The global bioplastic market size was about $5.5 billion in 2021 with strong growth projected in the future. In fact, about 2.5 million tons of bioplastics were made last year with production forecasted to increase to about 7.5 million tons in 2026. With companies increasingly focused on ESG and growing acceptance of bioplastics among consumers, the future looks bright for bioplastics.

What are bioplastics?

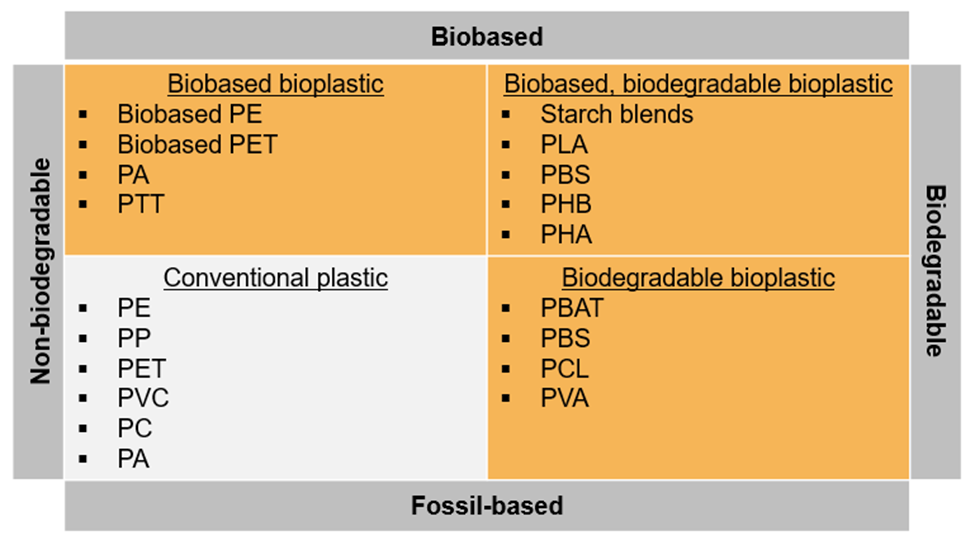

Bioplastics can be confusing to people because they don’t know how to define them. There are two key dimensions: origin and biodegradability. Bioplastics are either made from a renewable resource, are completely biodegradable, or both – only 40% of bioplastics meet both conditions. So, a petroleum-based plastic like PBAT (polybutylene adipate terephthalate) that is completely biodegradable is considered a bioplastic. Exhibit 1 categorizes various plastics by these two criteria.

Bioplastic markets

Polylactic acid (PLA) is the oldest and best-known bioplastic, so much of this discussion will focus on it. In recent years, PLA demand has outstripped supply. There was concern that demand would drop during the pandemic; however, demand increased due to demand for PLA-based items like food takeout containers and face masks. New capacity is not anticipated to come online until 2024, and it should double from around 400,000 metric tons today to about 800,000 tons in 2026.

There are two primary producers of PLA. The oldest is NatureWorks, which has made PLA for over 30 years, and the other is Total-Corbion, which has been making it for less than a decade. There are numerous companies that would like to make PLA, but they lack the technology or expertise to do so. The companies with the expertise are not licensing their technology.

NatureWorks is based out of Nebraska and is in one of the best positions to make PLA. They are co-owned by Cargill and co-located next to a Cargill owned corn milling facility. Additionally, there are several downstream businesses in the area, allowing them to share infrastructure, manage risk, and get credit for co-products that have nothing to do with PLA. This location and their years of experience developing the complex PLA manufacturing process gives them a significant advantage. Total-Corbion is based out of Thailand, and does not have a biorefinery, but is located at one of the largest, if not the largest lactic acid plants in the world.

There are also a lot of bioplastics blended with PLA. Total-Corbian has an agreement with Danimer Scientific to work on PLA-PHA blends, and NatureWorks has done the same with CJ Bio. BASF markets their Ecovio products, which are 50% PDAP and 50% PLA, with most of the PLA coming form NatureWorks. There are also new PLA players emerging with ADM and LG Chem coming together to build a new facility in the U.S.

There are companies working on products beyond PLA. Avantium is working to scale up their PEF technology. It is expected that once the technology is commercialized, beverage manufactures will probably use it for bottled beverages. There is also growing interest in biobased PBS. LCY Biosciences purchased bankrupt BioAmber in Canada and are now making 20,000 tons of biobased PBS. Capacity for PBAT has ramped up in China over the last few years, with numerous players there growing the market.

Summary

One thing is for certain, and that is that the bioplastics market is growing. This includes new manufacturers as well as new end users. As this ecosystem grows, market activity and advancements will speed rapidly. And as more players enter the market, market adoption will also accelerate. The limited availability of PLA, in terms of both supply and manufacturing locales, presents risk to end users, and until that capacity gets expanded, the market will be slow to adapt.

ADI Analytics helps clients in the chemical, petrochemical, and plastics industry with market research and strategic planning. Contact us to learn more.

Dustin Stolz