Refineries are responsible for the production of transportation fuels and other products, such as petrochemicals and lubricants, but they also contribute significantly to global GHG emissions. According to the U.S. Environmental Protection Agency (EPA), refinery GHG emissions in 2023 amounted to 160 million metric tons CO2 equivalent (MMT CO2e), with over 70% resulting from fuel combustion and the rest from process-related activities.

As global decarbonization efforts continue to gain momentum, refiners face growing pressure to reduce GHG emissions and comply with regulatory requirements. For instance, in the U.S., Renewable Fuel Standards (RFS) and Low Carbon Fuel Standards (LCFS) in California push refiners to produce fuels with low carbon-intensity. Similarly, carbon pricing such as the Emissions Trading System (ETS) in Europe and carbon taxes in Canada, Norway, and Sweden impose financial penalties on refiners for their GHG emissions.

Decarbonizing refineries can be a complex process which requires strategic planning. In the following sections, we discuss several key strategies to address refineries’ GHG emissions from both fuel combustion and process operations.

Strategies to reduce 70% of refineries’ GHG emissions from fuel combustion

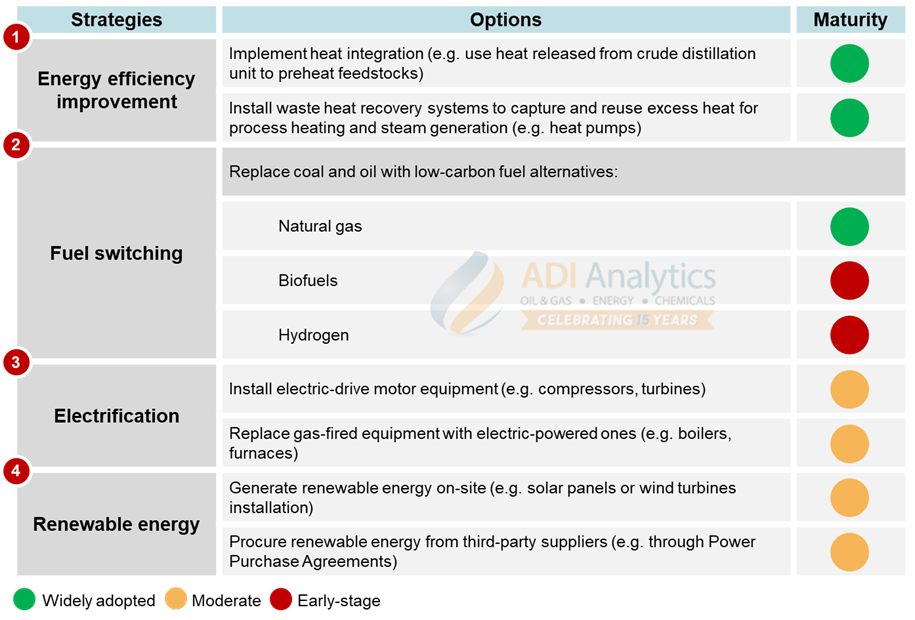

There are several effective strategies to reduce GHG emissions from fuel combustion in refineries, including (1) improving energy efficiency, (2) switching to cleaner fuels, (3) electrification, and (4) incorporating renewable energy (see Exhibit 1).

Exhibit 1: Decarbonization strategies to reduce refineries’ GHG emissions from fuel combustion.

Below, we delve in detail into each of the strategies and options to reduce refineries’ GHG emissions from fuel combustion outlined in Exhibit 1, highlighting their maturity and use cases at refiners.

Improving energy efficiency is one of the most established and reliable methods for decarbonization. This involves optimizing processes through better heat integration (e.g. use heat released from a crude distillation unit to preheat feedstocks entering other processes) or implementing waste heat recovery systems, such as heat pumps, to repurpose excess heat for applications like process heating and steam generation. These measures significantly reduce energy loss and overall energy consumption, making operations more sustainable and cost-efficient.

Fuel switching focuses on replacing high-carbon fuels, such as coal and oil, with lower-carbon alternatives such as natural gas, which can substantially reduce CO2 emissions. There are also alternative fuels, such as biofuels and hydrogen, which are still in the early stages of adoption. Hydrogen, for instance, is gaining traction, with ExxonMobil currently at the forefront of this initiative. The company plans to use hydrogen instead of natural gas for high-heat-fired equipment at its Baytown refining complex and the project will likely move forward upon receiving funding from U.S. Department of Energy under the Industrial Demonstrations Program.

Electrification offers another promising solution for reducing refineries’ GHG emissions from fuel combustion. This strategy involves using electricity to meet process energy needs traditionally supplied by fossil fuels. Refineries can lower emissions by replacing gas combustion equipment with electric alternatives, such as electric furnaces, electric-drive motors for compressors or turbines, and electric boilers instead of gas-fired ones. Although electrification is not yet widely adopted, it holds significant potential for decarbonizing refinery operations.

