As the global push for low-carbon energy intensifies, demand for nuclear power is gaining momentum in the United States. At the heart of this resurgence is the rapidly expanding energy appetite of data centers, particularly those supporting artificial intelligence (AI) and cloud computing. The immense power needs of these facilities are prompting a shift toward nuclear energy as tech giants, such as Microsoft and Google, seek reliable, carbon-free solutions to power their operations.

How data centers are reshaping U.S. power demand

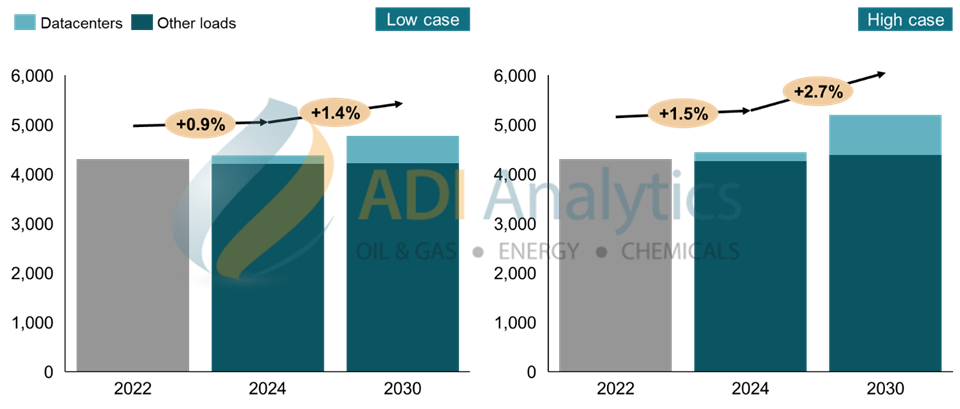

The explosive growth of hyperscale data centers for AI is dramatically reshaping U.S. energy demand. Unlike traditional data centers, these new facilities can require over 100 megawatts (MW) of power—an amount capable of supporting tens of thousands of homes. With hundreds of new data centers under development across North America, the pressure on power grids is intensifying. ADI’s projections suggest that data centers could drive growth in U.S. of electricity demand of 1.4% to 2.7% annually through 2030. This surge in demand has catalyzed interest in finding stable, high-capacity energy sources capable of delivering round-the-clock power.

Big tech’s drive for low-carbon energy solutions

Leading technology companies are actively pursuing reliable, 24/7 low-carbon energy sources to meet their escalating power requirements and uphold their sustainability commitments. Nuclear energy is increasingly seen as the ideal solution—it offers continuous, emissions-free baseload power, which is essential for data centers that operate non-stop.

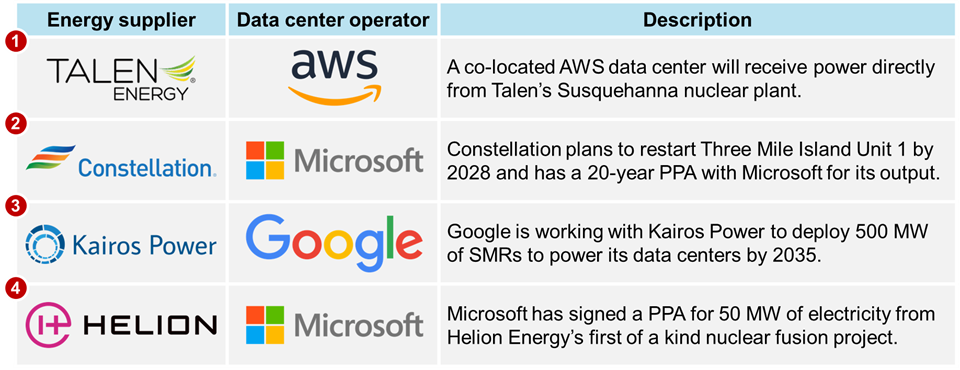

Recognizing this, big tech companies are pushing for more nuclear capacity, actively supporting both the restart of mothballed plants and the development of new technologies such as advanced geothermal and small modular reactors (SMRs). Their investments reflect not just the need for power, but also a commitment to decarbonizing their operations.

