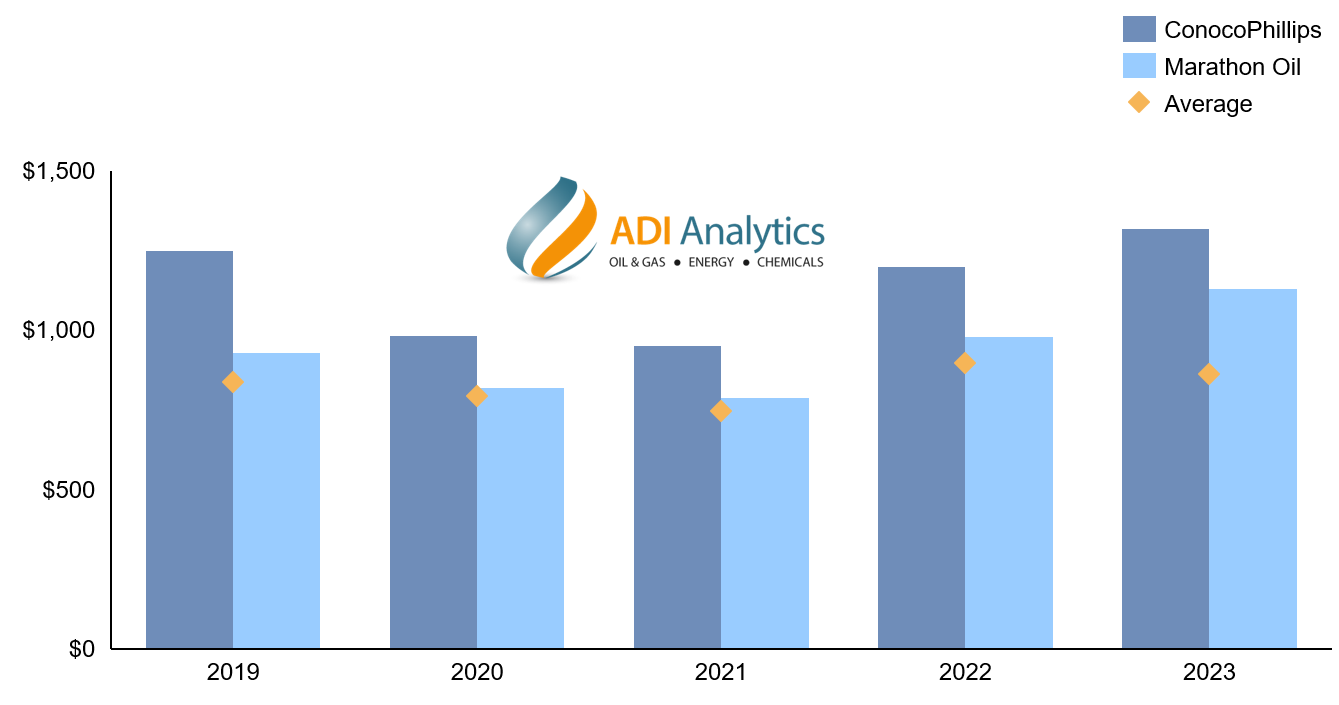

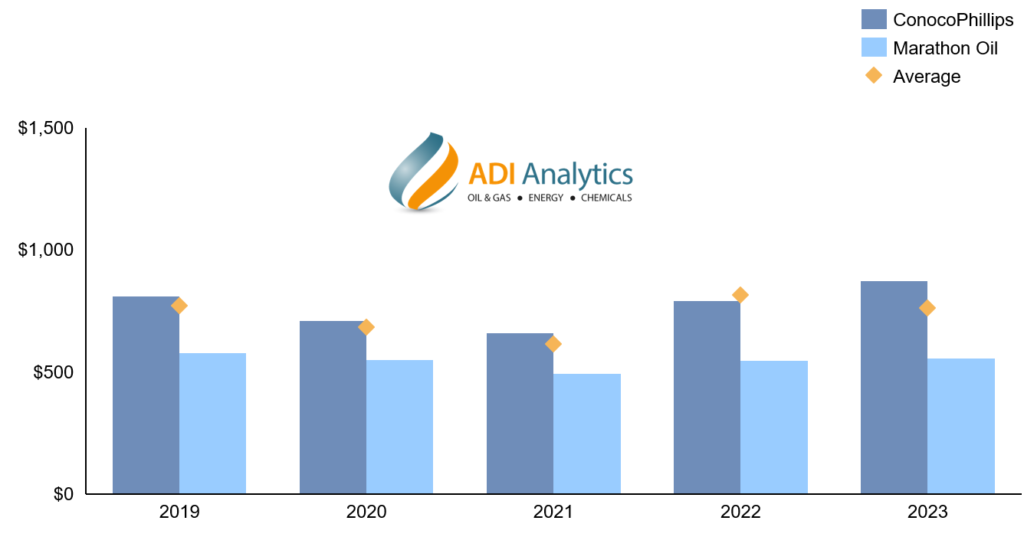

Achieving that operational excellence will not be easy as a lot of low-hanging fruit has been picked. For example, drilling and completion (D&C) costs for Marathon Oil are already lower than those at ConocoPhillips in key plays (see Exhibits 2.1 and 2.2). However, ConocoPhillips has shown higher well productivity than Marathon Oil suggesting that further reductions in opex may come at significant productivity reductions.

