Before the 2024 U.S. presidential election, ADI published an article analyzing the potential shifts in U.S. energy markets and policy under a second Trump administration. We noted that, in his second term, President Trump might ease some methane emissions regulations. Fast forward to today, President Trump signed a joint Congressional resolution repealing the Waste Emissions Charge (WEC) rule on March 14, officially rendering it ineffective. The WEC was part of the Inflation Reduction Act (IRA)’s Methane Emissions Reduction Program, which requires oil and gas operators to pay a fee for each metric ton of methane emissions reported above a certain threshold.

While the rollback of the WEC will slow for methane emissions reductions, we view its impact to be limited to the short term. Most likely, methane emissions reduction efforts are expected to continue across the U.S. oil and gas sector. Over the past few years oil and gas operators have already made a lot of efforts in reducing methane emissions. These efforts include reducing flaring activity, installing vapor recovery units (VRUs) to capture methane emissions, and replacing high-bleed pneumatic devices with non-emitting options such as compressed air systems.

Significant investments have also been made by industrials, OEMs, technology developers, start-ups, and investors in a wide range of technologies to measure, report, and verify (MRV), and reduce methane emissions, and ADI has been actively supporting operators, solution providers, and government agencies. Methane is 25 times more potent than CO₂ and is seen widely as a pressing climate issue that must be addressed, driving voluntary methane emissions reduction initiatives such as Oil and Gas Methane Partnership (OGMP) 2.0, the Oil & Gas Decarbonization Charter (OGDC), and programs at the ONE Future coalition.

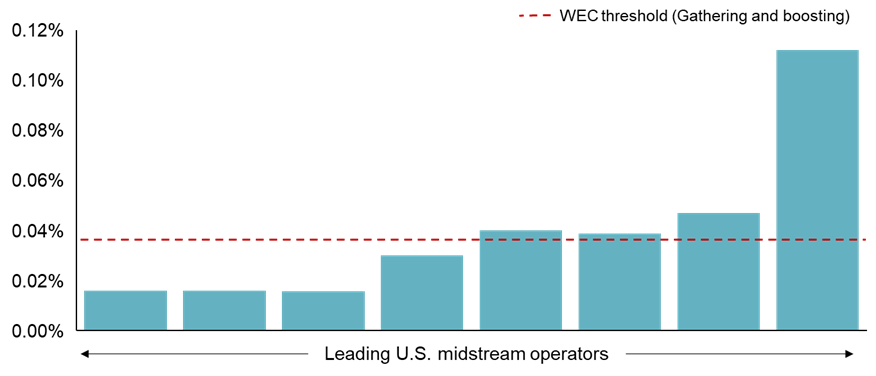

The repeal of the WEC will likely slow down methane reduction efforts among smaller operators, whose initiatives have been largely driven by regulatory pressure. In contrast, larger operators have no plans to abandon their methane emissions reduction efforts, as many of them are already meeting the WEC thresholds (see Exhibit 1). ADI has benchmarked large oil and gas operators both in the U.S. and globally, and many have methane intensities below the WEC threshold (contact us to learn more). Besides, larger operators’ methane reduction initiatives are driven by a broader range of factors, including investor pressure, ESG commitments, and methane intensity targets from voluntary initiatives such as the OGMP 2.0 and ONE Future coalition. CEOs at ExxonMobil and TotalEnergies have indicated strong support for methane emissions reductions and have highlighted in recent public comments that most operators have invested in new technology to limit emissions and abandoning such efforts would lead to attacks from climate groups and further damage the industry’s reputation. Further, some of these operators have suggested that since the WEC was part of the IRA, a law that still stands, there may be an implicit liability associated with methane emissions even if it is not enforced through the next few years.

Exhibit 1: Overall methane emission intensity of leading U.S. midstream operators, percentage

(Source: ADI Analytics)

Moreover, LNG exporters are under increasing pressure from European customers due to the EU methane rules, which require gas exporters to enhance their methane MRV practices to align with stringent EU standards starting in 2027. However, with the ongoing tariff threat from President Trump, there is a possibility of a relaxation of EU methane rules to aid compliance and ensure continued gas supply to European countries. We view any such potential relaxation in rules as temporary, as LNG exporters continue sourcing gas with low-methane intensity and strong methane transparency. For instance, Woodside Energy recently secured a deal with BP to supply MiQ-certified low-methane intensity natural gas for its Louisiana LNG project.

Additionally, there is growing demand for low-methane intensity gas and methane transparency in Asia, particularly in Japan and South Korea, driven by the Coalition for LNG Emission Methane Abatement Toward Net-Zero (CLEAN) initiative. As a result, this will encourage large LNG exporters such as Cheniere Energy and Freeport LNG to source gas with low-methane intensity and strong methane transparency from gas producers.

In summary, we view the rollback of the WEC as a minor setback for methane emissions reduction efforts among U.S. oil and gas operators. OEMs, technology developers, and investors should continue to invest in and develop their technologies, focusing on larger operators, even though there may be some short-term slowdown. As the global energy landscape evolves, demand for low-methane intensity natural gas is expected to grow despite regulatory challenges, and ADI is closely monitoring developments in these regulations. Additionally, during periods of LNG oversupply and falling prices, customers are likely to favor volumes with the lowest methane emissions, as these cleaner options become more affordable, even if they carry a slight premium. This is especially pertinent as natural gas is entering a growth supercycle.

ADI is launching a multi-client study, “Capitalizing on the natural gas supercycle”, that analyzes the drivers and trends impacting the global natural gas and LNG markets through 2050. This report aims to assist various stakeholders in the natural gas LNG value chain, including LNG project developers, EPC contractors, utilities, and investors, in developing a comprehensive strategy to capitalize on the anticipated growth in natural gas and LNG demand. To learn more, check it out here!

– Edmund Lam

Please contact ADI at info@adi-analytics.com if you would like to understand methane emissions across oil & gas and chemicals, policies and regulations on their mitigation globally, and developing business, operational, technology, and sustainability strategies to mitigate them.

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in these segments including methane and greenhouse emissions and their mitigation, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.