Data center demand sparks nuclear restarts

In a groundbreaking move, Constellation announced plans to restart Three Mile Island Unit 1, a reactor retired in 2019. The 835 MW facility, set to be renamed the Crane Clean Energy Center, is expected to return to service by mid-2028.

Microsoft has signed a 20-year power purchase agreement (PPA) to secure the full output of the plant, reportedly agreeing to pay a substantial premium to guarantee a steady supply of low-carbon nuclear energy. This deal not only signals the value that tech companies place on clean, reliable power but also highlights the economic potential of bringing dormant nuclear assets back online.

This groundbreaking agreement is underpinned by a combination of factors that make the restart both economically viable and strategically significant. Government incentives, such as federal clean energy tax credits of approximately $30 per megawatt-hour for ten years, play a pivotal role in supporting the financial foundation of the project. Additionally, Microsoft’s willingness to pay a premium for reliable, low-carbon energy, combined with government incentives and the structured agreement, provides Constellation with the financial certainty needed to move forward confidently with bringing the reactor back online.

Are more nuclear restarts on the horizon?

The question remains: Can we expect more nuclear plant restarts to power data centers? The answer depends heavily on the willingness of data center operators to continue paying premium prices for nuclear-generated electricity. Virtual PPAs, like the one between Microsoft and Constellation, are proving to be powerful tools in driving these restarts by providing financial certainty for nuclear operators.

However, restarting mothballed plants comes with significant economic and logistical challenges. While the Three Mile Island restart benefits from favorable financial structures and strong corporate backing, other projects could face higher hurdles. Despite these challenges, the potential for lucrative returns—especially when coupled with government subsidies and tax credits—could make additional restarts feasible in the near future.

Holtec International is already exploring the reactivation of retired plants such as Palisades and Pilgrim, while NextEra Energy is considering bringing the Duane Arnold plant in Iowa back online. As the economics of restarting older facilities become more attractive, particularly with high-value data center PPAs in play, more nuclear restarts could be on the horizon.

New frontiers in nuclear energy: SMRs and fusion

Beyond traditional nuclear restarts, tech giants are also investing in cutting-edge nuclear technologies. SMRs are gaining traction for their scalability, efficiency, and lower capital costs compared to conventional reactors.

Google has partnered with Kairos Power to develop SMRs, with plans to deploy up to 500 MW of SMR capacity by 2035 to power its data centers. Similarly, Amazon has made significant investments in X-energy, a leader in advanced SMR technology, and is collaborating with Dominion Energy and Energy Northwest to develop SMR projects aimed at bolstering its energy supply.

Microsoft has taken a bold step by signing a PPA with Helion Energy for a minimum of 50 MW of electricity from what is projected to be the world’s first fusion power plant, anticipated to be operational in Washington State by 2028. Although the commercial viability of fusion energy remains a future prospect, this agreement highlights Microsoft’s proactive strategy in exploring groundbreaking clean energy technologies.

What’s next for nuclear energy and data centers?

The increasing energy demands of data centers are poised to reshape the U.S. nuclear landscape. With tech giants investing heavily in nuclear restarts, SMRs, and even fusion, the stage is set for a revival of the nuclear sector—one driven not by government mandates but by corporate sustainability goals and economic opportunity.

For utility companies, this trend offers both challenges and unprecedented opportunities. As demand for reliable, low-carbon electricity grows, partnerships with data centers could provide the financial support necessary to modernize aging infrastructure and invest in advanced technologies.

Going forward, nuclear energy will likely play a central role in meeting the dual challenges of rising energy demand and the transition to a carbon-free future. If current trends continue, the power needs of data centers could mark the beginning of a new era for nuclear energy in the United States.

– Piercen Hoekstra

Contact us to learn more about our work on rising U.S. power demand led by data centers, data center power supply options, and developments in data center energy efficiency technology.

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including energy transition and electric utilities, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.