Coal is one of the oldest sources of energy. Originally, coal was used as a source of heat dating back to pre-historic eras. In the 1800s, coal was used to power steam engines making it the leader of large-scale energy creation. Over time, coal usage has begun to decline due to its high life cycle emissions. However, as this industry currently provides over 4,000 mining jobs in the U.S., many efforts are underway for solutions to keep coal a relevant commodity. As the global energy industry moves into a more ESG-focused era, clean coal and alternative coal uses continued to be pursued with varying impacts.

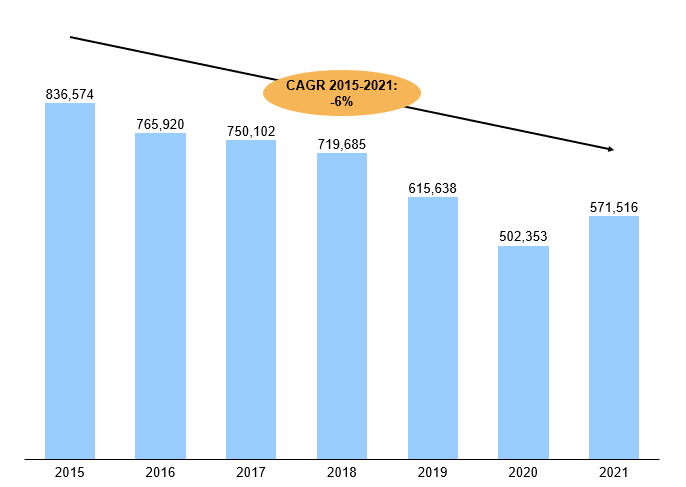

As the world continues to clean up its energy supply, many countries are making efforts to move away from coal altogether. Because of this, demand for coal is continuing to fall. In the US, consumption of coal has been falling at a rate of 6% per year since 2015 as seen in Exhibit 1. Much of this is due to the growing interest in using renewable energy as a power source. Between 2021 and 2023, renewable energy is expected to grow another 3% in the energy mix for U.S. power generation. As natural gas is expected to remain steady in the mix, this loss will come from coal power. This shift can already be observed in the major retirement of US coal power plants. Even in 2021, a year where coal production increased, 4.6 GW of coal capacity was shut down. With more closures on the horizon, many are scrambling to find a fit for coal in this new world.

Exhibit 1: US coal consumption in thousand short tons

Clean coal has been proposed in the past and comprises several technologies. One is by using limestone-based scrubbers to remove sulfur gasses from the flue gas output of coal-powered generation. There is also the idea of gasifying coal before it is burned. This process allows energy producers to remove many of the pollutants that are contained in flue gas before the coal is even used. Both solutions would heavily remove the sulfur output, but CO2 output reduction is challenging. For this, many have turned to the idea of using CCS and CCUS technologies at coal power plants to remove the CO2 emissions from the process. Not only does the inclusion of carbon capture technologies help clean up the industry’s image, but it also opens the door for tax credit opportunities with the 45Q Tax Credit.

The 45Q Tax Credit is a U.S. Tax Credit that provides tax cut options for CCS and CCUS projects. The Credit works on a per ton captured basis, and in 2026 it will credit the capturer $50 per ton of CO2 captured for CCS and $35 per ton of CO2 captured for CCUS. Any project that comes online before January 1st, 2026, will be eligible to receive the credit for 12 years.

Even with the addition of capture technologies to clean up coal’s emissions, though, the power mix is still moving toward renewable energy. Therefore, if the coal industry is to survive in the long-term, there must be new solutions for using coal as a commodity outside of power generation. One idea is the use of coal as a feedstock for synthetic fuel production. This would allow an extension of coals’ life as an energy transition source to a fully renewably powered world. Another option is in coals’ use as a feedstock for chemical production. The gasification process for coal has byproducts such as xylene, benzene, cresol, and other products. The syngas can also be reformed to produce hydrogen. Finally, coal is being studied for its potential as a component in construction materials like bricks and cement. This new technology could potentially lower emissions or even make stronger and lighter versions of current products as studies are beginning to show.

Despite all the drop offs from coal power we are seeing, coal will have a future in some capacity in the U.S. While it will likely be scaled back, the technology for clean coal allows it to be potentially used as an energy transition material as other uses are continuing to be discovered. With the emergence of coal as a construction material, there may still be a future for one of the world’s oldest energy commodities.

If you are interested in learning more about emerging markets driven by the energy transition, such as the coal market, please contact us at ADI Analytics which has been researching and consulting in these areas for a wide range of clients.

-Thomas Dennis