The oil and gas industry has come a long way since the first mechanically drilled wells, which were roughly 69 feet deep. From Edwin L Drake’s team striking oil at 69.5 feet in Titusville, Pennsylvania, in 1859, to today’s Permian Basin producers drilling wells over 3,000 feet in vertical depth and exceeding 25,000 feet in lateral length, the industry continually pushes boundaries. Throughout this evolution, wireline services have played a crucial and indispensable role, often acting as our eyes, ears, and hands at immense depths within narrow wellbores.

What are wireline services?

In essence, wireline services involve using a specialized cable to lower tools and equipment into a wellbore. This cable can be a thin, non-electrical strand, known as slickline, or an electric line. Electric lines can be single-strand or multi-stranded electrical cables for applications requiring high-strength wireline.

The electrical cable transmits power to downhole tools and sends real-time data back to the surface. This continuous data stream is then analyzed by geoscientists to develop a comprehensive image of the subsurface during well logging. Various types of well logs provide critical information about the formation:

- Gamma ray logs: Primarily used to identify shale content within formations.

- Resistivity logs: Crucial for indicating the presence of hydrocarbons and water.

- Neutron and density logs: Essential for determining the porosity of the reservoir rock.

- Sonic logs: Measure other formation rock properties and porosity, providing a deeper understanding of the subsurface.

Applications of wireline services

- Beyond well logging, wireline services support a wide range of well interventions and operations throughout a well’s lifecycle:

- Tool retrieval or fishing operations: Recovering lost or stuck equipment from the wellbore.

- Perforating: Lowering perforating guns into the wellbore to create pathways through the well casing and cement, allowing hydrocarbons to flow into the wellbore.

- Stimulation or workover services: Deploying or adjusting the locations of valves, balls, or plugs during stimulation or workover services such as hydraulic fracturing or acidizing to optimize well performance.

- Formation testing: Gathering valuable fluid samples and pressure data from specific zones to assess reservoir characteristics.

- Plugging and abandonment: Retrieving casing and installing plugs to safely decommission a well.

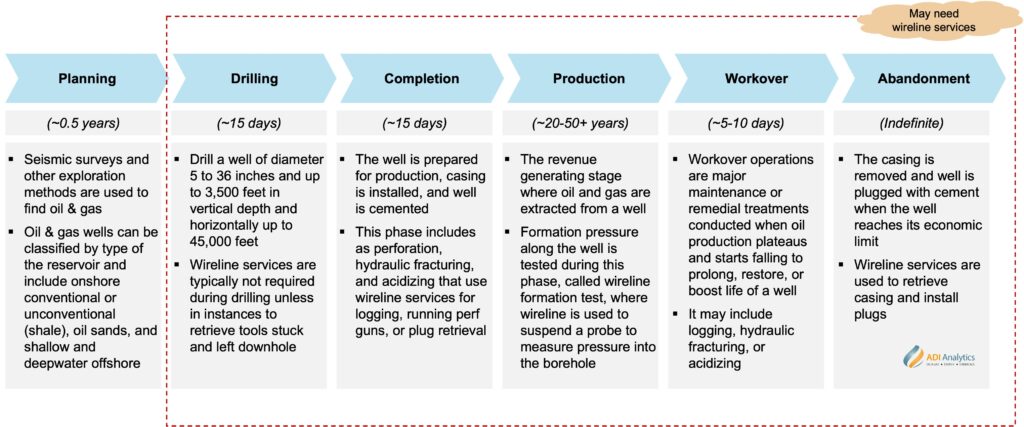

The specific type of workover service needed can vary significantly depending on the stage of the well, from initial drilling and completion to production, subsequent workovers, and ultimately, abandonment as shown in the exhibit below.

Exhibit 1. Various stages in life of a well wireline services may be needed

Wireline services in practice

Wirelines are typically spooled around a drum attached to a trailer, making them easily transportable to any well site. These services are primarily owned and operated by oilfield services and equipment companies (OFSEs), with operators typically renting the services or equipment as needed. While most operators opt for master service agreements (MSAs) on an annual basis with OFSEs, who often offer a broader suite of services like hydraulic fracturing, acidizing, fishing, open- or cased-hole logging, or plugging, there are also instances where operators pay additional daily rates to rent specific equipment.

Advancements in wireline services

As the oil and gas industry continues its journey of innovation, wireline services are keeping pace, experiencing significant advancements in several key areas:

- Electrification: Wireline units typically run on diesel fuel. However, OFSEs are now offering electric or battery-powered units. This shift directly supports operators’ sustainability goals and significantly lowers the overall carbon footprint of their operations.

- Advanced manufacturing design: Traditional wirelines use grease for lubrication and pressure control, especially when navigating bare rock, cement, or steel pipes. Now, OFSEs are offering greaseless options made possible by advanced designs that incorporate polymer-based coatings for smooth operations. For example, KLX Energy Services provides both greaseless and electric/battery-powered wirelines, while Forum Energy Technologies offers greaseless cables.

- Digitization and AI: Leveraging the power of digitization and artificial intelligence, OFSEs are developing solutions to remotely monitor and even automate wireline operations. Oil States International, for instance, has developed an app to automate hydraulic fracturing, allowing operators to make or break wireline connections directly from their phones. This innovation not only improves safety but also leads to significant cost and time savings.

In addition to technological advances, we have also seen business changes in the wireline services industry led by higher merger and acquisition (M&A) activity. Mid-sized OFSEs have strategically acquired smaller players to leverage economies of scale and expand their customer base. A notable example from 2021 is Ranger Energy Services’ acquisition of Patriot Completion Solutions, PerfX Wireline Services, and assets from Basic Energy Services. On the flip side, large-scale M&A among operators can also impact service providers; ProPetro Holding Corp., for example, gained ExxonMobil as a customer when it acquired its customer, Pioneer Natural Resources, in 2024.

Wireline services will continue to support the oil and gas industry with growth and innovation. At ADI Analytics, we have extensive experience assisting a diverse range of stakeholders, including OFSEs, OEMs, and private equity firms active across the oil and gas value chain, from exploration to drilling and completion, production, and transportation. Our expertise encompasses sizing, segmenting, and assessing product and service markets through a combination of primary (voice-of-customer) and secondary research, coupled with robust market size modeling. Contact us to learn more about how we can support your business objectives, including market sizing, competitive benchmarking, customer survey, organic and inorganic growth opportunity assessment, and M&A due diligence.

By Panuswee Dwivedi