Oil and gas prices were relatively high in 2022, although they have come down significantly from their highs reached last summer. Despite the drop, oil prices have remained higher than what we have seen for the last seven years, and natural gas was at level not seen in over a decade. Even with these prices, exploration activities have remained subdued as energy companies remain weary of political and pricing volatility and instead focus on short cycle projects and returning cash to shareholders. Global lease rounds in 2022 were at the lowest level since 2000, with only 44 expected, and acreage awards are also at a 20 year low.

Lease rounds have dropped significantly in Russia, the U.S., and Australia, while new acreage awarded in Asia has nearly quadrupled compared to the same period in 2021. The largest contributor of lease blocks awarded this year is Brazil (59) followed by Norway (54), India (29), and Kazakhstan (11).

High-impact drilling

Despite all this news, high-impact well activity is rebounding from a 2021 low and there remain some hot areas for exploration with several significant discoveries being made in 2022:

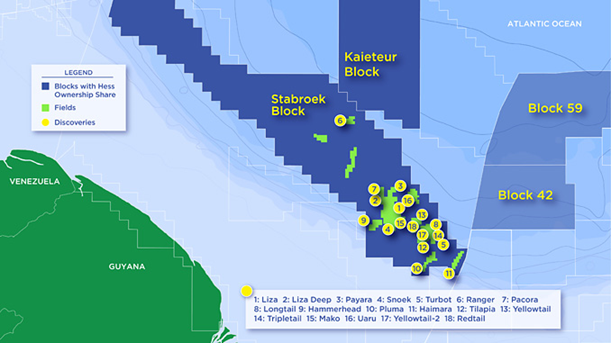

- Guyana – The Guyana-Suriname basin remains one of the hottest areas of exploration. Guyana is considered the most significant new deepwater producer and will be producing more than 1 MMBOEPD in the near future. A group led by ExxonMobil has already made a number of discoveries (Exhibit 1) on the Stabroek block with recoverable reserves totaling 11 billion barrels of recoverable oil and 30 TCF of gas. Guyana is planning on auctioning off an additional 14 blocks. Much of the reserves found to date have been in Upper Cretaceous turbidite sands, similar to west Africa. Interestingly, ExxonMobil also discovered oil in what is interpreted to be a carbonate bank formed on a sinking volcano.

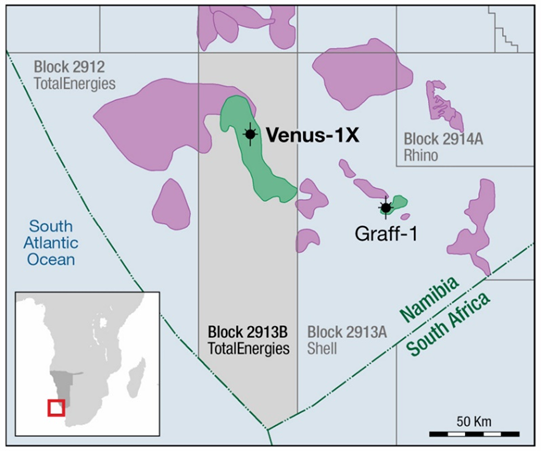

- Namibia – In what is being referred to by some as “the next Guyana”, two recent discoveries earlier this year have propelled Namibia’s Orange Basin into the spotlight. TotalEnergies’ Venus discovery is considered Sub-Saharan Africa’s biggest ever oil find with more than 3 billion barrels of reserves. Twenty days before the Venus discovery, Shell’s Graff-1 well made an oil discovery in Cretaceous sands believed have ~300 MMBOE of reserves. It has been reported that a Suriname-Guyana scale oil province is possible, and the discoveries could also be significant for South Africa, where the Orange Basin extends.

- UAE – Another high-impact discovery in 2022 includes the XF-002 well operated by Eni. The XF-002 marks the first exploration well for Eni in their Abu Dhabi Offshore Block 2. In February 2022, a gas discovery from a shallower reservoir was announced in the area, and the XF-002 encountered a new, deeper reservoir. Total gas in place for this well is estimated at 2.5-3.5 TCF, and the reservoirs were reported to test with high flow rates.

