Demand for lithium from the EV industry is growing rapidly as the energy transition moves forward. One of the interesting things for the U.S., is that the production of EV batteries for this industry is being onshored, partly due to the growing market and partly due to provisions of the recently enacted IRA place sourcing requirements for EV components and critical minerals. However, one challenge the U.S. faces is supplying lithium for this growing battery market. The U.S. Department of Energy is working towards advancing lithium production and new chemistries may affect some lithium usage, but lithium remains a highly desired commodity in the U.S. and abroad.

Growing demand

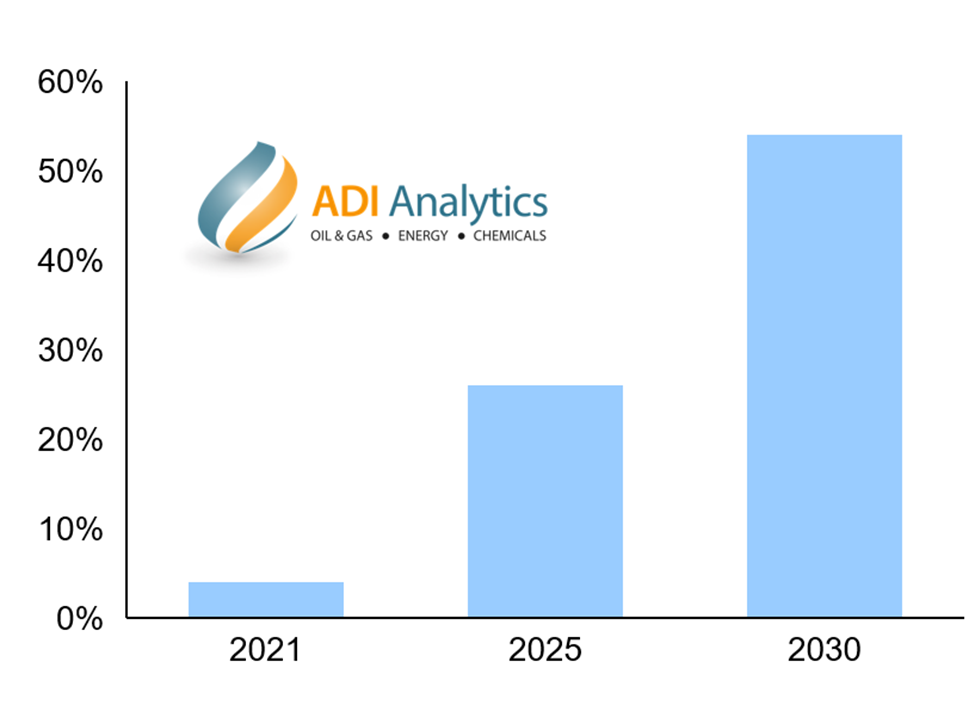

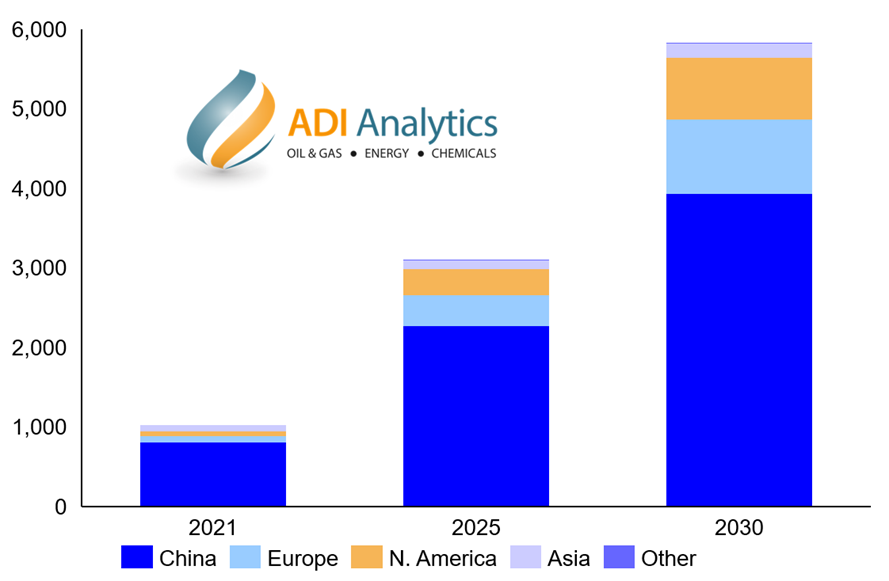

The demand for batteries continues to grow throughout the world, largely due to the booming EV industry (Figure 1). In 2021, LIBs comprised approximately 40% of the battery market and is expected to grow to 63% of the market by 2030. Over the same time, Figure 2 shows that market penetration for EVs in the U.S. is expected to grow from 4% to 54%, driving up demand for lithium-ion batteries.

