Natural gas and liquefied natural gas (LNG), once touted as a bridge fuel to a low-carbon renewable energy-powered future, are now increasingly seen as a permanently central part of the evolving global energy landscape. Factors such as explosive growth in AI and data centers in the U.S. and elsewhere, energy security concerns in Europe and the Middle East, economic growth in emerging economies, and reshoring of manufacturing in developed economies (exhibit 1) are driving a reset in the expectations of stakeholders around the centrality of natural gas and LNG. More specifically, they are accelerating global demand for natural gas and LNG and creating a supercycle.

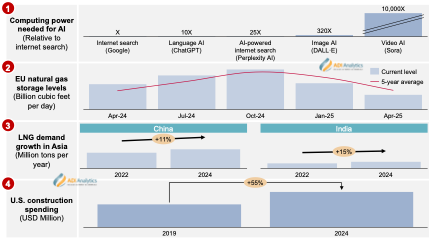

Exhibit 1. Global drivers for natural gas and LNG demand

We see four key drivers impacting natural gas and LNG demand growth in this supercycle. Firstly, computing power required for data centers going forward, especially for generative models, image generation, and video AI, will be immense. U.S. power demand could double by 2035 due to data center growth alone. Several U.S. utilities say natural gas is crucial to their long-term fuel mix as they plan to meet this growing demand.

Secondly, energy security concerns are consistently growing in the EU and the Middle East. In the years after COVID, the EU experienced a drop in natural gas demand due to mild weather and industrial slowdown. However, a close-to-average winter and a modest revival of industrial demand in the past year resulted in higher-than-expected growth in gas demand. Concerned with high gas prices and energy security, EU regulators are now even considering relaxing methane emissions rules to support U.S. LNG imports and are being open to modest Russian gas returns.

Thirdly, as LNG supply has grown and prices have commoditized, emerging economies now view LNG as a cost-effective fuel for power generation, while also lowering carbon intensity. This is exemplified by significant growth in LNG imports by China and India in the past two years. Collectively, this growth is driven by Asian economic expansion, that not only uses LNG for power generation, but also in transportation and chemical industries.

Finally, advanced economies drive natural gas demand growth due to geopolitical concerns and supply chain disruptions that are driving a reshoring of manufacturing to North America and the EU.

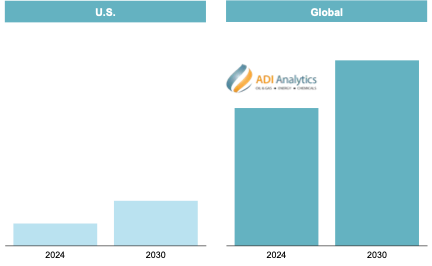

Natural gas and LNG supply will meet global demand growth, but the outlook also faces uncertainties. Both U.S. and global LNG export capacities are expected to rise by 2030 (exhibit 2), but will have to overcome several challenges, including cost inflation, permitting delays, and labor shortages. Short-term optimism from policy support and deregulation in President Trump’s second term does not guarantee long-term economic viability due to capital cost unpredictability and evolving policies on methane emissions and sustainability. Argentina’s YPF, for instance, dropped its plans to build an LNG export terminal due to long-term viability concerns and will continue to monetize Vaca Muerta gas into LNG using floating vessels.

Exhibit 2. U.S. and global LNG export capacity outlook in million tons per annum

ADI is launching a multi-client study, “Capitalizing on the natural gas supercycle”, that analyzes the drivers and trends impacting the global natural gas and LNG markets through 2050. This report aims to assist various stakeholders in the natural gas LNG value chain, including LNG project developers, EPC contractors, utilities, and investors, in developing a comprehensive strategy to capitalize on the anticipated growth in natural gas and LNG demand. To learn more about ADI’s multi-client study, download the prospectus here!

By Panuswee Dwivedi

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring C-suite executives together for meaningful dialogue and strategic insights across the oil & gas, energy transition, and chemicals value chains. Learn more about the ADI Forum, which is chaired by Uday Turaga, Founder & CEO, ADI Analytics, at www.adi-forum.com.

Subscribe to our newsletter or contact us to learn more.