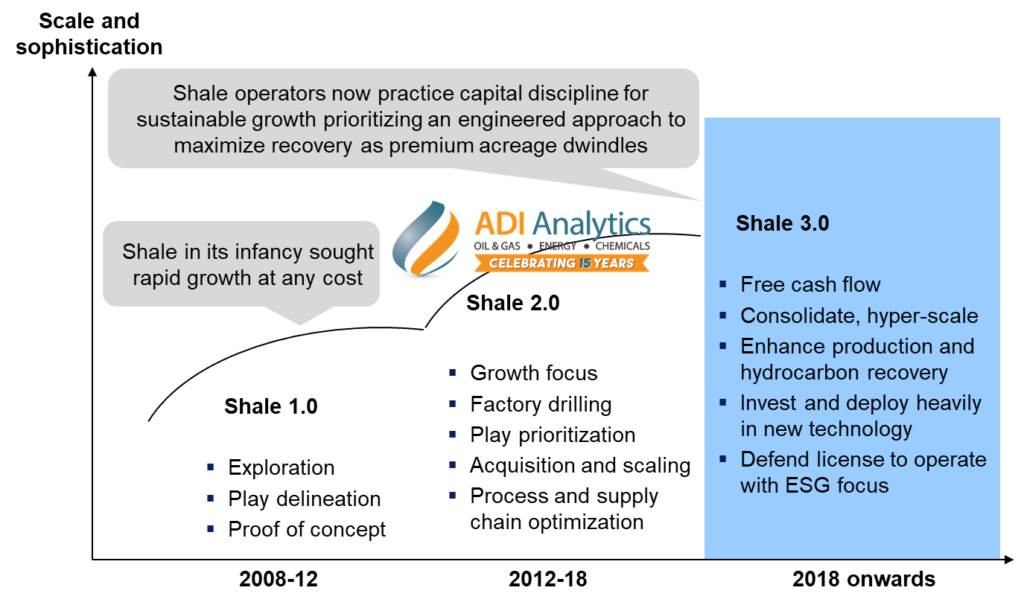

Shale operators are in the midst of a remarkable transformation. Moving away from the era of rapid expansion at any cost, the industry is now embracing Shale 3.0 – a phase characterized by strategic growth and sustainability. This shift places a strong emphasis on capital discipline, innovation and engineered approaches, and a heightened focus on environmental, social, and governance (ESG) factors. Exhibit 1 summarizes the key features of Shale 3.0 and delineates its differences compared to earlier cycles in the lifespan of North American unconventional resources.

Exhibit 1: Evolution of the U.S. onshore oil and gas industry.

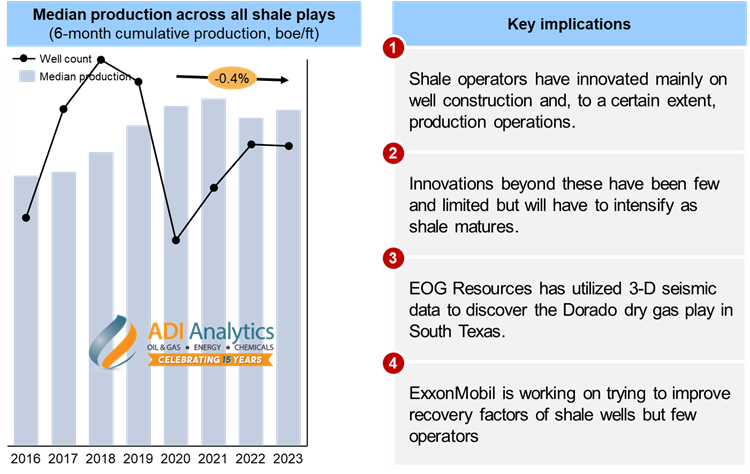

Shale 3.0 is further influenced by maturating shale plays, leading to stagnant or declining well productivity, which is illustrated in Exhibit 2. The chart on the left shows that, over recent years, the 6-month cumulative oil and gas production from shale reservoirs has stagnated or declined modestly. As we navigate this phase, operators have pivoted towards innovation, particularly in well construction and oil and gas production operations. However, these evolving challenges call for operators to demonstrate an intensified focus on innovation and engineered solutions.

Exhibit 2: Median production across all shale plays and key implications.

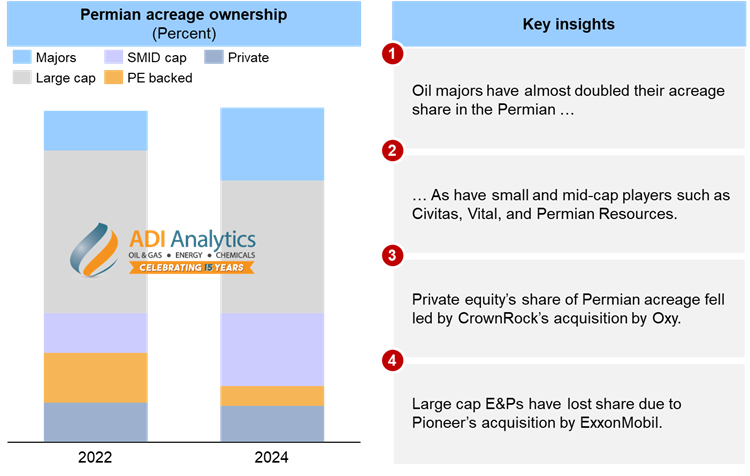

The Permian basin serves as a vivid illustration of the dynamics of Shale 3.0, with a shift in acreage ownership that is decreasing the influence of private equity capital, as illustrated in Exhibit 3. Oil majors and smaller players like Civitas, Vital, and Permian Resources, have expanded their presence in the Permian. Meanwhile, the share of Permian acreage under private equity firms has dwindled, propelled by Oxy’s strategic acquisition of CrownRock. Large-cap exploration and production companies are also not immune to this evolution, resulting in a reduction of their share, accentuated by ExxonMobil’s acquisition of Pioneer. More recently, Diamondback Energy has announced its intention to acquire Endeavor Energy Partners in a substantial cash-and-stock deal valued at approximately $26 billion, including debt. Oil and gas producers are strategically leveraging their high stock prices to secure lower-cost reserves in preparation for the anticipated slowdown in shale growth that is likely to drive more deals.

Exhibit 3: Permian acreage ownership and key implications.

ADI anticipates ongoing shifts in the shale landscape, particularly driven by mergers and acquisitions aimed at securing premium acreage access, achieving economies of scale, improving shareholder returns, and enhancing sustainability. These drivers are expected to persist in shaping the industry’s direction, compelling operators to adapt by embracing innovation, consolidation, and creativity around both corporate and operational strategy.

-Maria Lopes

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including shale landscape, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.