Figure 2: U.S. EV market penetration (Source: JP Morgan, ADI Analytics)

Battery manufacturing capacity is projected to keep up with this growing demand (Figure 3) with a number of gigafactories being planned throughout the U.S. and North America. This growth in U.S. manufacturing is in part driven by recent legislation. The Infrastructure Investments and Jobs Act allocated $7 billion to strengthen the U.S. battery supply chain, and the Inflation Reduction Act revamped the EV tax credit but put restriction on the sourcing of components and critical minerals. As a result of this growth, U.S. battery manufacturing capacity is expanding rapidly and the market share is expected to double by 2030.

Lithium supplies

Sourcing the lithium necessary to supply this growing industry could be challenging. Currently the U.S. has only one active lithium mine, Albermarle’s Silver Peak site, a brine operation that produces 900 tonnes of lithium each year (Figure 4). The Thacker Pass Project in Nevada, operated by Lithium Americas Corp., is the next likely project to come online. The project recently received all required permits and broke ground. The site has 3.7 million tonnes of lithium carbonate equivalent (LCE) reserves with a planned annual production capacity of 80,000 tonnes (40,000 tpa in Phase 1), and first production is targeted for 2026.

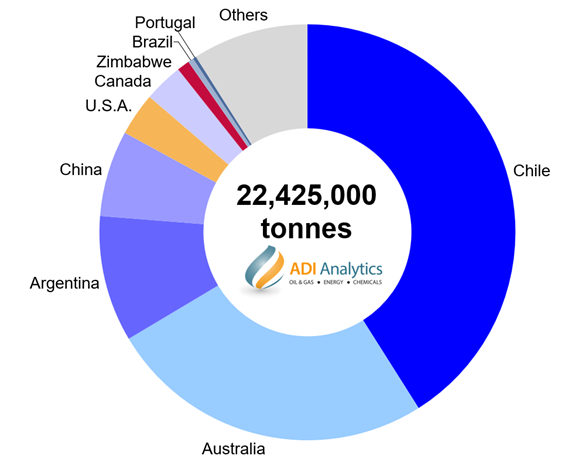

Based on the growth rates in the battery market, the U.S. could need ~30,000 tonnes of lithium annually by 2025, although some estimate demand could be as high as 75,000 tonnes annually. This lithium could theoretically be supplied from domestic reserves as the U.S. is home to some of the largest lithium reserves in the world (Figure 5). With 750,000 tonnes of reserves, the U.S. has ~3% of the world’s lithium reserves and is the world’s fifth largest holder of lithium. These reserves keep growing, as in 2018, the U.S. only had 30,000 tonnes of reserves. Outside of Nevada, other reserves and projects are in various stages of development in Maine, North Carolina, and California.

Figure 5: World reserves of lithium in 2021 (Source: Natural Resources Canada, ADI Analytics)

Barriers to growth

There are several challenges to bringing new lithium sources online, particularly in the U.S. Although there are several projects in various developmental stages, many are years away from production, and the overall process is very time consuming. It can take 4 to 10+ years to bring a project online. The majority of this time is often spent on permitting and delays from environmental lawsuits.

Another challenge is the low average lithium concentration in U.S. sources, which make them more complicated and costly compared to other sources around the world. The concentration of lithium in brines is lower than that in the Salar de Atacarma and other brines produced in Chile. Likewise, known U.S. clay deposits contain less lithium than the hard rock deposits being produced in Australia. Geothermal brines host a whole other set of complications due to the host of other associated minerals, including toxic ones. However, these challenges do present opportunities to the companies that can innovate and find a way to optimize their production.

Summary The U.S. faces several challenges supplying lithium for its growing EV battery industry. Currently, there is very limited domestic supply, and additional supplies are not due to come online for years. Improving the permitting bottlenecks would go a long way to advancing these industries; however, additional advances are needed improve the efficiency of recovering low concentration lithium deposits.

ADI Analytics has performed numerous projects helping clients in the energy transition, metals and mining, and battery space. Contact us to learn more.

Dustin Stolz