Renewable energy integration allows refineries to further lower their carbon footprint by utilizing solar, wind, or biogas. These energy sources can be generated on-site, for instance, by installing solar panels or wind turbines, or procured through power purchase agreements (PPAs). For example, OMV recently secured a PPA to supply 67 gigawatt-hours (GWh) of renewable electricity annually from VERBUND and ImWind for its refinery in Austria. In our previous blogs, we have covered seven renewable electricity procurement options and the characteristics of each of these options that could help companies in making informed decisions in choosing their renewable electricity procurement options.

Strategies to reduce the remaining 30% of refineries’ process-related GHG emissions

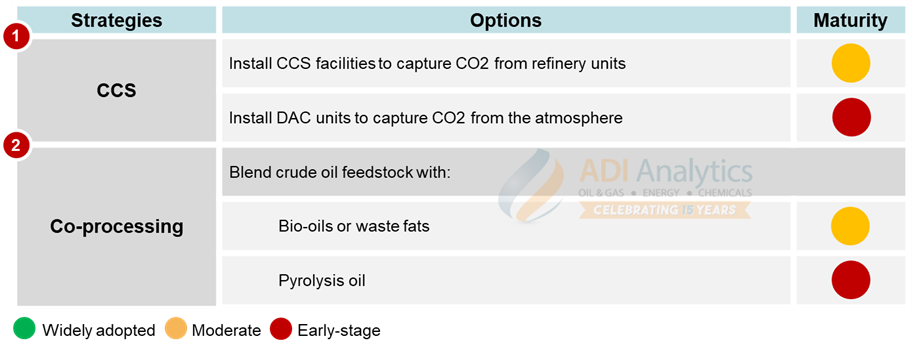

While fuel combustion accounts for most of a refinery’s GHG emissions, the remaining 30%—primarily process-related emissions—requires targeted solutions such as (1) carbon capture, and storage (CCS), and (2) co-processing (see Exhibit 2).

Exhibit 2: Decarbonization strategies to reduce refineries’ process-related GHG emissions.

Below, we discuss each of the strategies and options outlined in Exhibit 2 in depth, covering their maturity along with illustrative decarbonization initiatives by refiners.

CCS facilities capture CO2 from refinery units for reuse or storage. For instance, fluid catalytic cracking (FCC) units can produce a concentrated stream of flue gas, making them ideal for carbon capture. Phillips 66 plans to build a CCS facility at its Humber refinery in England, capable of capturing up to 3.8 million tons of CO2 annually from its FCC units. Another emerging CCS technology is Direct Air Capture (DAC), which removes CO2 directly from the atmosphere for storage or utilization, but is currently still in the early stages of development. ADI has published an industry-leading DAC multi-client study which closely monitors the market, funding and initiatives, technological advancements, and other developments in this emerging field.

Captured CO2 can be stored, repurposed for enhanced oil recovery, or monetized as feedstock for making valuable products such synthetic fuels (e-fuels), calcium carbonate for green cement production, or low-carbon urea for agricultural applications by reacting it with green ammonia. This multifaceted approach enables refineries to reduce emissions while creating value-added products.

Co-processing offers another effective solution by blending renewable or recycled feedstocks with fossil fuel-derived feedstocks, reducing the carbon intensity of refinery operations. For example, sustainable aviation fuel (SAF) can be produced by co-processing renewable feedstocks including bio-oils or waste fats within existing refinery infrastructure. Similarly, pyrolysis oil, derived from plastic waste recycling via pyrolysis, can be co-processed and upgraded into naphtha-like feedstock for petrochemicals. Neste, for instance, has exemplified this approach by transitioning its Porvoo refinery in Finland to produce renewable diesel, SAF, and circular feedstocks for the petrochemical industry. ADI closely tracks SAF and plastic recycling markets through its SAF Tracker and The Circularity Compass newsletter.

Conclusion

In summary, refineries can adopt a range of decarbonization initiatives to lower their carbon footprint, support a circular economy, and create value-added products. However, there is no one-size-fits-all solution. Strategies must be tailored to each refinery’s size, configuration, and regulatory requirements.

– Edmund Lam

Please contact ADI at info@adi-analytics.com if you would like to understand in-depth on how each decarbonization strategy can support refinery decarbonization, along with respective insights into their market dynamics, economics, supply and demand, and technology landscape. At ADI, we have extensive experience helping clients in their decarbonization and energy transition efforts, with expertise across various market areas, including renewable energy, CCS and DAC technologies, SAF, and plastic recycling.

ADI Analytics is a prestigious, boutique consulting firm specializing in oil & gas, energy transition, and chemicals since 2009. We bring deep, first-rate expertise in a broad range of markets including renewable energy procurement and Scope 2 emission reduction strategies, where we support Fortune 500, mid-sized and early-stage companies, and investors with consulting services, research reports, and data and analytics, with the goal of delivering actionable outcomes to help our clients achieve tangible results.

We also host the ADI Forum, one of Houston’s distinguished industry conferences, to bring c-suite executives from oil & gas, energy transition, and chemicals together for meaningful dialogue and strategic insights across the value chains.

Subscribe to our newsletter or contact us to learn more.