Exhibit 2.1. D&C cost per foot by operators in Eagle Ford

Exhibit 2.2. D&C cost per foot by operators in Bakken

Therefore, ADI anticipates a slow but growing focus on investments in technology and innovation, for example in exploration. Examples of operators renowned for their efforts in this area include EOG Resources and ConocoPhillips themselves. These companies have a proven track record of utilizing technology and innovative drilling techniques to maximize efficiency and well performance.

EOG has claimed frequently that its commitment to seismic exploration has allowed it to develop new plays such as Dorado in south Texas that offer significant gas production growth at a much smaller cost relative to its peers. We anticipate that consolidation – especially led by larger E&P operators such as ExxonMobil, Chevron, and ConocoPhillips – will lead to operational excellence but also technology and innovation that goes beyond incremental operational improvements.

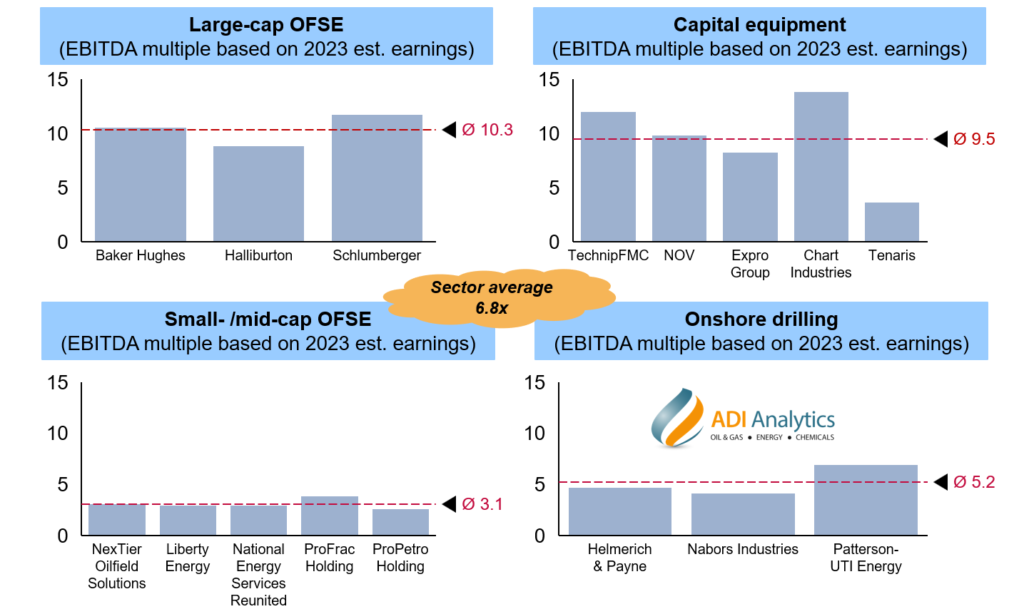

- Consolidation will squeeze the oilfield services sector

The increasing consolidation among oil and gas operators will have a ripple effect across the industry. One sector likely to feel the squeeze is the highly fragmented oilfield services and equipment (OFSE) sector. With a plethora of OFSE companies vying for a shrinking pool of E&P operators, competition in the OFSE space is fierce. There are over 15,000 OFSE companies operating in the U.S. alone. This fragmentation leads to price wars and erodes margins and eventually valuations for service providers (see Exhibit 3).

Exhibit 3. EBITDA multiples for OFSE companies

With fewer operators controlling a larger share of production, OFSE companies can expect increased pressure on pricing. The only way for these companies to survive and thrive in this new environment is through consolidation and a renewed focus on innovation. By merging to gain scale and developing cutting-edge technologies that deliver greater hydrocarbon recovery and capex and opex efficiency for operators, the OFSE sector can adapt to the changing landscape.

The road ahead

The consolidation wave sweeping across the shale industry is reshaping the competitive landscape. With a focus on maximizing shareholder returns, optimizing existing assets, and achieving operational excellence, the future of oil and gas will be defined by efficiency and innovation. As consolidation continues, the pressure on the OFSE sector to adapt and evolve will become even more pronounced. Only those companies that can embrace change and deliver value to the increasingly concentrated group of shale giants will survive and prosper in the years to come.

– Uday Turaga, Bhautik Gajera, Panuswee Dwivedi, and Maria Lopes

If you are interested in the U.S. E&P M&A Outlook and obtaining a detailed analysis of the implications of consolidation in the shale patch, please contact us at info@adi-analytics.com.

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, power, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including upstream oil and gas where we support Fortune 500, mid-sized, and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.