As renewable energy capacity addition accelerates, the renewable energy credit (RECs) can play an important role. But what exactly is an REC and how does it work?

RECs are tradable, non-tangible commodities or digital certificates that demonstrate that one megawatt-hour (MWh) of electricity was generated from a renewable energy resource and then delivered to the electricity grid. RECs, also known as renewable energy certificates or alternative energy credits (AECs) are basically an important currency in renewable energy markets.

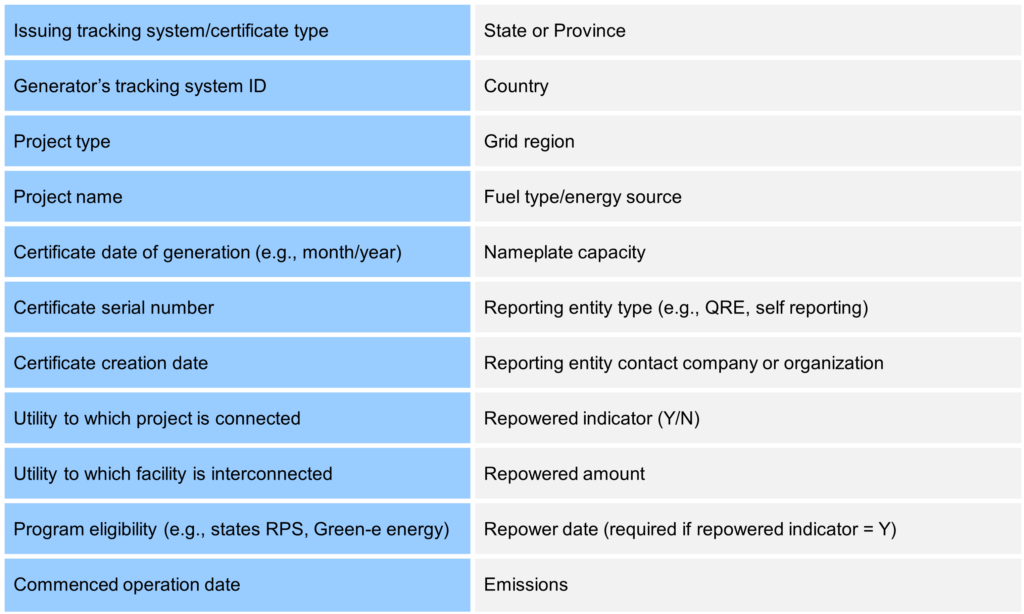

Every renewable energy credit has a unique number and typically includes details like where it was produced, what kind of renewable resource it came from, and the date it was produced. An REC that has been sold once cannot be purchased again. Additionally, the exchange of all RECs is tracked and recorded. A REC has a three-year life during which it may be transferred or sold. In other words, a REC may be used for compliance during the year of generation and the following two calendar years, but it must be retired after that.

Exhibit 1: Typical REC certificate data

RECs play an important role in accounting, tracking, and assigning ownership to renewable electricity generation and its use. RECs are the instruments that electricity consumers use to substantiate renewable electricity use claims on a shared grid where electricity is being transmitted from different resources. Electricity consumers can benefit from RECs as they lower the cost of renewable energy use, as well as substantiating renewable energy use and carbon footprint reduction claims.

Types of RECs

RECs can be classified based on the way they are sold or by type of energy source. RECs can also be classified as Tier-1 and Tier-2 by Renewable Portfolio Standards that slightly varied from state to state. We briefly discuss these types here:

- Bundled RECs

An REC is referred to as being “bundled” when it is sold through a power purchase agreement along with the energy it is associated with. Bundled RECs are generally generated from new renewable energy projects since developers must demonstrate secured revenue streams for the anticipated energy to receive financing for the project. Lately, several organizations prefer to buy bundled RECs since they can make “additionality” claims and receive tax incentives from the government. Additionality means that new renewable energy would not have been financed, developed, or added to the national grid without a green power purchase or investment.

Making a purchase with a claim to additionality appeals to many commercial buyers who want to differentiate themselves from competition by committing to renewable energy or carbon reduction. They also show the investors and stakeholders that the company’s investment directly enabled a new project to be built adding new, low-cost renewable energy to the grid that displaced more emission intensive fossil fuel-based energy.

- Unbundled RECs

An REC is referred to as being “unbundled” when it is sold separately from the underlying energy. Since unbundled RECs aren’t tied to their underlying unit of power therefore buyers can’t make “additionality” claims. Unbundled RECs can be sourced from a single type of energy resource such solar, wind, hydro, etc., and are offered across the country. Because unbundled RECs are much cheaper than bundled RECs, they provide many organizations with a flexible and affordable way to support clean energy development and still meet their sustainability objectives.

While companies can still purchase unbundled RECs to achieve sustainability goals, they do not have any real environmental impact because they do not result in the generation of new renewable energy and instead represent a re-shuffling of the existing renewable energy supply in the market.

- Tier 1 RECs

Tier 1 RECS generally include solar photovoltaic (PV), solar thermal energy, wind power, low-impact hydropower geothermal energy, biologically derived methane gas, fuel cells, biomass energy, and coal mine methane.

- Tier 2 RECs

Tier 2 RECs generally include waste coal, distributed generation systems, large-scale hydropower, municipal solid waste, integrated combined coal gasification technology, generation of electricity utilizing by-products of the pulping process and wood manufacturing process, integrated combined coal gasification technology.

- Solar RECs (SREC)

Renewable Portfolio Standards (RPS) are state regulations that vary by state and require a certain percentage of the electricity sold by utilities come from renewable resources. In some states, the Renewable Portfolio Standard (RPS) requires electricity suppliers to secure a portion of their electricity from solar generators which is called solar carve out or SREC program. The SREC program provides a means for Solar Renewable Energy Certificates (SRECs) to be created for every megawatt-hour of solar electricity created. As of now, major states with a solar carve-out and SREC market includes Maryland, Delaware, and Washington DC.

Customers

There is no single market for RECs. There are multiple fragmented markets with widely varying prices. In the renewable energy market, there are two major types of buyers for RECs:

- Compliance buyers

Compliance buyers are utilities or electric suppliers required by state regulations to generate or sell a certain percentage of their electricity from renewable sources. Under these laws, utilities must provide renewable credits as proof that they are sourcing a set amount of their electricity from renewable resources. These buyers meet the RPS requirements by purchasing RECs or generating them through their own renewable energy projects.

- Voluntary buyers

Voluntary REC purchasers are environmentally conscious businesses or individuals looking to reduce their carbon footprint or greenhouse gas emissions. These buyers purchase RECs to offset carbon emissions associated with their purchased electricity or to meet renewable energy commitments. Some existing voluntary buyers of RECs include Fortune 500 companies such as Meta, Microsoft, UBS, Starbucks, Apple, and Google.

Several companies have ambitious environmental goals that are now more incentivized because of the Inflation Reduction Act. This results in a new group of emerging voluntary RECs buyers. Furthermore, as more states implement RPS, the number of new compliance buyers seem to grow significantly, a trend which is predicted to continue in the coming years.

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including energy compliance, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.

– Umair Hammad