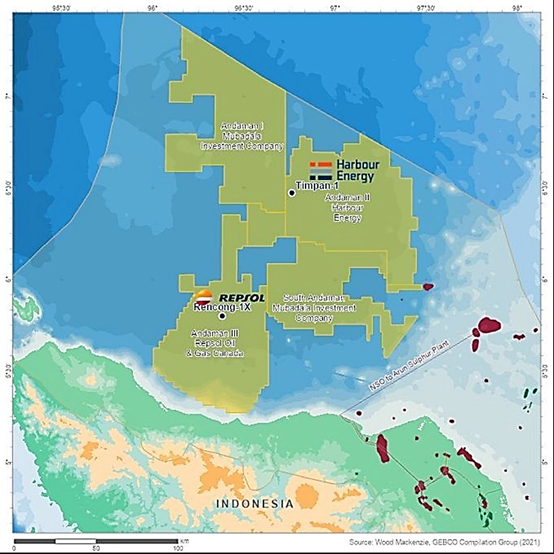

- Indonesia – Indonesia remains an area of active exploration with frontier exploration in the deepwater Andaman Sea. Until 2022, no commercial discoveries had been made in the deeper parts of the basin, which remains relatively undrilled. Two high-impact wells were drilled there this in 2022 (Exhibit 3). Harbour Energy drilled the Timpan-1, which encountered a 390-foot gas column and upon testing, the well flowed 27 MMSCFD and 1,884 bopd of 58° API condensate through a 56/64 inch choke. Although significant reserves were found, the rock was lower quality than expected and the commercial potential of the accumulation is still being evaluated. Harbour’s initial success is reviving interest in the area. In July 2022, Repsol spud its highly anticipated Repong 1X, which was originally scheduled to be drilled in 2019. Results for this well have been reported as disappointing, and Repsol is not committed to drilling their second exploration well.

Emerging areas of exploration?

Beyond these specific discoveries, the recent energy crisis is spurring changes in policies and more aggressive lease auctions throughout the world. These changes along with other political pressures could yield new exploration activity in the near future.

- India – In an effort to ramp up hydrocarbon exploration and bring the experience of global companies to develop their resources, India is increasing their lease block offerings, with 42 blocks for exploration offered in their latest licensing round. Of these, 26 are for oil and gas and 16 for coal bed methane. Of the oil and gas blocks, 15 are ultra-deepwater blocks, 8 are shallow water, and 3 are onshore; they cover an area of more than 86,000 square miles. Interest so far has been reported as tepid; nevertheless, these areas could lead exploration activity.

- U.K. – In response to the energy crisis in Europe, the U.K. lifted its ban on hydraulic fracturing in September. While this could spark new activity in the U.K. for developing shale gas, the proposed measure requires “local support” that could hinder this activity. Additionally, the U.K. announced in October that they will be auctioning off potentially more than 100 blocks of the North Sea off the cost of Yorkshire, Lincolnshire, and Norfolk. The U.K. is prioritizing blocks near existing infrastructure and production to promote quick development of assets.

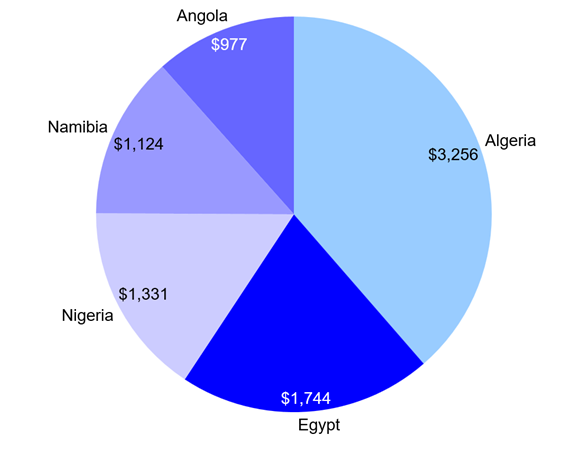

- Africa – Beyond Namibia, Africa remains a significant area for oil and gas exploration. CAPEX for exploration in Africa increased from $3.4 billion in 2020 to $5.1 billion in 2022, per a report by Urgewald. The majority of exploration dollars in the last three years has been spent in Algeria, followed by Egypt, and Nigeria. (Exhibit 4). There is a push by some for Europe to lean more heavily into Africa’s natural resources to offset their reliance on Russian natural gas; however, most of Africa’s natural gas resources are located south of the Sahara, and largely stranded from infrastructure connected to Europe. Time will tell whether those initiatives gain any traction.

(USD Millions) – Source: Urgewald; ADI Analytics

Summary

Volatile oil prices and political environments tend to hinder oil and gas exploration. Nevertheless, the world has a clear and growing need for energy. Oil and gas remain a necessity, even as the energy transition moves forward. If we are not careful, the lack of sound and stable energy policy and low interest in exploration will lead to even higher oil prices and energy crises in the future.

ADI monitors the oil & gas and energy markets and is tracking policies and activities around the globe. Reach out to us to learn more.

– Dustin Stolz