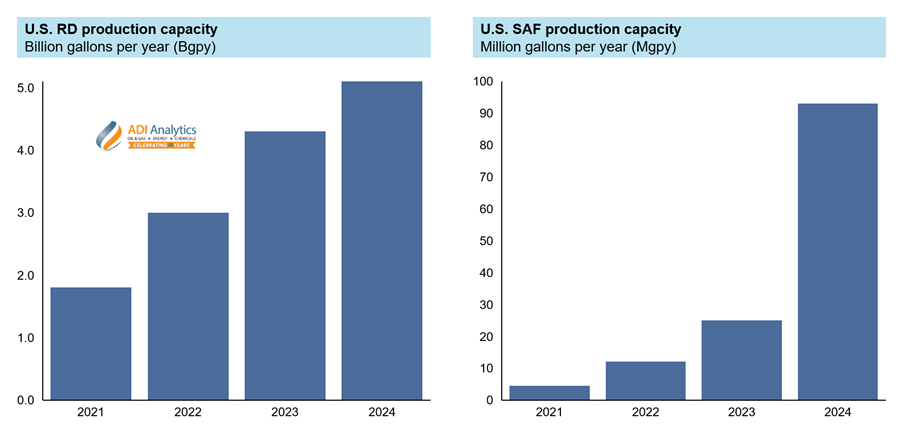

The U.S. biofuels industry has experienced rapid growth in renewable diesel (RD) production since 2021, while SAF production has also accelerated, with capacity nearly tripling between 2023 and 2024 as new facilities came online. The surge in RD and SAF capacity (see Exhibit 1) was driven primarily by policies such as the Blender’s Tax Credit (BTC) and California’s Low-Carbon Fuel Standard (LCFS). These policies provided strong financial incentives through tax credits for lowering carbon intensity (CI).

Exhibit 1: U.S. SAF and RD production capacity

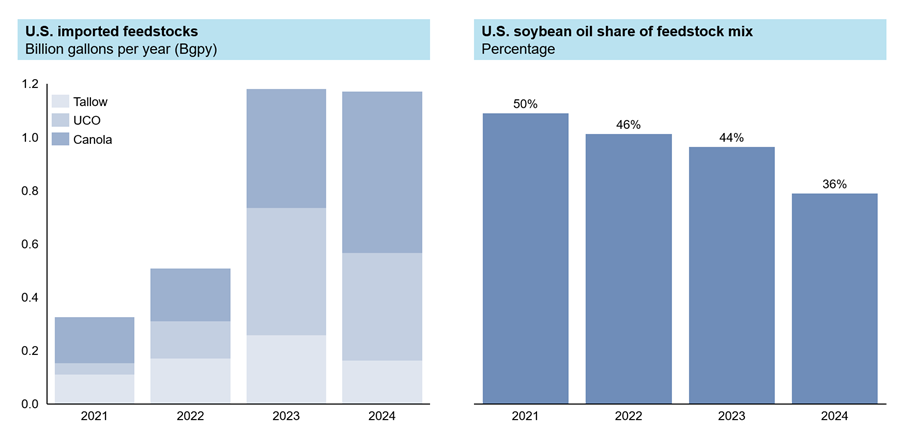

As a result, the demand for low-CI feedstocks in the U.S. rose sharply to support the expanding RD and SAF capacity. At the same time, refineries actively sought more cost-competitive alternatives with lower CI to maximize their tax credits. This spurred interest in imported feedstocks like used cooking oil (UCO), inedible tallow, and canola, which offer greater carbon-emission reductions and are cheaper than domestic vegetable oils. Exhibit 2 highlights how these imports have grown substantially for four consecutive years since 2021, eating away domestic soybean oil’s share in biofuel production. This trend has raised concerns about the long-term resilience and competitiveness of U.S. agricultural feedstocks.

Exhibit 2: U.S. imported feedstocks and soybean oil demand

In response to these dynamics, the Biden Administration introduced the 45Z Clean Fuel Production Credit (CFPC) guidance on January 10, 2025, to strengthen the role of domestic feedstocks in the U.S. biofuels industry. As discussed in our previous blog, “The Flight Forward: How 45Z Guidance is Reshaping the Future of U.S. SAF”, the 45Z guidance included foundational updates that redefine feedstock eligibility, impose stricter processing and certification requirements, and reiterate that facilities may only claim one IRA credit (45Z, 45V, 45Q, or 45Y).

However, several questions remained unresolved, particularly concerning the treatment of imported used cooking oil (UCO), integration of climate-smart agriculture (CSA) practices in the 45ZCF-GREET model, and the future of the 45Z tax credit beyond 2027. These pending questions were addressed by the House Ways and Means Committee in their draft proposal on May 12, 2025, addressing key modifications to the 45Z guidance.

Key updates in the recent House Ways and Means Committee’s proposal include the following:

1. Feedstock eligibility is limited to sources from the U.S., Canada, and Mexico. Producers who previously used imported feedstocks, such as used cooking oil (UCO) and tallow from China and Brazil, will no longer be eligible for the 45Z credits.

2. Emissions from indirect land use change (ILUC) are excluded from carbon intensity (CI) calculations. In addition, fuels derived from animal manure will have different emission rates based on the type of manure used, including dairy, swine, and poultry.

3. 45Z tax credit is extended through 2031. The proposed extension will make the 45Z credit available through 2031, allowing eligible fuel producers to qualify for the incentive for the next six years.

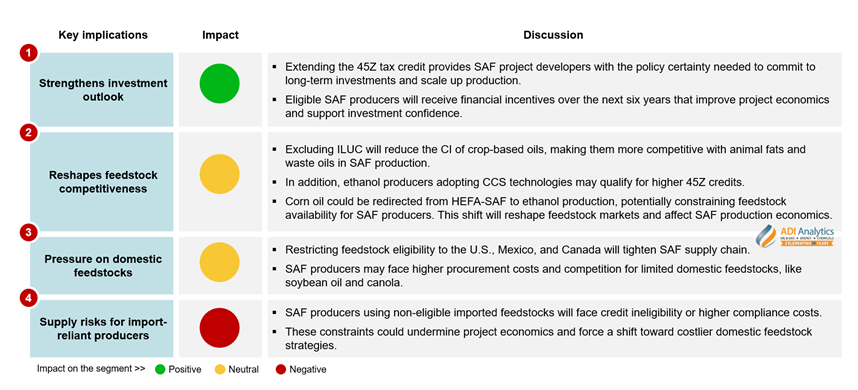

The recent 45Z proposal is poised to have notable implications for the U.S. SAF industry. As shown in Exhibit 2, these include: (1) a stronger investment outlook, (2) increased competitiveness of crop-based feedstocks, (3) more pressure on domestic feedstocks, and (4) higher supply risks for import-reliant producers.

Exhibit 2: Key implications on U.S. SAF in the 45Z proposal

Nevertheless, the latest 45Z proposal signals an uncertain outlook for U.S. biofuels, particularly RD. Unlike the previous BTC, which expired in 2024, the 45Z credit applies only to domestic producers, discouraging RD imports and tightening domestic supply. Additionally, the North American (NA) feedstock content restrictions are expected to limit domestic feedstock availability and intensify competition within the U.S. market. These factors create challenges for RD producers that rely on imported feedstocks to earn tax credits. This could lead to slower RD expansion, higher RD prices, and further compressing profit margins.

While the 45Z guidance continues to evolve, its final form remains uncertain. This ongoing uncertainty since January has led to a notable decline in U.S. RD and biodiesel production during the first quarter of 2025. The House Ways and Means Committee proposal reflects only one side of the debate, while the Senate is working on its version, which could introduce fixed credit values for each fuel type. ADI actively tracks the U.S. and global biofuels and alternative fuels industry and publishes a bi-weekly newsletter on SAF. Contact us to learn more. Ultimately, the future of U.S. biofuels, including SAF and RD, depends on how the finalized 45Z guidance is crafted to shape the market incentives and urge producers to prepare for the evolving policy landscape.

– Christine Ho and Panuswee Dwivedi

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including up-to-date renewable diesel, ethanol and sustainable aviation fuels (SAF) policy insights, regulatory compliance, and market dynamics, where we support Fortune 500, mid-sized and early-stage companies, government agencies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives together for meaningful dialogue and strategic insights across the oil & gas, energy transition, and chemicals value chains. Learn more about the ADI Forum, which is chaired by Uday Turaga, Founder & CEO, ADI Analytics, at www.adi-forum.com.

Subscribe to our newsletter or contact us to learn more.